Cybersecurity to Protect You

In this distribution from 13 June, I shared that I attended a session by an IT specialist on fraudulent online banking activity at our PWM national conference.

This was such an insightful and fascinating session that we reran it, as we felt it was a talk that we had to share with our clients.

Fraudulent attempts on our banking and other electronic devices are ever-increasing, and this presentation provides practical examples of how fraudsters are becoming far more sophisticated today, and how you can take easy and proactive steps to protect yourself.

To view this session we hosted with Kevin Hogan, Head of Fraud Risk at Investec, you can watch by clicking on the YouTube link below;

One of the key takeaways was that your mobile phone has become the new gateway to your online banking. Gaining access to your phone by any means greatly increases the likelihood of accessing your bank accounts.

In addition to proper passwords being a key basic security measure, making your phone far more secure, one further aspect highlighted was to use virtual credit cards, that is offered by all banks, and are where you can usually have up to 5 of these accounts on your internet banking linked to your main credit card account.

We can’t escape online banking, and one of the highest causes of fraud is actually through the many well-known retailers that we all use daily for online shopping. It’s not that these retailers themselves are fraudulent, but instead it’s relatively easy for their staff to sell your details to unscrupulous fraudsters.

For shopping online, you can earmark one virtual credit card account for your internet shopping, and then deactivate it each time you make a purchase. This will prevent the fraudster from using your card details. The message they will receive is that your card is inactive.

When you wish to shop online again, click the 'Activate' button. After your shopping, you can then deactivate your virtual card again until next time.

Excess in one direction....... | A Nedgroup View

We have a long-standing relationship with Nedgroup Private Wealth (previously known as BOE), with which we first began engaging on behalf of our clients over 20 years ago.

Earlier this week, they shared this note below, which I thought well summarised recent events in SA;

“Excess in one direction will lead to an opposite excess in the other direction”

Bob Farrell’s market rules (1998)

South African investors have had to contend with much uncertainty in recent years. Credit downgrades, grey listing and tariffs are just some of the issues we have had to adjust to. The cost to the local economy has been reflected via a weakening exchange rate, persistently high inflation expectations and higher bond yields. Higher real interest rates led to weak investment and economic growth, as investors were instead handsomely rewarded by taking advantage of offshore investment opportunities. However, as is often the case, the tide may be turning. As the Rev. Thomas Fuller is believed to have stated in 1650, “it is always darkest before dawn”.

South Africa was added to the “grey list” by the Financial Action Task Force in February 2023. This was due to the assessment by the FATF that the country exhibited major regulatory inadequacies to combat money laundering, terrorist financing and proliferation financing. The FATF provided a laundry list of issues that had to be addressed. The SA government and the banking sector have been hard at work addressing each requirement on the FATF list. It is now understood that the FATF is currently engaged in a final assessment to determine whether all requirements have been met. If SA has fully met these requirements, the country may be removed from the grey list at the next plenary of the FATF, which takes place from 20 to 24 October 2025. Therefore, to the extent that being added to the grey list in 2023 harmed investor sentiment towards the local currency and bond markets, it is possible that we could experience a positive effect if SA passes inspection. Success could also prove to be a positive catalyst for the local banking sector.

Moody’s was the last major ratings agency to apply a sub-investment grade of Ba1 in March 2020. This meant that all three major ratings agencies, including Fitch and Standard and Poor’s, have applied a junk rating to SA sovereign bonds. The impact of junk status includes weaker economic growth, a weaker currency, higher inflation, and higher long-term interest rates, among others. In recent months, the ratings agencies have provided updates to their ratings, the latest being Fitch, which issued its assessment on 12 September 2025. While the agency retained its sub-investment grade rating, the outlook is stable. The agency attributes the country’s low foreign currency-denominated debt levels (approximately 10% of the total debt outstanding, compared to a median of 55% for peers), strong institutions, credible monetary policy, and government reform efforts as positives. Positive change occurs at the margin, and the incremental improvements taking place may result in a ratings change. In turn, this may encourage increased foreign investment in the local economy.

The SA Reserve Bank’s de facto 3% inflation target is a huge positive for the local economy. While it may not lead to a sharp drop in short-term interest rates, a successful entrenchment of the 3% target could see long-dated bond yields decline somewhat from current levels. Long-term real interest rates are quite elevated when compared to the rest of the G20. Lower long-term real interest rates would be instrumental in encouraging investment in the local economy, as they would lower the cost of capital for investment, thereby spurring economic growth and job creation.

While JSE has gained substantially so far in 2025, not all sectors have participated equally in the rally. This creates an opportunity for investors. Sectors such as retail and banking have underperformed in recent months as resources and industrials led the market to record highs. The dividends generated by the banking sector, together with their historically low price-to-earnings ratio, provide investors with a margin of safety. A strengthening currency, lower inflation, and falling bond yields are positives that should benefit consumers and allow local retailers to maintain, and perhaps even improve, their margins.

The JSE is one of the top-performing exchanges globally so far this year. If the ZAR continues to strengthen, which is likely given the expectation for a weakening US Dollar, market leadership may undergo some changes as investor focus shifts from offshore to local. Investors have the opportunity to shift profits from past winners to future winners. SA Inc could prove to be an exceptional value at current levels.

We are available to assist you, our most valued client, in reaching your trading and investment goals. Please contact us at any time if we may be of service.

Warm regards

NPW Stockbrokers – Cape Town”

PWM Note in Moneyweb | Behind the Lines

Similarly, if you’ve been following the news lately, you’d probably say that South Africa is falling apart. The fight against organised crime and corruption seems to be going backwards. However, if you look at the local financial markets, there is an upward trajectory. What gives?

Our chief investment strategist, Izak Odendaal, answers this in our PMW weekly investment note that subsequently featured in Moneyweb yesterday, which you can read by clicking this link.

From my side, further supporting this, last week our local bond market saw considerable inflows from foreigners who are seeing our local bond market as increasingly attractive. R24.8 billion of government bonds were bought on just the day last Friday, which makes this the biggest daily inflow since before COVID-19.

For the week, bond purchases by foreigners totalled R41,3 billion, according to the JSE data.

Smartie Box Asset Class Returns to End of August

Diversification is the one free lunch in investments; use it. That’s because it pays to invest across different asset classes, geographies and economies.

After time in the market, diversification is the second most valuable tool you can use to manage risk, as it reduces the impact that a single poorly performing asset has on your overall portfolio. Not putting all your eggs in one basket is one of the fundamental attributes of investing.

By having a diversified portfolio, you don’t remove the volatility, but you can drastically reduce it by spreading your risk across different asset classes.

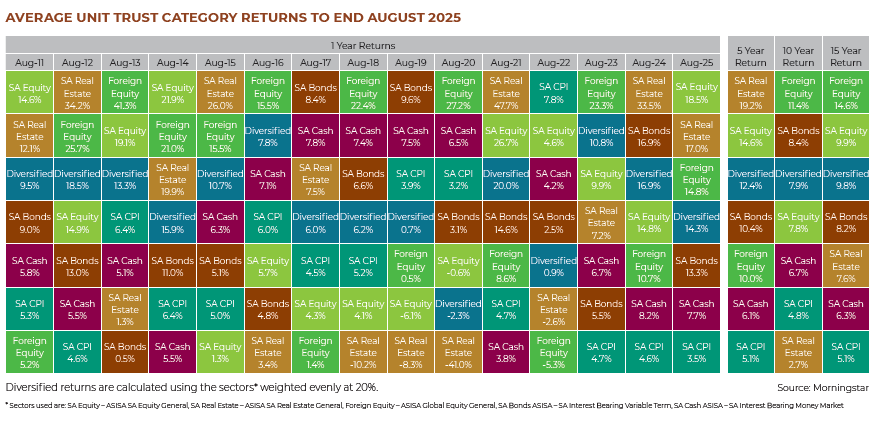

As shown below by the performance of various unit trust categories from year to year, a diversified portfolio is not without volatility. Yet over time, it has a more stable return path than many of the riskier asset classes.

A diversified portfolio also has the potential to provide returns, which are in line with or above inflation, when invested for the long term;

Very often, the best-performing asset class in one year is the worst-performing class the following year. There is very little to no correlation from year to year, as this demonstrates, regarding which asset class will be the best the following year.

Looking at the listed property that has a very close relationship to bonds, I believe very few would have thought, a year ago, when sentiment in SA was extremely pessimistic, that it was even remotely possible for this class to now be the top-performing asset class over the last 5-year period.

Friday Finish Line