8 Investment Lessons from OMIG | Asset Classes Unpacked by OMIG

Each year the Old Mutual Investment Group (OMIG) shares their more comprehensive views in their LONG-TERM PERSPECTIVES 2024 publication, now in its eleventh edition.

This publication aims to show graphically and in simple terms the drivers behind the returns of the different asset classes - highlighting the importance of both diversification and longevity in the market.

The analysis includes understanding the major macroeconomic drivers of investment returns, such as currency and inflation. In addition, this publication draws investors’ attention to the long-term patterns in asset behaviour and, in so doing, puts shorter-term volatility into perspective.

These patterns culminate in eight informative lessons that empower the long-term investor. We hope that the lessons we have focused on will help you make the right decisions to grow your wealth in the years and decades to come.

Included are concise firm views on the local and offshore stock markets, the Rand, Gold, Inflation and Bonds both locally and abroad, Listed Property and the Money Market. There are also useful summaries of each section, covering the 8 investment lessons they share;

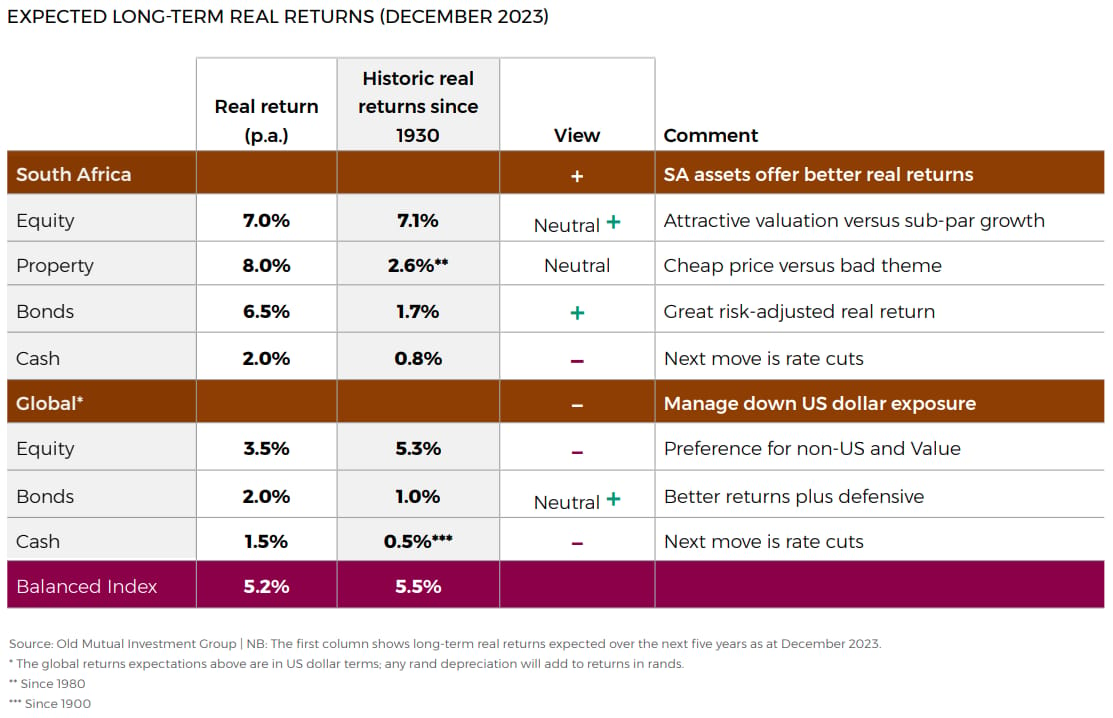

On page 40, Macro-Solutions first provides some context, then summarises the investment return expectations for the next 5 years for each of the asset classes:

* All investment returns stated are over and above what inflation will be, i.e. Real Returns.

**Offshore asset class returns towards the bottom are all stated in $US. Therefore, any current weakness or strength is to be added.

The left-hand column shows the expected real returns (over and above official inflation), per annum, over the next 5 years. The 2nd column shows the actual historical results, per annum, over and above inflation, since 1930.

In other words, reading the above image from top to bottom, OMIG expects local shares to deliver 7,0% per annum for the next 5 years over and above inflation, and Listed Property also 8,0% per annum over the next 5 years (these all over and above the official inflation rate). Looking at local bonds and cash, we see bonds yielding an attractive 6,5% per annum in real terms of levels for the inflation and interest rate outlook, and cash is likely just to only beat inflation before tax.

Offshore we see offshore cash and bonds likely to deliver marginally positive real returns, and so the preferred asset class remains equity, with a preference towards non-US and value shares.

This framework supports the basis of our client portfolios in both discretionary and non-discretionary portfolios.

For those clients who have retired and/or draw a regular retirement income, this is the basis for supporting their regular income requirements.

Friday Food For Thought