China leading the world in September

China’s government introduced sizeable monetary stimulus last month, as well as cutting their lending rate by 0,5% in an additional surprise special interest rate cut, where no announcement was previously scheduled or due.

The Prescient China Balanced Fund which we use a lot in client portfolios (invested mainly on the Shanghai exchange) surged last week, where their fund did 18% in USD terms (the CSI300 Shanghai stock market did 16%) for the week. The Prescient China Balanced Fund did an impressive 21,389% not annualised in USD terms for September.

Most other general Emerging Market funds also share in Chinese growth, where these wider funds invested between the many emerging market countries would typically have between 33-40% of the fund also invested in China, but mostly invested via the heavy tech sector of the Hong Kong market.

Global Economy in September

September’s big news was the arrival of the long-anticipated US interest rate-cutting cycle. The Federal Reserve lowered its policy interest rate by 50 basis points (0,5%). Going into its meeting, there was some uncertainty over the size of the move, though not on the direction. The case for front-loading interest rate cuts makes sense considering the recent weakening of the labour market.

Given progress on the inflation side of the Fed’s dual mandate, it is prudent to shift focus to its other goal of maintaining full employment and taking a pre-emptive step to prevent the recent slight rise in unemployment from accelerating.

Fed chair Jerome Powell was at pains to argue that the Fed was not responding to a crisis or panicking. Still, lower inflation afforded the Fed room to make a bigger cut and forestall any further deterioration of labour market conditions. Powell characterised the US economy as still relatively healthy and wanted to keep it that way.

Nonetheless, more cut cuts are on the way, with Fed officials estimating that the “neutral” level of interest rates – that theoretically keeps the economy on an even keel – is around 3% compared to the current 5%.

Undoubtedly, the Fed’s move opens room for other central banks to ease policy, and 27 did so during the month. This includes the European Central Bank, which cut interest rates for the second time this cycle, lowering its deposit rate by another 25 basis points to 3.5% amid ongoing weakness in the Eurozone economy, particularly in Germany. However, the Bank of England and the Bank of Japan kept interest rates unchanged. The former is likely to cut at its next meeting, while the latter is expected to resume its hiking cycle.

Brazil hiked rates amid a strengthening economy and rising inflation, not long after a cutting cycle that lasted from July 2023 to May this year. It is a reminder that if inflationary pressures resurface, central banks elsewhere could also be forced to respond. No interest rate path is preordained; it always depends on how the inflation, employment and growth outlook evolves.

Unexpectedly, the real policy fireworks came from China in response to ongoing soggy economic data and persistent deflationary pressures. Annual core inflation fell to only 0,3% in August, while producer inflation remains negative. Youth unemployment climbed to 18.8%, the highest level in a year as per the refined definition.

Therefore, the People's Bank of China cut the reserve requirement ratio for banks by 50 basis points (0,5%), freeing up room for more lending. It also reduced homeowner mortgage rates, lowered its policy interest rate, and injected liquidity into the financial sector, including measures to explicitly boost equity values.

Following the unscheduled meeting, the Politburo promised to mobilise fiscal resources to ensure the world’s number two economy met its 5% growth target.

For the first time, it appears that Beijing is prepared to tackle the economic malaise at its source – the beleaguered property sector – rather than relying on exports to keep the economy humming along. This suggests further stimulus measures in the months ahead, which could raise the growth outlook and support markets.

One of the highlights is the current Rand strength at around R17,23 to the USD at the month-end (last month end of August: R17,80).

While this is naturally good news, the Rand strength detracts from offshore allocations when looking at valuations from a Rand investor's point of view.

We expect more Rand strength in the remainder of this year, that remains our formal view.

Local Economy in September

The SA Reserve Bank’s Monetary Policy Committee took a more cautious approach to its first rate cut of the cycle. As with the Fed, its policy stance was probably too restrictive, given the economy's state. Before the recent cuts, falling inflation increased real short-term interest rates to 3% in the US and 4% in South Africa.

Consumer inflation declined to 4,4% year-on-year in August, a touch lower than expected. With big petrol price cuts in September and October still to be reflected in the official numbers, inflation is likely to fall further in the next few months. The SARB’s official forecast suggests inflation will be somewhat below the 4,5% target over the next two years.

Unlike in the US, however, the economic growth outlook is improving as structural reforms are implemented, notably easing the electricity constraint.

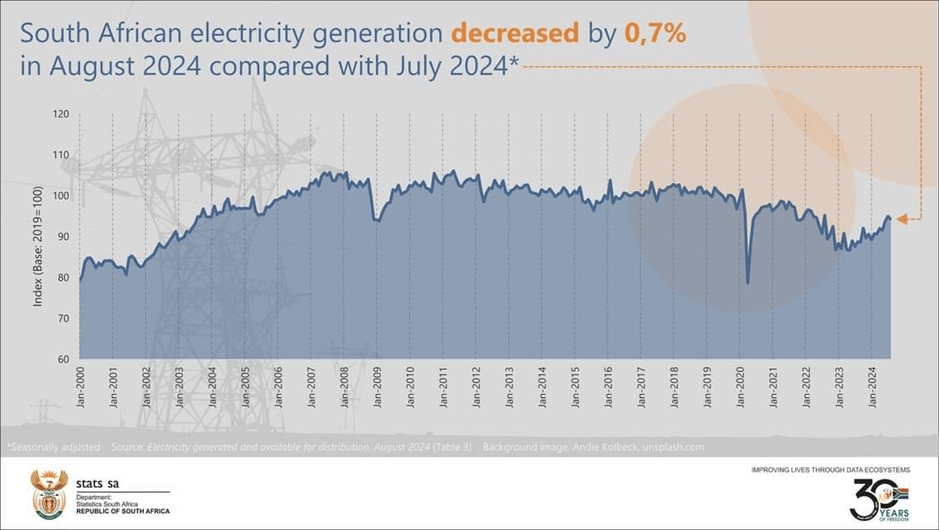

Electricity generation was 0,7% lower than the previous month, but is up 6,3% from a year ago;

The Reserve Bank expects economic growth to rise from around 1% to 1,8% over the medium term.

Backward-looking economic data is still on the soft side. For instance, the economy grew by 0,4% quarter-on-quarter in real terms in the second quarter, a pedestrian performance, but better than 0% growth in the first quarter.

However, sentiment is improving; the Bureau for Economic Research’s long-running surveys of consumer and business confidence have both turned up noticeably from depressed levels in the third quarter. This points to improved optimism over economic prospects, which should ultimately lead to higher levels of investment spending.

Overall Global Market Returns

In terms of overall market returns, for September, the US S&P was up 2,1%, as the MSCI World Index gained 2,3%.

Chinese equities gained 23% in the month, and since the market had been treading water for several months, the one-year return of the MSCI China index (mainly Hong Kong) was a similar 23% at the end of September. This boosted the overall emerging market sector, with the MSCI Emerging Markets Index returning 6% in September, 17% in 2024 thus far, and 26% over 12 months.

Regarding commodities, the gold price hit a fresh all-time high during September and closed at $2 648 per ounce. This good increase was in line with our previous views, and it’s pleasing to see this coming through.

In contrast, the price of Brent crude oil fell 8% to close the third quarter at $71 per barrel, as it appeared that major producers would lift output restrictions. Geopolitical concerns, notably an escalation in the conflict in the Middle East, continue to be a source of uncertainty in the outlook for oil prices. New stimulus measures announced by Chinese authorities supported metals prices, with copper and iron ore jumping during the month.

This saw a further drop in our fuel prices at home.

Platinum and palladium prices also rose somewhat in September, but the palladium price remains 20% lower than a year ago.

SA Market Returns

South African equities were positive in September, with the FTSE/JSE Capped SWIX hitting a new record level on the way to returning 3,9%. This boosted 2024 returns to 15% and the one-year return to 25%, well ahead of cash and inflation, though the 12-month number was flattered by global market weakness a year ago (as is the case with offshore markets, too).

All three traditional sectors on the JSE were positive in September. The interest rate-sensitive financials sector had another strong month, returning 2.5%, boosting the year-to-date return to 23%. The resources sector gained 3.6% in the month, pulling 2024 returns into positive territory. With links to the Chinese market, Industrials had a good month with a 5.3% return, boosting the year-to-date performance to 17%.

South African bonds had another strong month, returning 3,8%. This lifted the 2024 JSE All Bond Index return to 16% and the 12-month return to an equity-like 26%, well ahead of cash. Inflation-linked bonds returned 0.7% in September and 13.5% over 12 months.

The rally in listed property continued in September with the FTSE/JSE All Property Index returning another 5%. Coming off a depressed base, the sector has returned a remarkable 30% in 2024 and 51% over 12 months.

The rand closed the month 3% stronger at R17,23 per dollar (at the end of August, it was R17,80). The 8% appreciation against the dollar over 12 months detracts from the returns South African investors earn abroad.

In the past month, global markets have very positively accepted lower inflation and accompanying interest rate cuts worldwide, including SA.

Friday Food for Thought