5-Year Asset Class Returns

Looking at the updated 5-year investment returns across the various asset classes to the end of September, SA and global investors have much to be pleased about;

The returns above are per annum returns for the various asset classes over the last 5 years.

Lower inflation and interest rates support risk assets and investment markets - as they have always done, especially where growth rates remain positive, even if somewhat muted. That is our expectation, and is supported by the International Monetary Fund (IMF) latest views and forecasts further below.

The Rand

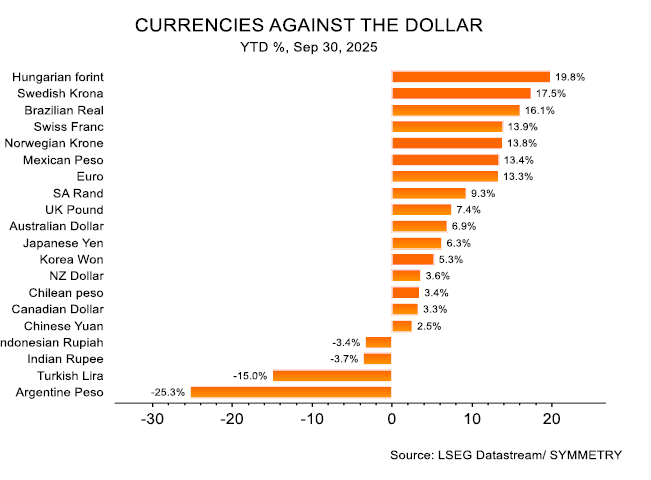

Looking at the Rand, most currencies have gained against the US dollar this year, even though several countries are particularly exposed to US tariffs due to their export dependence (notably Canada and Mexico), or because of the magnitude of the tariffs (50% on Brazil, 30% on SA), and one would therefore have expected their currencies to weaken.

By the end of September, the Rand has strengthened by 9,3% to the US dollar this year-to-date;

The Rand strengthened by a little more than the GBP, but the overall strength of Europe against the US dollar has also been substantial.

USD on a Real Trade-weighted Basis

The US dollar has been more stable over the past few months after declines earlier this year, but if the US economy weakens, the US Fed rate cuts will be a source of renewed downward pressure.

The dollar remains well above its historic average on a real trade-weighted basis as this longer-term graph illustrates, suggesting it has in fact far further room to fall. This won’t happen in a straight line, however.

Trade Improvement, Imports vs Exports

One of the factors supporting the rand against the dollar is the terms of trade improvement. In other words, export prices are increasing faster than import prices. Looking just at commodity prices, the terms of trade gains suggest that the rand could have appreciated more.

Purchasing Power Parity (PPP) basis

The theory of purchasing power parity (PPP) holds that one currency will move relative to another based on the inflation differences between the two countries over the long term. In the short term, an exchange rate can deviate from the PPP implied level.

On this basis, the rand appears modestly undervalued against the US dollar, but not as cheap as before.

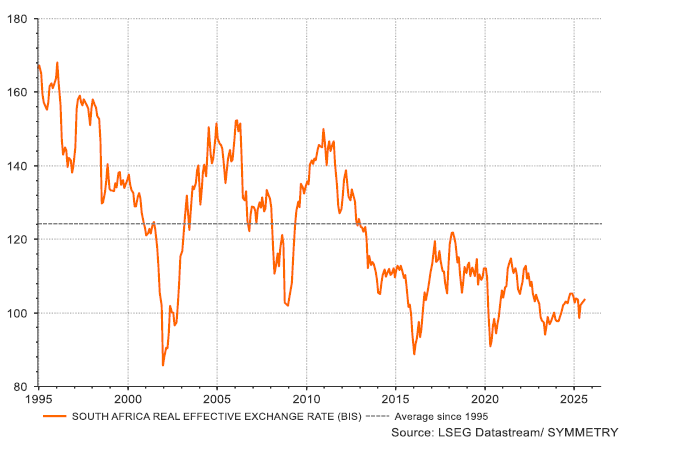

Looking at the real trade-weighted basis

On a real trade-weighted basis, the rand similarly looks somewhat undervalued. We expect it to appreciate over the medium term, supported by improvements in domestic fundamentals, including a lower inflation outlook. In the short term, it can remain very volatile and subject to shifts in global risk appetite.

What Others Think

SA Reserve Bank The rand should be R7 to the dollar – BusinessTech

Investec’s Annabel Bishop, Kevin Lings Chief Economist at Stanlib, and our own Izak Odendaal; The United States dollar on the back foot – Daily Investor

What a Weaker USD Means for Offshore Investments

To give a greater perspective on what this means for clients’ offshore investment funds, in late July, we shared our views we taking a deeper look at the weaker $US dollar unfolding, which you can read by clicking on this link: PWM note

Many of these themes as then shared a few months back are now coming through.

In the final analysis, nothing happens in straight lines, however, and if this is the start of a down cycle for the USD – as seems to be the case – there will still be dollar rallies. The extent of the cycle will also be limited by the fact that all other major currencies have their own problems.

A weaker dollar would benefit the world economy precisely because it is so widely used by businesses worldwide. If it is cheaper to obtain dollars to pay suppliers or to service debt, it is beneficial.

It also usually implies lower interest rates in other countries. It is no surprise that periods of strong performance in emerging markets have coincided with a weaker dollar. A weak dollar would also not be bad news in America, as it would support exports and lift the foreign earnings of multinationals.

For South African investors, the strong dollar environment of the last decade or so coincided with a falling rand. This boosted offshore returns and depressed domestic returns, as global investors limited their exposure to emerging markets. South Africa’s numerous own goals worsened matters considerably, but the dollar cycle played a significant role. If that cycle has now turned, it implies less downward pressure on the rand.

This definitely doesn’t mean that offshore exposure should be abandoned, but rather that investors should not rely on currency depreciation to inflate their investment returns. Sensible diversification across local and global markets will remain important.

Offshore investments are far more than only about betting against the Rand, and more about accessing market opportunities otherwise not available in SA, where SA only represents a very small part of the global market.

IMF Growth Forecasts

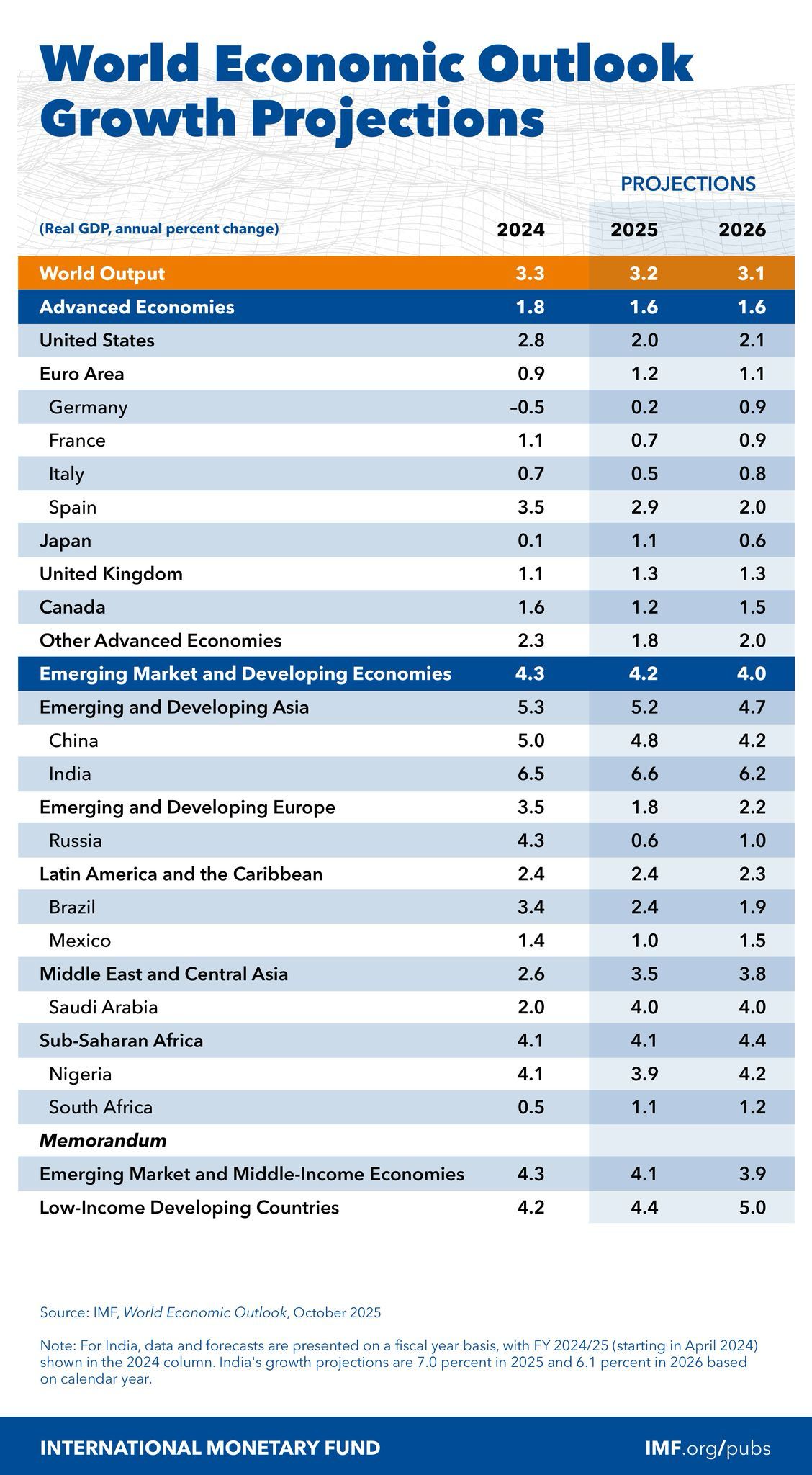

The International Monetary Fund (IMF) revised their forecasts on global growth this week, to what can be expected.

The IMF has a good past track record of getting these forecasts right, more often than not. In April, they lowered their expectations for the world to grow by 2,8% for this year, and 3,0% for next year, before increasing these in August to 3,3% growth for this year, and 3,1% for next year, which was positive.

The latest forecasts for broadly in line with the August revisions, and the US is still expected to slow significantly in line with previous forecasts, while Europe looks fairly pedestrian over the next year or two. The absolute totals for the US are overall decidedly lower.

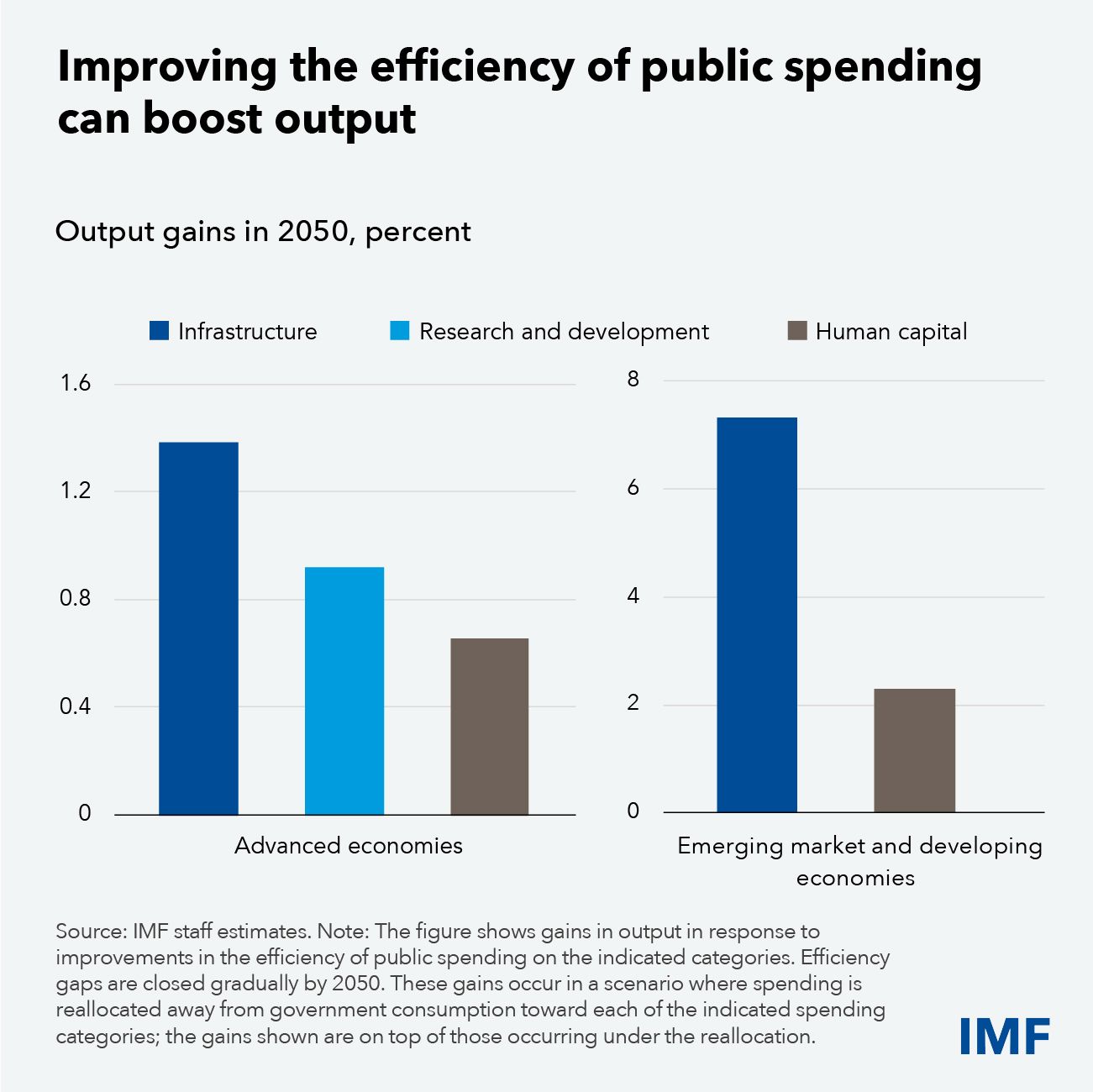

The IMF further explains that smart public spending can substantially boost long-term economic growth and reduce income inequality in both advanced and developing economies.

According to the IMF, “the latest Fiscal Monitor analysis shows that shifting just 1% of GDP from lower-impact spending to infrastructure or education can raise output by up to 6% over 25 years. Improving how money is spent—by increasing investment efficiency and implementing complementary policies—can amplify these gains even further”;

SA is certainly seeing lower inflation and interest rates, and a more stable and stronger Rand currency.

The next non-negotiable for us in SA is seeing our growth rates increase.

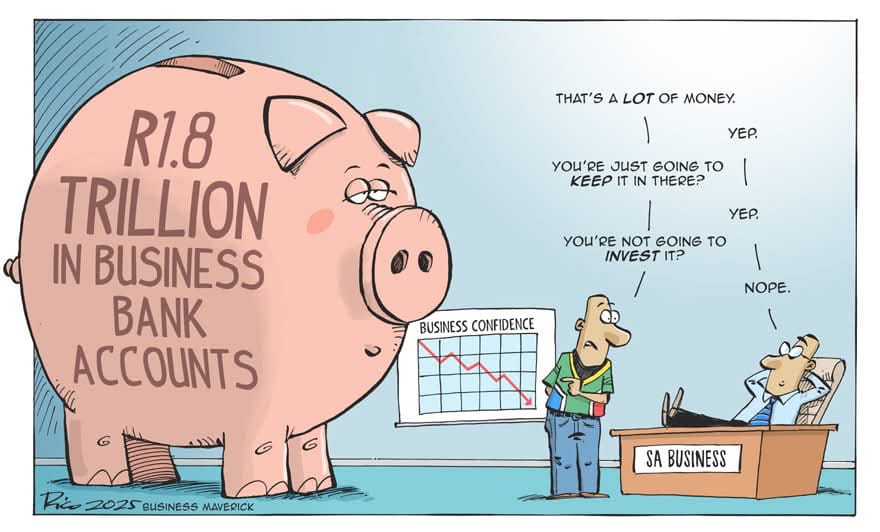

To do this, we next need greater fixed investment, and then policy certainty to allow big business to deploy their substantial cash balances that they otherwise simply won’t use, where I thought this cartoon captures this well;

The Benefits of Working with a Financial Planner

October is Financial Planning Month – the perfect time to reflect on your financial journey and the value of having a trusted planner by your side.

According to a recent survey by the Financial Planning Standards Board Ltd (FPSB), which has 230,000 certified financial professionals worldwide, 79% of consumers reported that financial planning helps fulfil life dreams. Working with a financial planner who has committed to competency and ethical standards helps people worldwide achieve greater financial well-being.

Working with a financial planner provides:

🔵 Clarity: A clear understanding of your financial position and goals.

🔵 Expertise: Guidance tailored to your unique circumstances and future needs.

🔵 Accountability: Support to stay on track and adjust when life changes.

🔵 Peace of mind: Knowing you have a trusted partner to help secure your financial future.

At PWM, we're committed to walking this journey with you, ensuring your wealth serves your goals, now and for generations to come.

Friday Food For Thought