Budget Speech 2025 Highlights

This year's Budget Speech was somewhat unique; while it was the first budget speech presented under the GNU, we all got to learn what the first version entailed.

VAT dominated the discussions from version 1, due on 19 February, to version 2, presented on Wednesday.

From version 1, knowing there was to be a budget shortfall, the question was how Fiscus could balance the budget, which remains the most important pillar.

Of course, a budget speech alone will never fix all the country’s problems, nor is it supposed to. Yet, it remains a crucial cog in creating an environment conducive to business, which will drive the economy.

Izak Odendaal | Impact on the macro-economic environment

Old Mutual Chief Investment Strategist Izak Odendaal analyses the budget speech and its implications for the macro-economic environment, investment markets, investors, and consumers. He also commends the GNU for its commitment to fiscal consolidation.

He points out that “what is a good Budget for investors, is not necessarily a good Budget for taxpayers”.

To view, click on this link;

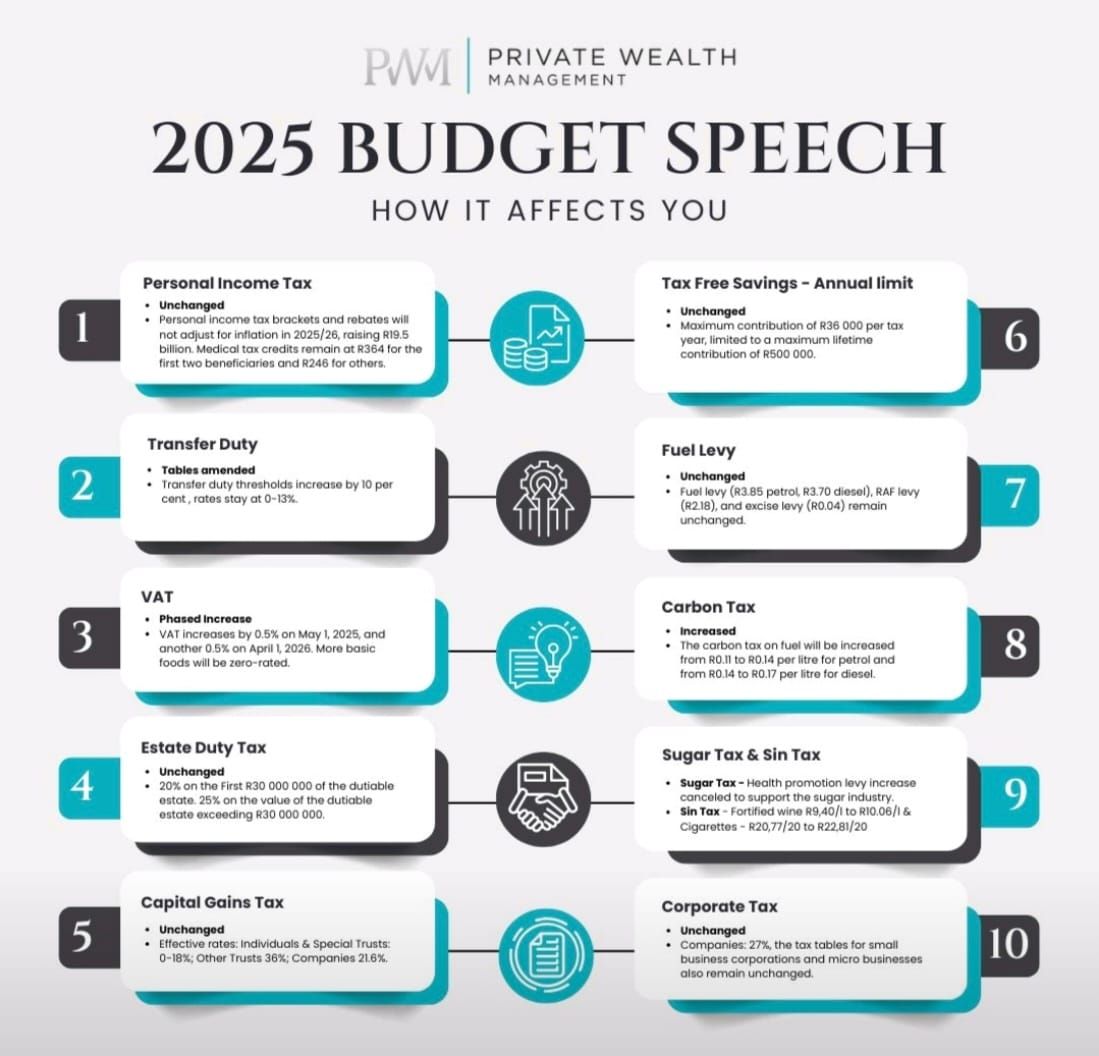

PWM Budget in a Nutshell | How it Affects You

We summarise the Budget as it affects individual taxpayers;

Income Tax Collections

Tax collections are now over the R2trillion mark, and are estimated to be;

SARS is receiving further funding to collect outstanding taxes, the SARS Commissioner will share more details in two weeks;

The Nitty Gritty for Individual Taxpayers

Personal taxes saw no shifting of individual income tax brackets for any inflationary adjustment. This means we all pay higher taxes if we get an inflation salary increase.

There were no new higher tax bands for wealthy individuals, nor any increase in VAT, Capital Gains Taxes, or Dividend Withholding Taxes, nor were the fuel levies increased, and Corporate Income Tax remained the same. Even the medical aid credits stay the same.

After a few years of no changes, relief was provided for the transfer duty tables for property purchases, which saw the tables adjusted by 10% to provide some inflationary relief;

The theme of increasing indirect taxes instead of direct taxes continues, which makes sense in our country, where we have a high proportion of unregistered tax persons relative to the total population.

In summary, you will be paying the same Income Tax next year on the same income and the same amount (but not adjusted higher for inflation) on your fuel levies. But you will pay more on sin taxes.

Most of the other individual tax mechanisms and allowances remained unchanged. This includes the annual interest exception, the Capital Gains exemption, the annual limits for TFSAs, Estate Duty, the Primary Residence exemption, and the Estate Duty exemptions and allowances. Effectively, this represents an inflationary tax increase on all of these.

Tiaan Herselman | OM Wealth Head of Advice and Proposition

Tiaan discusses the South African Budget Speech outcomes, focusing on the VAT increase and the lack of inflationary adjustments on personal income tax. He examines the impact on financial planning, including investments and long-term retirement funding strategies.

To view, simply click on the link below;

Examples of How Treasury Could Have Seen No Vat Increase but Didn’t

For example, a 1% VAT increase brings in an estimated R30-R40billion. Cancelling what was supposed to be the once-off COVID-19 grant of R370 per month to unemployed individuals who did not receive any other social grant or UIF payment - would mean that we would then have had no VAT increase.

A better example may have been to increase the fuel levy. This could have been a good option as, besides being an easy tax to collect, international oil prices are heading lower based on reduced demand, and together with a Rand heading stronger, meaning our fuel prices are heading lower, it could have been easy to increase our fuel levies.

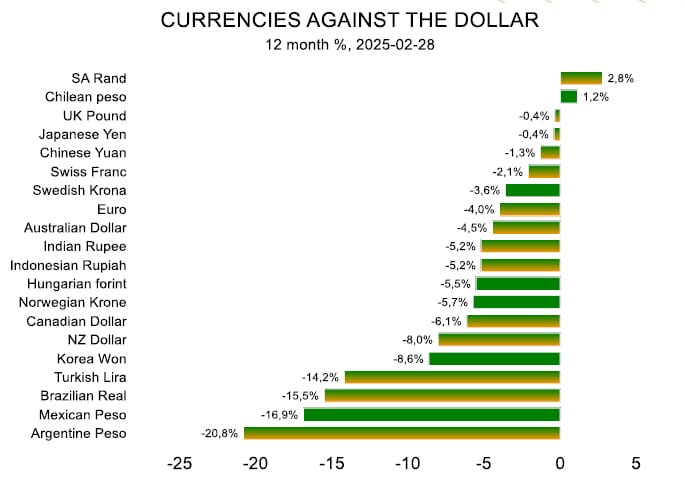

To the end of February, the Rand has been the strongest currency against the US dollar over the last one-year period;

However, he consciously didn’t increase the fuel levies, sighting the impact on the lower income earners, and ultimately wanting to provide a lower inflationary environment. This is better in the medium and long-term to keep inflation down and the national overall debt under control.

Higher inflation means it would be more expensive to fund the Budget deficit, which ultimately hurts the very poor the most.

What if this Budget Is Contested

As Izak highlighted in his video earlier, the Budget still needs to be approved in Parliament.

Via the Daily Maverick, here is a good overview of what happens next if contested. To read this summary, click on the link below;

Planner Thoughts on the Budget

My initial thoughts on the budget :

“Tax collections came through higher than expected, although more will be shared in two weeks.

What the Minister did do in largely keeping total expenditure the same from version 1 to version 2, was to change the income or tax collection side, from a 2% higher VAT rate with a wider reach to be matched with accompanying income tax relief - to no income tax relief with a 0,5% VAT increase.

We all would have liked to see more initiatives around small and medium-sized businesses to boost growth, but that was lacking.

Last month, the Minister also kept to his comments that there was no additional funding for the NHI, any large income tax increases, or wealth taxes.

Thereafter, the Minister indicated that next month will see a full revision of government expenditure, which we all welcome.

Beforehand, what was needed from this budget speech was strong fiscal discipline to balance the budget - and the Minister showed his commitment here.

That government debt will stabilise, at 76,2 per cent of GDP in 2025/26, while the consolidated budget deficit narrows to 3,5 per cent by 2027/28, which is also better than previously thought.

Markets will like this Budget”.

FRIDAY FOOD FOR THOUGHT