Bringing a new life into the world is exciting and joyous, but it also comes with a fair share of financial responsibilities. Having gone through this experience 2 years ago, here are some things to consider before the baby comes along.

If you're about to become a gran or grandpa, give your kids these few guidelines to make sure they've put everything in place. If they are financially secure, then you can enjoy your retirement with no financial concerns.

Update your budget

Right off the bat, your monthly expenses will increase – things like medical aid, childcare costs and consumables. (Besides a mountain of nappies, you’ll also need wipes, baby wash and shampoo, creams, sterilisers etc.) You’ll also need to consider the once-off cost of items you need to buy before the baby arrives, like a car seat, cot, clothing, blankets, carrier, stroller, toys…

Top tip: Make a gift registry for the baby shower, itemising all the things you’ll need, so that friends and family can help you out.

The medical stuff

Medical-related expenses for childbirth can run in the thousands, or even tens of thousands if you factor in the antenatal consultations, ultrasound scans and blood tests during pregnancy and the type of birthing method you choose (natural or planned caesarean section). How much you’ll have to pay out of pocket depends on the extent of your medical aid and gap cover, as well as the rates that your doctors charge.

When choosing a gynaecologist, ask what their rates are for the birth, along with relevant medical aid tariff codes. Then speak to your medical aid to understand how much of the bill they’ll cover.

With gap cover, you might be able to claim back some or all of the shortfall (what your medical aid doesn’t cover), but remember that you’ll still have to front the initial costs out of pocket.

Top tip: Most gap policies require you to take out cover before falling pregnant. There’s often a waiting period before cover starts, which can be up to a year or more. So, even if you’re just thinking of starting a family, take out a gap policy as soon as possible.

Looking long term

Ah, school fees. Saving for your child’s education can start well before they’re even born. Make a line item in your budget and remember that private education fees are substantial. It’s also worth pointing out that it’s never just the school fees. You also need to consider the cost of uniforms, stationery, sports, extra-murals etc.

And what about your living situation? Do you need a bigger house? If you’re bursting at the seams, you’ll need to budget for an increase in rent or for a deposit to buy a property.

And then there’s life cover. It’s crucial that the breadwinner in the family has an appropriate level of cover for all the expenses related to raising and schooling a child. This could easily be between R1–and R2m for a middle-income household. Make sure your budget also includes the life cover premium.

And lastly, you need to update your will. Who will be your child’s guardians in the event that you pass away? It’s not nice to think about, but it’s important.

The list goes on

I’ve touched on a few important points, but this is by no means an exhaustive list. Having a child may seem daunting, but proper planning can remove some of the stress that comes with the extra responsibility. If you feel overwhelmed, chat to me so that we can make sure your budget covers everything you’ll need.

Life is a series of baby steps – take one step at a time and you’ll get there!

PWM Investment Solutions

In October 2021, we introduced our PWM range of investment funds for our clients.

Providing this update on these funds, these were designed to complement our top-performing SIS discretionary managed strategies.

Never to complete or replace these. Instead, it’s a simplified additional investment option for our clients. The fund names, structure and different options have all been given to keep to the simplicity of this offering.

Similarly, with our SIS discretionary managed strategies, we have registered these funds at the FSB as standalone funds, blending top unit trust and passive fund managers within each fund to meet specifically targeted investment returns.

The background asset allocation and fund research are done jointly between us and the SIS investment team (now called Old Mutual Multi-Managers), using their existing research and investment capabilities.

For the needed fund structure, Prescient provided us with the best overall solution to hold these funds, for which reason their name is used in the branding.

Funds Available

Here is a link to the latest fund fact sheets to the end of August for each of the four different fund offerings, being the Stable, Balanced, Dynamic and Worldwide Funds Our Funds - Private Wealth Management

The recent returns have been pleasing overall, with the last one-year returns seeing a net return of 10,42% for the Stable Fund, 12,51% and 14,89%, respectively, from the Balanced and Dynamic Fund, and 19,97% from the Worldwide Fund.

These returns are stated after fund fees, and these are shown on the fact sheets. These see a strong reduction in the overall fund fees, which has been negotiated on the aggregate strength of our clients.

The difference between the Dynamic and Balanced Funds - is that while these two funds will, for the most part, have similar holdings, the Dynamic Fund will see more active tactical decision-making through the market cycle.

Looking at worldwide funds, by definition, a worldwide fund differs from a pure offshore fund in that it will have some allocation to SA assets, too. At this stage, we are holding 95% offshore – but investors can reasonably expect this to drift down to up to roughly 30% in local assets.

These funds are available for regular voluntary investments, preservation funds, retirement annuities and living annuities.

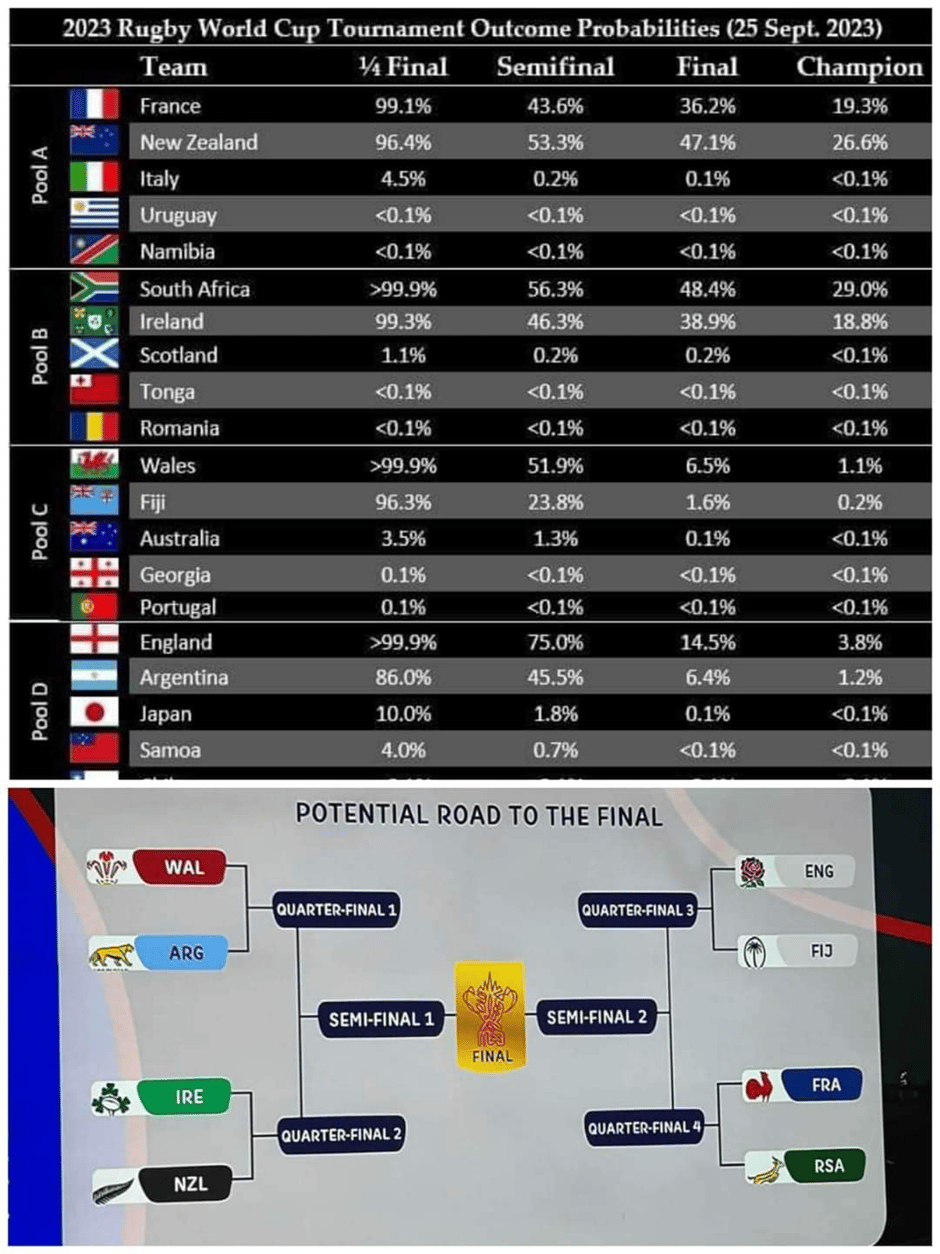

Rugby World Cup | Updated Algorithms Show Boks Still Favourites

Artificial Intelligence (AI) updates regularly. After last weekend’s matches that included the Boks loss to Ireland – while the gap has reduced, the Boks are still the statistical favourites to take the overall title.

AI is becoming more prevalent, but remember that human interactions are far less predictable, and this gives me faith that I can still enjoy the games without spoilers.

Friday Food for Thought