Eyebrow Raising Prediction from the Crown

On Tuesday this week, I attended a seminar update with Coronation.

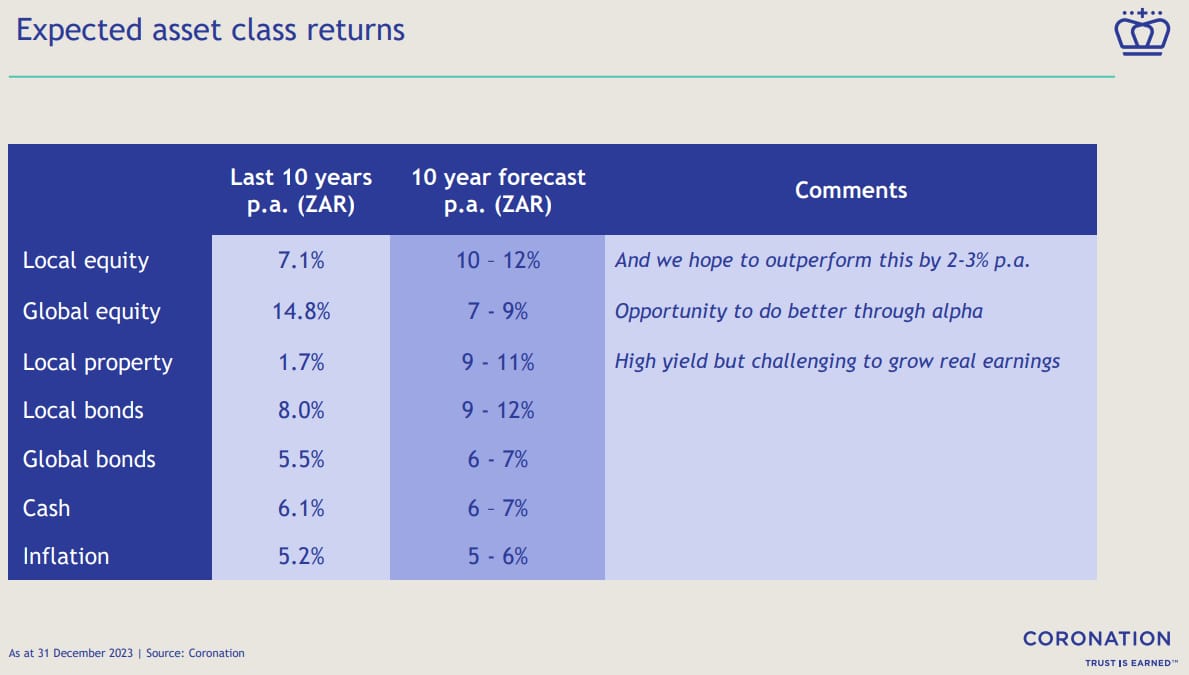

Most investment houses including ourselves, Ninety One, Allan and the Mail & Guardian - all agree the local SA share market presents very good value.

However, Coronation first shared the overall background, and then looked at their good fund performances across their range, They then took it a step further and came out in the open forum sharing that they expected the local SA market to outperform Global Markets, over the next 10 years (with the currency effect included);

We won’t necessarily agree with this, but Coronation has a strong track record when predicting asset class returns, enough for us all to take note.

At a minimum, we will agree to say that in a rounded diversified portfolio, SA assets present outstanding value, and should be incorporated where they shouldn’t be completely ignored either.

Alexander Forbes and Bank of America then expressed similar views in the press yesterday, which you can view by clicking on this link;

Misleading Headlines on Social Media

In last week’s article, I wanted to make sense of excellent one-year market returns within the context of a poor previous 2022. and making better conclusions of these using the 3-year asset class returns. I wanted to show that if you ignore the shorter-term fluctuations, investors can be relatively pleased with results over the last few years.

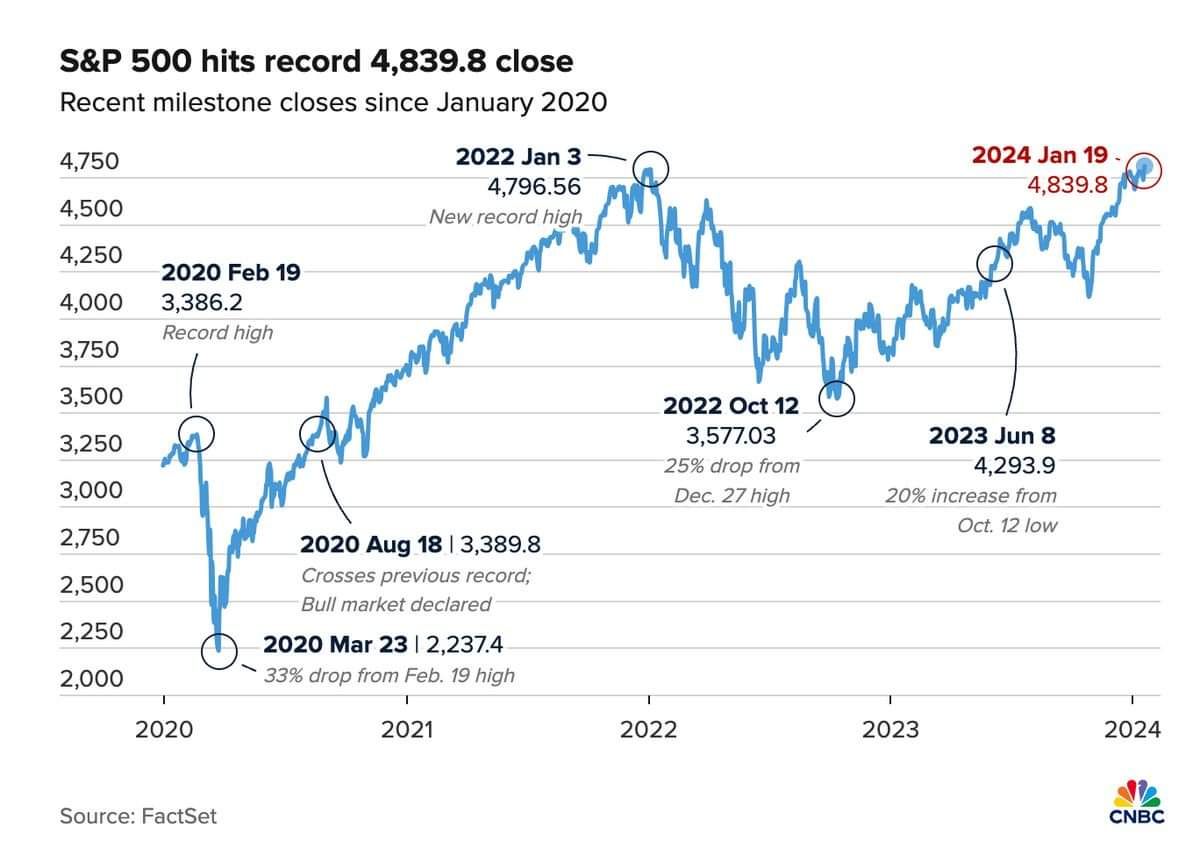

Following this, earlier in the week I saw a rather sensational headline on social media with the heading “US S&P markets hit record highs”, from a fairly reputable international news agency.

The article opened to this 5-year graph of the US market;

Anyone looking at the graph will see it's now only a tad above the levels of January 2022 two years ago, this is what I highlighted last week. Place this in perspective, even the money market makes new highs daily.

At the same time for investors, it’s still a good result overall for the 5 years, despite the peaks and troughs. I think it’s just important to keep perspective and not be steered off-course by poorly considered news headlines.

FRIDAY FOOD FOR THOUGHT