Beyond the Rally

2025 has had it all – volatility, shocks and even a few silver linings. The rand has rallied against the dollar, local markets have outperformed, and gold is flashing signals again. Ninety One’s director of investments, Jeremy Gardiner, unpacks what it all means for investors and the key local and global trends to watch heading into 2026.

What can we expect from 2026?

Global markets post April’s trauma seem to have largely digested the tariff news. However, Trump needs tariffs to be lower. Having Brazil, India and China at 50% or above will be felt by Americans, and he can’t risk a spike in inflation, so expect a softening of tariffs shortly: Brazil, India, China and hopefully even South Africa.

Thank heavens for the oil price, which has played a major role in keeping inflation low and providing relief to consumers. Having started the year at US$75 per barrel, the oil price has spent most of the year around current levels of US$65. The US consumer is thus fairly robust, and given that they constitute 70% of the US GDP, the economy is in reasonable shape.

In terms of geopolitics, the ceasefire in the Middle East is holding, and hopefully, the momentum can see both sides adhering to the agreement details.

As we approach the fourth year of the Russia-Ukraine conflict, it is, first of all, amazing that Ukraine has managed to hold back mighty Mother Russia for this long. But what’s becoming clear is that no amount of Trump shouting is going to get Volodymyr Zelensky to forfeit land, while Vladimir Putin needs something to save face. He can’t put Russia through war for four years, with close to a million men killed or wounded, and then walk away with just a ceasefire. Any solutions, however, would be beneficial in terms of stimulating a risk-on environment, supporting emerging markets – the so-called “risk dividend”.

Looking ahead, lower oil prices keeping inflation under control, softer tariffs, and interest rates heading down (with a few extra cuts for Trump) all point to firming growth, healthy corporate earnings and market opportunities. However, sky-high technology share prices, stretched valuations, and leveraged retail investors, not to mention an unpredictable president, are a dangerous cocktail, so tread carefully.

By contrast, as global investor attention finally turns to emerging markets, South Africa too is feeling better. We have indeed come a long way since the dark depths of mid-2023. To me, that was when we as a country hit “rock bottom”.

We have indeed come a long way since the dark depths of mid-2023

It was pre-GNU, the ANC was large and in charge, and everything was broken. We were limping post “state capture”, we had just been grey-listed, we had level 6 load-shedding (with rumours it could go up to level 15), the railways and ports were broken, and on top of that, the US had just accused us of supplying Russia with weapons.

Adding insult to injury, it was midwinter, and South Africans were cold and depressed. It was essentially our Winter of Discontent!

Two years later, things are looking better. The GNU is functioning, albeit imperfectly, and progress is being made. Visa backlogs have been cleared; Home Affairs is being digitised; Operation Vulindlela has essentially fixed electricity; and railways and ports have made significant progress. Their next focus is on water, crime and municipalities – fixing the country one step at a time.

We’re off the grey list, growth is improving, gold is up 50% this year, and the JSE is one of the top-performing stock markets globally in dollar terms this year – yet it remains reasonably priced.

Bottom line

From the depths of despair in mid-2023, South Africa has been trending slowly in the right direction. Momentum looks set to continue, with a positive medium-term outlook for the next couple of years.

It’s been a long time since we’ve been able to say that.

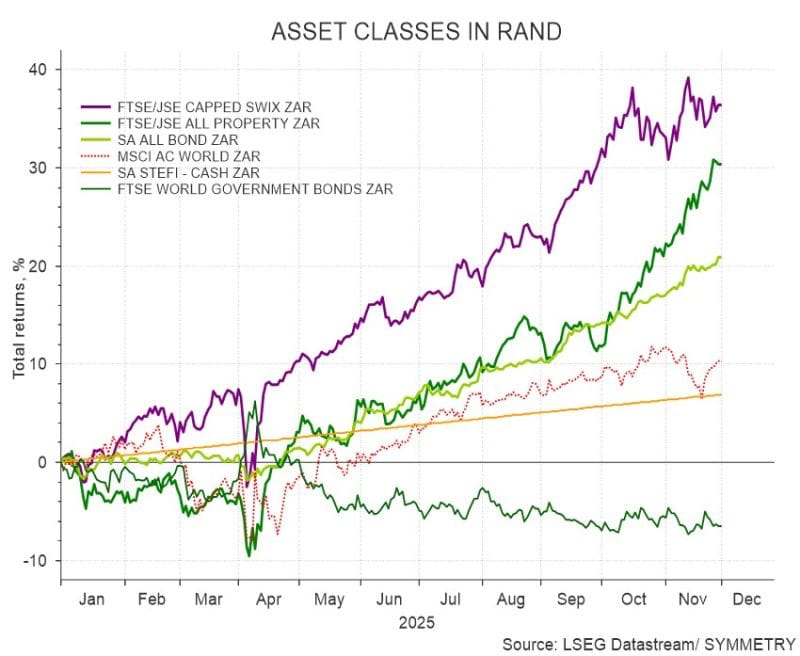

Asset Class Returns in Rand

To the end of November, with one month to go, it has been a good year for South African investors.

The only negative among major asset classes has been global fixed income in ZAR, and that is because the rand at the end of last month has gained 9% against the US dollar.

Building Strong Foundations with PWM

A lasting legacy isn’t created overnight. It’s built through consistent, intentional financial decisions:

· Investing with purpose to grow long-term wealth.

· Protecting your family through adequate insurance and estate planning.

· Planning for retirement early to maintain your lifestyle later in life.

· Teaching financial responsibility to the next generation.

· Reviewing your financial plan regularly to stay aligned with your goals.

Building a legacy is about more than wealth; it’s about creating stability, opportunity, and peace of mind for those who matter most.

RETIREMENT PLANNING – WHAT DOES IT REALLY MEAN?

Talking about Building Strong Foundations with PWM, we are not just talking about the 5 points above, but also building the business and bringing in new talent and planners of the future, which brings fresh new perspectives and ideas

In our latest quarterly connect newsletter, one of our associate planners interns helped me right an article with the title “What Does Retirement Planning Really Mean”. This, coming from a 21-year-old fresh out of varsity, can really teach not just the young generation about the importance of retirement planning, but even the ones close to retirement will find value in this.

In conclusion, she writes: As Ninety One highlighted in their 2024 Investor Report, “Retirement success isn’t about timing the market, but about spending time in the market.” The longer you stay invested – through both good and bad cycles – the more your portfolio benefits from growth and compounding over time. Ultimately, retirement planning isn’t about being perfect or predicting the future. It’s about being prepared, intentional, and adaptable. With the right plan and the right guidance, you can create not just financial security, but financial freedom – the freedom to enjoy the golden years you’ve worked so hard for, without the stress of uncertainty

Here is the link to the full Connect newsletter: https://www.privatewealth.co.za/wp-content/uploads/2025/12/PWM-Connect-Newsletter-Ed4-2025.pdf

Friday Food For Thought