70 is the new 50

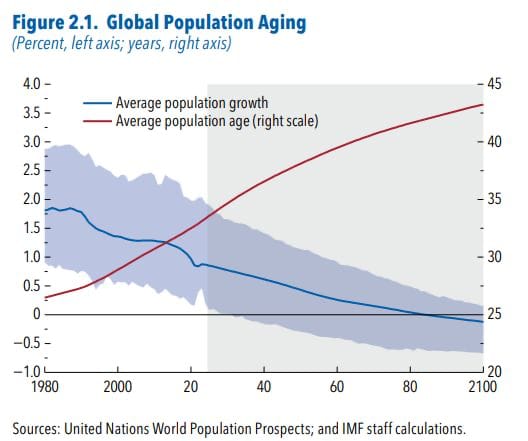

We all know that the world is ageing, and the consensus is that this, in time, will weigh on global economic growth and put pressure on government finances in the decades ahead.

There is disagreement on what it means for inflation and interest rates, though. Some argue that slower growth will drag down inflation and rates, while others argue that shrinking workforces will lead to wage pressures and inflation.

The impact of technology is uncertain, but many hope for a productivity revolution to prevent or postpone the decline in potential GDP economic growth.

There is a small silver lining to the silver economy, where, according to a recent International Monetary Fund (IMF) report, age “70 is the new 50”.

"Data from a sample of 41 advanced and emerging market economies indicate that, on average, a person who was 70 in 2022 had the same cognitive ability as a 53-year-old in 2000."

This is a big jump in the health and cognitive abilities of older persons, in a relatively short space of time.

It means labour force participation need not decline as quickly as it has in the past, and therefore, overall workforces need not shrink as much as is often projected. If the IMF is right, it will offset some of the impact of ageing.

The question is whether you'll want to have to work into your 70s? And can you afford not to, and choose to do so if you wish?

And this is precisely why we are here: to provide you with that certainty.

IMF Growth Forecasts

At the same time as having a lower inflation and interest rate environment, one must consider how the greater economies will grow.

If lower inflation results in recessions or depressions, however, then of course it’s less welcome.

Many commentators and financial articles have highlighted the risk of US trade tariffs threatening recessions in the US, possibly flowing into the rest of the world.

From our side, Old Mutual Chief Economist, Johann Els, has revised his views to say that he now expects a recession in the US, even if it is shallow and short-lived.

For investors, placing this in perspective, a recession is simply defined as two quarters with negative Gross Domestic Product (GDP) growth. And given the current events, I don’t believe this is an undue expectation.

A recession, however, differs starkly from a depression, which is a prolonged and severe economic downturn characterised by a significant decline in economic activity, lasting for several years, often accompanied by high unemployment, reduced consumer spending, and a sharp drop in business activity. It is considered more severe and prolonged than a recession, which is a milder and shorter-term economic slowdown.

For equities (shares), where we invest in companies and not economies, it is naturally easier for companies to do well when market conditions are most favourable (i.e. a low inflationary environment) and where there is economic growth.

Simply stated, two quarters of negative GDP growth, while not ideal, wouldn’t be a crisis.

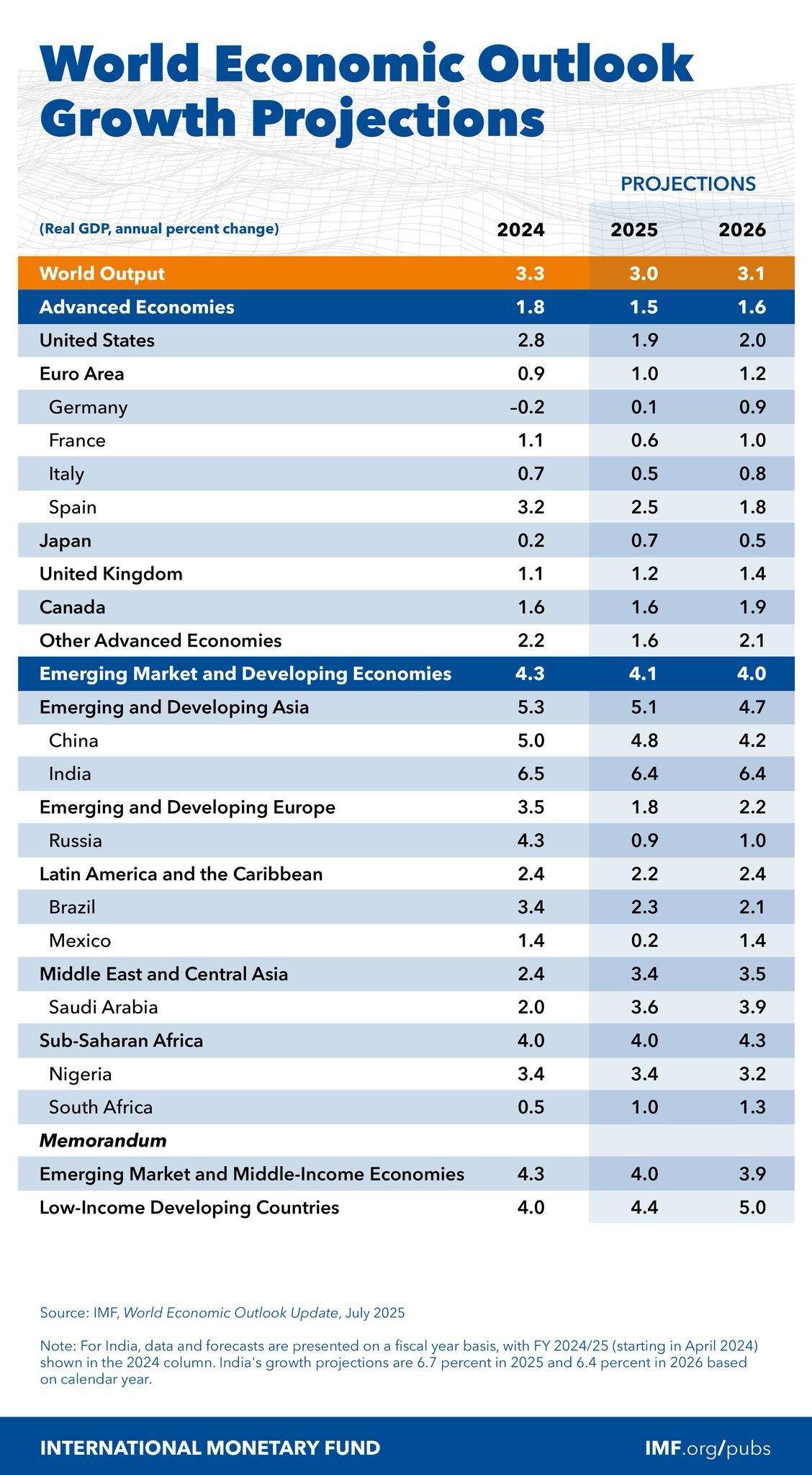

Whether or not there is to be a recession in the US, the International Monetary Fund's world economic growth projections give good and reasonable expectations going forward to the macro “bigger picture” global economy.

And the International Monetary Fund has now updated their forecasts as a result of the recent global tariff disputes led by US President Donald Trump, to what can be expected.

The IMF has a good past track record of getting these forecasts right, more often than not.

In April, they lowered their expectations for the world to grow by 2,8% for this year, and 3,0% for next year.

The IMF has since come out a fortnight ago, stating that they now expect 3,3% growth for this year, and 3,1% for next year, which is positive.

The US is expected to slow significantly in line with previous forecasts, and Europe looks fairly pedestrian over the next year or two. The absolute totals for the US are overall decidedly lower.

Thereafter, the greatest difference lies between Advanced Economies being expected to grow by 1,5% this year, and Emerging Market Economies growing 4,1%.

Within emerging markets, China, bearing the worst brunt of the Trump Tariffs, has since seen its growth forecasts increase, and is now expected to grow by 4,8% this year, and 4,2% next.

From an investor's point of view, this further supports and highlights the expectation that while US markets will still give solid real returns over time, total returns should moderate and be more muted going forward.

And for Emerging Markets, where the growth can be expected to extend to some extent in their share markets, this is supportive evidence that Emerging Markets should be included in a rounded diversified portfolio.

And as for the question of whether a US recession (two quarters of negative growth) takes place or not, US growth is anticipated at 1,9% for the year in a low inflation rate environment, putting this in a far better perspective.

If you have been receiving my newsletter for a while and would like to discuss your financial concerns or goals in more detail, please have a look at the link below, where you will find everything existing clients of mine have experienced, the tools we use when doing financial planning for them and answers to any other questions you might have about us.

Friday Food For Thought