Budget Speech 2024

The annual budget speech is now being delivered, and the transcript of his speech per the first attachment.

You can now read the speech as he presents.

Global economic growth is expected to be 3,1% this year, to 3,2% in 2025.

South Africa’s economy grew by an estimated 0,6 per cent last year. This is a downward revision from the 0,8 per cent projection in the 2023 MTBPS, reflecting a worse-than-expected outcome in the third quarter of 2023.

Between 2024 and 2026, growth is projected to average 1,6 per cent.

Tax Proposals

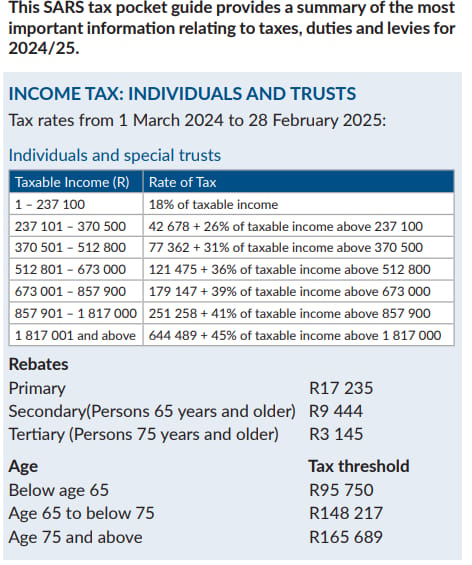

Personal Tax brackets see inflationary increases.

Sin taxes increased as expected.

This means that the duty for alcohol products excise duties, above-inflation increases of 6,7 and 7,2 per cent for 2024/25 are proposed.

This means:

• A can of beer increases by 14 cents;

• A can of a cider and alcoholic fruit beverage goes up by 14 cents;

• A bottle of wine will cost an extra 28 cents;

• A bottle of fortified wine will cost an extra 47 cents;

• A bottle of sparkling wine will cost an extra 89 cents; and

• A bottle of spirits, including whisky, gin or vodka, increases by R5.53.

We also propose to increase tobacco excise duties by 4.7 per cent for cigarettes and cigarette tobacco, and by 8.2 per cent for pipe tobacco and cigars.

This translates to:

• A R9.51 cents increase for cigars;

• A 97 cents increase to a pack of cigarettes; and

• An extra 57 cents for a pipe of tobacco.

New Tax Tables

Not Introduced

No specific wealth taxes per se

No increase in VAT

Two-pot Retirement system to be looked at further and implemented 1 September 2024,

Planner Thoughts on the Budget

My initial thoughts on the budget :

“Tax collections came through lower than previous years, but a little more than expected at the time of the Medium Term Budget Policy Speech.

Beforehand, what was needed from this budget speech was strong fiscal discipline to balance the budget, which it appears at first glance that this has achieved.

The consolidated budget deficit will decline to 4,9 per cent of GDP in 2023/24, far better than many feared.

The budget deficit will begin to improve from 2024/25 to an estimated 4,5 per cent of GDP, reaching 3,3 per cent by 2026/27 – with debt now peaking at 75.3 per cent of GDP in 2025/26, I believe will please investment markets”.

Kind regards

Financial Planner | Private Wealth Management

BComm

Post Graduate Diploma in Financial Planning

T. +27 (0)21 555 9355 C. +27 (0)82 436 4597 E. [email protected]

Private Wealth Management (Pty) Ltd | Reg no: 2019/470597/07 | An Authorised Financial Services Provider