The mood in South Africa is starting to lift from last year’s depths of depression.

Next week is our long-awaited election, and local investment markets have started re-rating upwards in anticipation of at least a satisfactory election outcome.

This Wednesday our inflation data came out a bit lower-than-expected on the back of lower food and non-alcoholic beverages, notwithstanding the higher petrol price last month providing upward pressure - and where next month we should see a sizeable cut in fuel prices (and therefore lower inflation over the next month or two);

Ninety One Director of Investments Jeremy Gardiner shares his insights on the greater improved sentiment in SA;

“2024 was meant to herald better times. While the first half of the year was always going to remain tough with interest rates hovering at more than 20-year highs globally, July to December promised relief with declining inflation followed by at least six rate cuts seemingly ‘baked into’ US, UK and European cycles.

Geopolitical issues, including a higher oil price on the back of the war in the Middle East, have seen the descent in US inflation pause, stubbornly close to the finish line. This has pushed out US interest rate cuts (and therefore ours in SA as well) to September at least.

President Joe Biden, who deserves more credit for the current better-than-expected economic strength, will no doubt be disappointed, as earlier rate cuts could have cemented his second term. However, the perceived cognitive decline might weigh too heavily on his campaign, making US elections at this stage too close to call.

The UK economy is starting to show signs of life

Across the pond, the inflation decline in the UK and Europe has been more ‘compliant’, which should allow both to lead the US, with their first cuts expected next month. Having just emerged from a mild recession, the UK economy is starting to show signs of life. Any signs of growth, or early rate cuts, however, are unlikely at this stage to save Rishi Sunak or the Conservative Party in their elections later this year.

Improved economic health in these economies is important from an SA perspective, as they are all significant trading partners of ours. The better they feel, the more of our stuff they’ll buy, and the more tourists will come.

Also, adding to this improved outlook is the fact that China, our biggest trade ‘client,’ is also finally starting to look a bit better. After a rough post-pandemic period in China, any improvement in the country will significantly improve our prospects.

Back home, despite loud (and often scary) pre-election rhetoric flying around, the mood in SA is certainly better than the depths of depression we as a country found ourselves in this time last year.

The national mood reached the lowest level I’ve experienced in my professional career, with more talk of emigration than ever before

Let me remind you that this time last year we’d just been through nearly 3 weeks of Stage 6 load-shedding, and going into winter, there were rumours that we may even face a complete grid collapse. On top of that, we were acting bizarrely ‘unneutral’ in the Russia-Ukraine conflict, and the Americans had just accused us of supplying weapons to Russia. Foreign investors gave up on us – they dumped our bonds, the currency collapsed, which pushed both inflation and interest rates up. The national mood reached the lowest level I’ve experienced in my professional career, with more talk of emigration than ever before.

But most importantly, and very simply, this year the lights have been staying on a lot longer than last year, and certainly more than expected. And we are assured by both government and big business that this is because of improved maintenance, less sabotage and massive investment in renewables, and not, as we would be quite entitled to believe, a brief pre-election respite.

We can expect to average Stage 2 throughout winter and be at Stage 1 by year-end. Next year, after 16 long, dark years of load-shedding, courtesy of government incompetence, mismanagement, and corruption, we should be largely free of load-shedding.

That is enormously significant. There is nothing more confidence destroying, both for foreign investors as well as for us as South African citizens, than the lights going out. Suddenly, the vicious cycle that we’ve been labouring under – declining growth, jobs lost, fewer taxpayers, lower tax revenues and less investment turns around and becomes virtuous – higher growth, more jobs, more taxpayers, increased taxpayer revenues and investment.

Happy days.

Add to that an improvement in ports and railways, expected to gradually improve into the next year, and we may have reasons for optimism.

There is the looming election hurdle, which we still must clear. Fortunately, most analysts and surveys are pointing to a mildly positive result (ANC coalition with a few smaller parties). The much-vaunted ANC-EFF coalition at a national level seems statistically unlikely, but then so was Brexit, so remain vigilant.

In summary

An improved global backdrop because of declining global interest rates (they’re not going to stay at 23-year highs forever) plus the business-induced reversal of our SOE ‘own goals’ of years gone by, could finally give exhausted and deserving South Africans a reason other than sport to smile”.

NHI, Electricity Regulation Amendment Bill, and Two-Pot Retirement System | Old Mutual in the News

Last week we saw several new laws introduced.

NHI

The National Health Insurance Act introduced was first mooted when I was still in school over 25 years ago, and very little detail was released last week, to comment on.

From my side, this should not be seen as a political issue, but rather a financial issue in the simple law of numbers. Healthcare was even the largest matter debated in the Trump vs Obama election back in 2015 (Obamacare). Therefore, it’s certainly not only a SA-only issue.

In the basic arithmetic of compounding numbers, we currently are on an unsustainable path. Over the past two decades, medical aid costs have risen annually well ahead of inflation, and the only manner to keep medical cost increases palatable was for medical aid benefits to be cut back.

After two decades of doing so, there’s simply now nothing left to be cut. And so, an increased cost of 3-5% per annum above inflation going forward would mean that if nothing is done - most of us will no longer enjoy medical aid coverage in 10-20 years’ time.

Which, in the context of SA, we have high delivery risk, is not disputed. As a result, a slow implementation over 30 years is envisaged, where this is merely the first step to providing some framework.

Electricity Regulation Amendment Bill

Separately in further changes to legislation, and where we as a country need almost all we can get our hands on (and that missed the news headlines last week) - was the formal introduction of private providers being able to supply electricity to the grid.

For more on this positive introduction, you can click on this link; Signing of Electricity Regulation Amendment Bill will open market for power suppliers - Solar PV Industry Association (ewn.co.za)

Two-Pot Retirement System

The Two-Pot Retirement System was also formally introduced last week and will be implemented from 1 September this year. Gontse Tsatsi, head of Retail Clients at Old Mutual Investment Group, and previously our Cape Town area manager at PWM, shares a few myths to beware of, in providing more clarity around the Two-Pot system.

To view the full article via The Citizen, click on this link; Beware of these myths about the two-pot retirement system (ampproject.org)

The Two-Pot Retirement System does not have any effect on post-retirement funds for persons already withdrawing from their retirement savings.

SA Rides as Wave of Investor Cash Before the Election | Peter Brooke in MoneyWeb

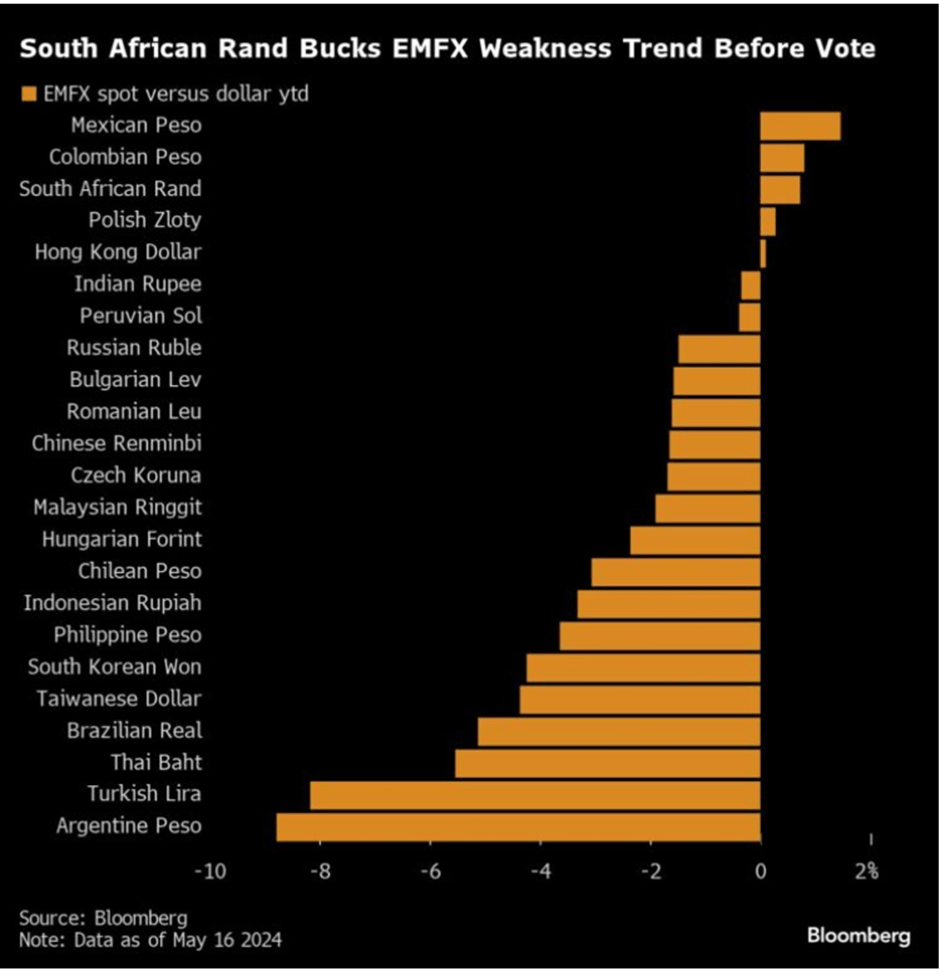

This year-to-date, the Rand currency has proved far stronger to the US Dollar, in relation to most other Emerging Market countries;

Head of Macro-Solutions, Peter Brooke, was recently featured in Moneyweb, on how foreign investors over the last decade have been underweight to SA, are now wanting to not repeat previous mistakes made in other market emerging countries, are now investing in SA again.

For the full article, you can read it by clicking on this link; SA rides a wave of investor cash before the election - Moneyweb

Friday Food For Thought