A Chart a year ago Thought Impossible

The Rand has been much stronger year-to-date on the back of lower inflation across the globe and in SA, particularly after the formation of our GNU, which represented the best-case financial scenario following our election.

The Rand to the end of last month is now 9% stronger over one year, and this rand strength translates to a positive year-to-date performance comparison to offshore markets, which is benefitting from lower interest rates, where all are stated in USD terms,

This is one chart I don’t think many would have thought possible a year ago, where this time last year the negative SA sentiment was close to its worst.

This week, going over 200 days without load shedding, offshore events are still of more importance, with inflation in the US heading lower. A further 0,25% interest rate cut in the US is expected next month, and we in SA should also benefit by cutting our interest rate back at home.

The US Fed is cutting interest rates and should continue to do so, even if there is uncertainty about where they will ultimately settle. Inflation is still moving in the right direction, even if there are some sectors where price pressures are sticky, and some months where the data is disappointing.

A return to sustained inflation below 2% in the US, which was the case before COVID-19 in the US and Europe, seems unlikely, but inflation hovering between 2% and 2,5% should be acceptable to the Fed, even if it would not admit it.

Global growth is still resilient, though unexciting. There are sectors under pressure in the US economy, notably manufacturing and housing, but overall, consumer spending is growing at a healthy pace. There are also countries with unique problems – Germany’s overreliance on car manufacturing and China’s on real estate – but the overall picture seems good. This is the supportive macro backdrop for markets, particularly equities (shares).

Another way to think about it is simply that the rand was battered by several storms in recent years. Most notably, the US dollar has been globally strong, up 25% on a trade-weighted basis over 10 years.

Commodity prices, particularly platinum and palladium, have been soggy. Emerging markets have also generally fallen out of favour with global investors, and South Africa has done little to convince them otherwise through load shedding, logistics crises, and policy and political uncertainty.

Some of these headwinds are now easing and some are turning into tailwinds.

Our petrol price is almost R5 less per litre than a year ago (R20,26 vs R24,95 in Oct 2023).

After all, the good thing about storms is that they ultimately pass.

The trick is to have a diversified and valuation-based investment strategy to avoid anchoring incorrectly and getting buffeted by the wild market winds.

Our Chief Investment Strategist, Izak Odendaal, on the Rand | Via Business Tech

Our Chief Investment Strategist, Izak Odendaal, was quoted earlier this week via Business Tech “that the rand’s fair value is as much art as science”.

The rand is currently standing at R17,62.

Although this is better than the near R20 to dollar seen in May 2023, it is still much weaker than the roughly R14/$ seen in 2022.

The rand also stood at R11,57/$ in February 2018.

“One valuation approach is to employ the purchasing power parity (PPP) theory, which holds that the exchange rate will reflect inflation differences between two countries over time,” said Odendaal.

“Since higher inflation will erode one country’s competitiveness relative to the other, its currency will fall to adjust for this.

“A PPP estimate suggests a fair value range around R15,70.”

He added that another way to think about the rand is that it has been battered by several storms in recent years.

The US dollar has been especially strong, up 25% on a trade-weighted basis over the last ten years.

Commodity prices, especially platinum and palladium, have been soggy. Emerging markets have also fallen out of favour with global investors, and South Africa has done little to convince them otherwise. Load shedding, logistics issues, and policy uncertainty have hurt sentiment.

“Some of these headwinds are now easing, and some are turning into tailwinds.”

“The good thing about storms, after all, is that they ultimately pass.”

“The trick is to have a diversified and valuation-based investment strategy to avoid anchoring incorrectly and getting buffeted by the wild market winds.”

Investec Chief Economist Annabel Bishop said the rand averaged R17.49/$ in the first 14 days of Q4 2024.

However, Bishop said that two 25 basis point (0,25%) cuts in interest rates from the US Federal Reserve should see the rand run stronger towards R17/$ by the end of Q4.

For the full article, you can click on this link: The rand should be worth R15.70 to the dollar – BusinessTech

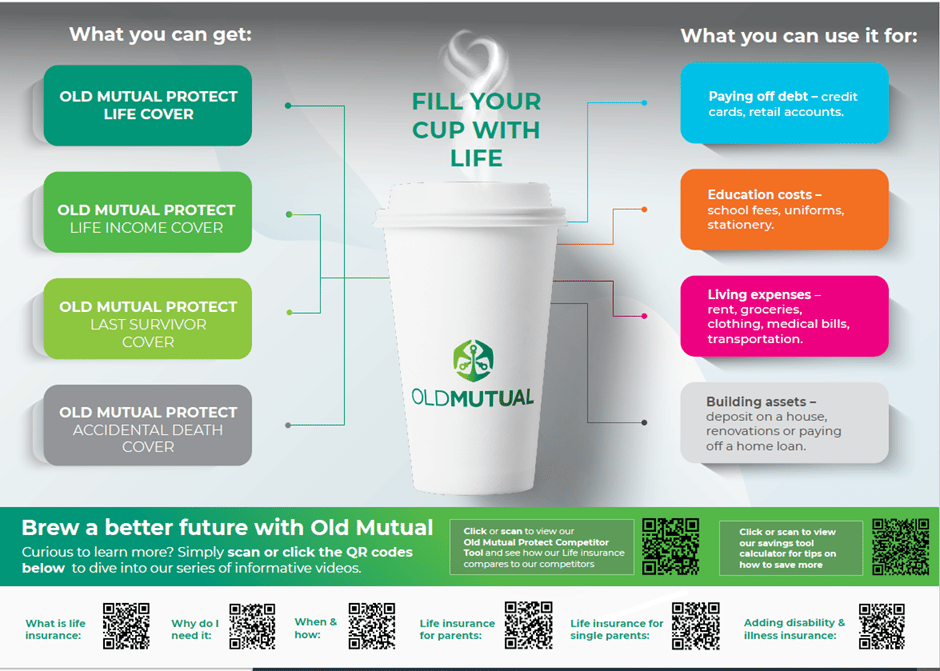

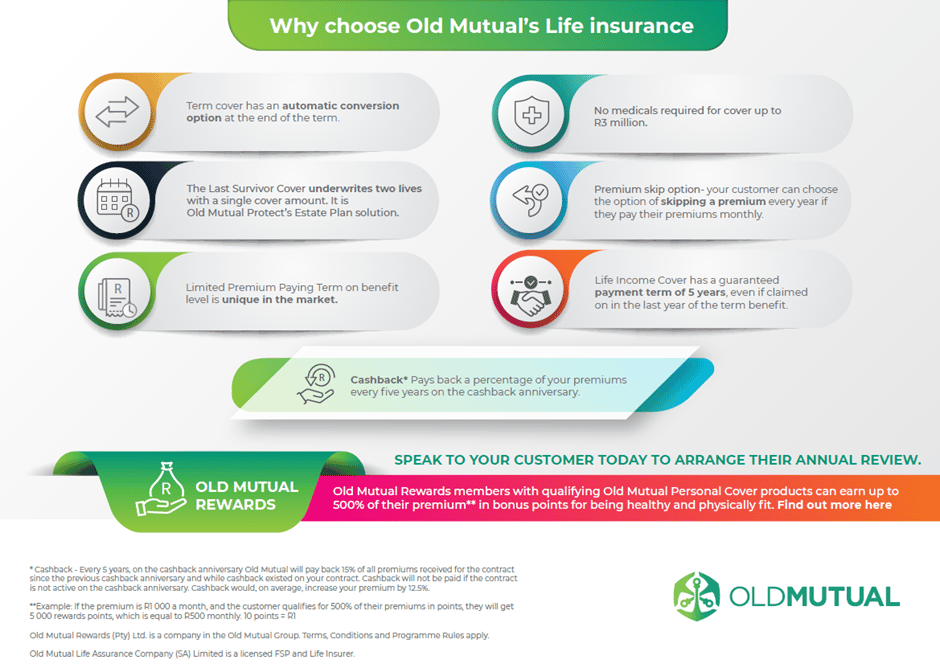

Life Insurance Focus

I came across these 3 pages on an Old Mutual Life Brochure and thought it would be quite interesting to you. Most people think life insurance is very expensive, but if you look at what Coffee and beer costs these days, you might reconsider that thought.

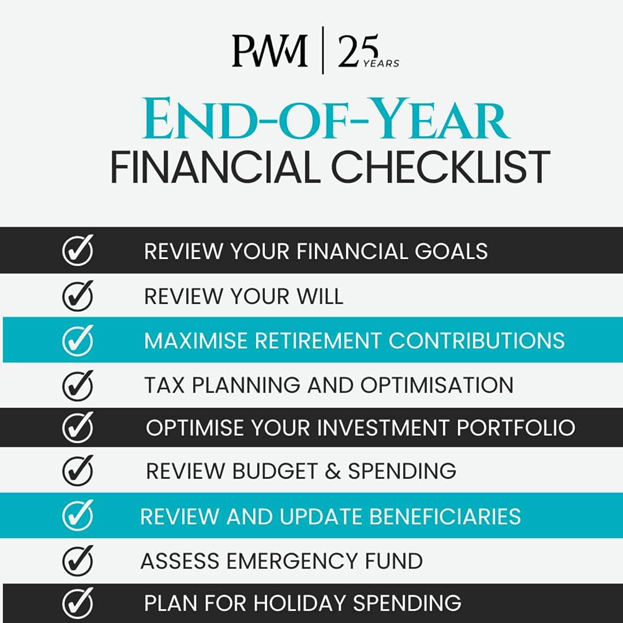

The end of the year is approaching rapidly, here’s a checklist we compiled to prioritise: