SIS Strategies and PWM Solutions

For our clients that are invested in the SIS Strategies, here are the latest results to the end of September, which are pleasing and can be summarised as;

1 year | 2 years | 5 years | |

SIS Inflation Plus | |||

1-3% Strategy | 13,20% | 15,10% | 11,40% |

3-5% Strategy | 14,60% | 16,30% | 12,40% |

4-6% Strategy | 16,90% | 17,90% | 14,60% |

Maximum Return Strategy | 18,90% | 18,60% | 13,50% |

*These stated investment returns for longer than one year are annualised (i.e. the returns per annum)

These are solid performances and meaningful results in terms of absolute returns achieved, and are well above the general average market returns on a risk-adjusted basis.

For clients invested in our newer discretionary managed PWM Strategies;

1 year | 2 years | 3 years | |

PWM Solutions |

|

| |

Stable Fund | 13,15% | 13,80% | 12,87% |

PWM Balanced | 16,69% | 17,47% | 16,43% |

PWM Dynamic | 14,23% | 14,13% | 14,66% |

PWM Worldwide | 15,36% | 14,05% | 15,87% |

PWM Extra Interest Fund | 8,50% | n/a | n/a |

To give some further commentary, it’s noteworthy that over the last year to the end of September, at the fund level, our PWM Dynamic Fund strategy has now returned 14,23%, given that we hold approximately 68% of this investment offshore, and 32% local. The Rand strengthened by 9,3% against the USD over this same period, as I highlighted last week, which would detract from returns for SA investors when reporting in Rands.

The PWM Worldwide Fund returns above are also expressed in Rands, and, for the same reason, given the Rand strength we saw over this period, represent a meaningful real return.

We are therefore well pleased with this set of returns. This goes to show, yet again, that offshore investments are far more than just betting against the Rand; they are more about accessing market opportunities that are not available in SA, where SA represents only a very small part of the global market.

When the Multiple Stalls, Compounding Must Carry | Ninety One Global Franchise Fund

Included in both our discretionary managed SIS and (in most, but not all, as not in the PWM Extra Interest Fund) the PWM Strategies, as well as available as a standalone fund on all leading investment platforms, is the Ninety One Global Franchise Fund, which is, in essence, a concentrated offshore blue-chip share portfolio of 27 shares. These are predominantly leading international companies with global earnings, listed in the US.

On Tuesday, Clyde Rossouw, as fund manager, shared his views on how he expects further growth to continue and the main drivers going forward.

This is to give greater insight into some of the investment themes underlying and contained in our strategies.

And following this, further below, is a write-up of the session the next day, via Citywire.

Clyde Rossouw: When the Multiple Stalls, Compounding must Carry

As the sustainability of AI stocks draws debate among investors, Ninety One’s quality team is focused on compounding earnings.

By Jaco Visser

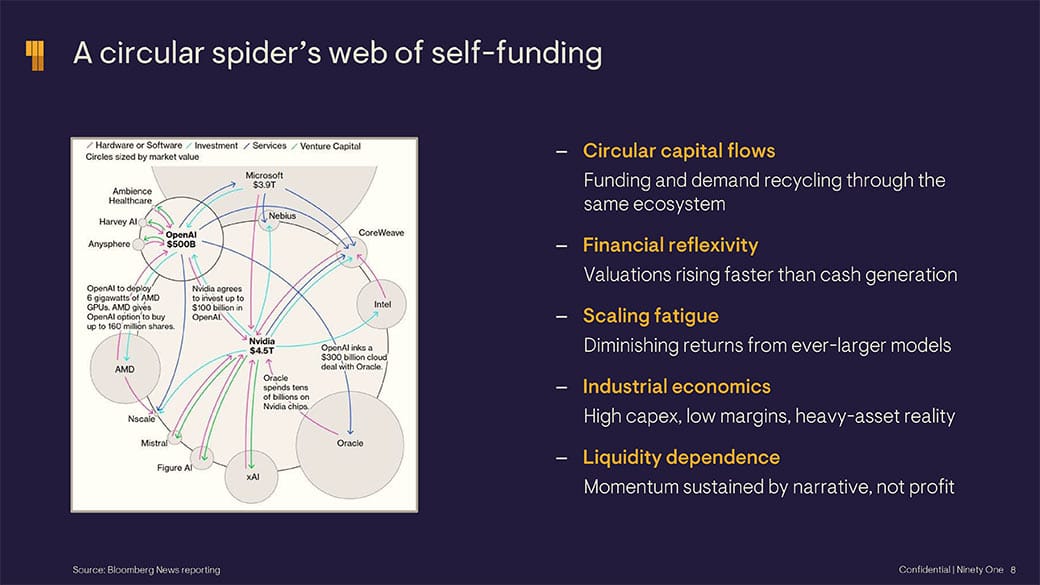

Clyde Rossouw, head of quality at Ninety One, described parts of the global equity market as ‘a circular spider’s web of self-funding’.

In a webinar on Tuesday, Rossouw (pictured above) set out how price moves had enabled successive waves of capital raising and capacity buildouts, with investors validating higher prices because the previous round cleared.

‘There are risks on either side of the equation,’ he said, pointing to valuation and concentration pressures as conditions where liquidity, rather than profit, risked becoming the driver.

He said that his team chose a different path: ‘Our market sensitivity has come down quite dramatically’ – a deliberate step to avoid being hostage to one dominant driver. Market sensitivity here means the degree to which a portfolio moves with the broad market (beta).

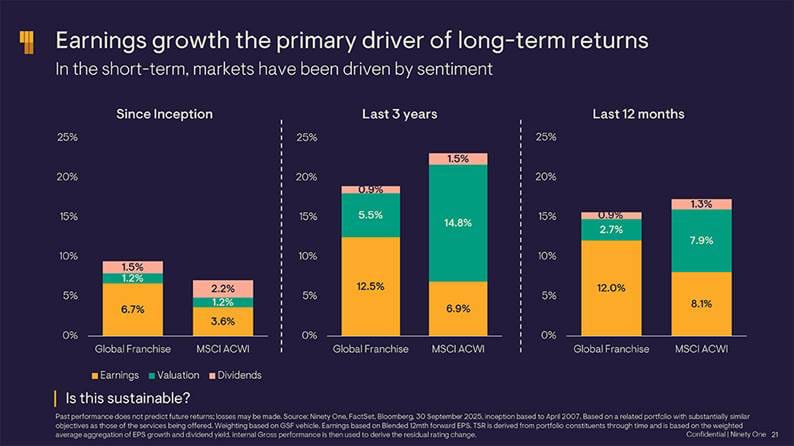

Rossouw broke down total return into three parts: earnings growth, dividends and ‘rating change’. Rating change is the market paying a higher or lower multiple for the same earnings. If that component adds little or detracts, the other two must carry (see graph below).

Rossouw asked whether a rerating-led advance was sustainable. The point did not rely on forecasting the next turn in sentiment. It relied on the arithmetic of how returns had been built and where the base now sat.

Rossouw tied that arithmetic to the Ninety One Global Franchise portfolio’s earnings trajectory. Over the past 10 years, portfolio earnings grew by about 10% a year against roughly 7% for the MSCI All Country World index.

The investment team’s bottom-up work showed a potential five-year compound annual growth rate of 12.3% for portfolio earnings.

‘We have not run out of growth in the companies we hold,’ he said. ‘They keep compounding earnings, and that is what drives value creation over time.’

Portfolio changes

This approach shaped trading over the past year.

Rossouw’s team reduced Booking Holdings, Moody’s, S&P Global, Check Point, VeriSign and Philip Morris, and exited Nestlé in July.

It added or initiated in ICON, Marsh & McLennan in February, Align, London Stock Exchange and LVMH in July (see graph below).

Rossouw said the pattern reflected recycling from stocks after strong multi-year runs into businesses ‘in the middle – or even the bottom – of their performance cycles.

This did not mean buying ‘cheap, unloved nasties’. The aim was to own businesses with resilient cash generation at points in their business cycle where earnings compounding could do more of the work, and reliance on a higher valuation multiple could do less.

Rossouw also described how the holdings were spread by performance drivers rather than by a single theme. The team grouped businesses as defensive, durable and dynamic.

Defensive names tended to grow free cash flow in the mid- to high single digits. Durable names tended to grow in the low double digits. Dynamic names tended to grow in the mid-teens.

These bands referred to five-year free-cash-flow compound growth rates. The intention was not to predict which bucket would lead. Instead, it was to avoid a lineup where all holdings were at peak expectations at the same time.

His comments on reflexivity in the AI sector extended to parts of the semiconductor and AI supply chain (see figure below).

Rossouw referred to an ‘exotic’ web of deals that ‘only work if stock prices keep on going up’. Reflexivity here meant price action influenced funding capacity and vice versa.

Where that dependence persisted, the question became whether earnings would meet the implied returns on capital. In that setting, he said, cutting market sensitivity and insisting on free-cashflow compounding was policy.

The Ninety One Global Franchise fund delivered strong double-digit returns in dollars across one, three and five years, ahead of quality peers; 10-year portfolio earnings compounding of 10% versus the market’s 7%; a forward portfolio earnings growth projection of 12.3% a year; and relative valuation described as the most attractive since 2016, with cashflow multiples below the market.

Friday Finish Line