Global IMF Growth Forecasts

Earlier this week, the International Monetary Fund (IMF) updated their forecasts for global growth, where they see the world growing by 3,0% this year and 2,9% next year;

The IMF has a good past track record of getting these forecasts right, more often than not.

A few months ago, many were concerned that high inflation in the first world could see the world going into recession. Pleasingly, the anticipated growth shows that the world will still be growing well, with some parts growing more than others.

Looking internationally, we take note of the detail in the interrelationships trends to be expected. Therefore, these are embedded in our investment views and are good to compare.

SA vs USA and Europe

The USA is expected to grow by 2,1% this year and 1,5% next year. Then, towards the bottom of the table, the latest update sees South Africa having grown 1,9% last year and is expected to grow by 0,9% this year and 1,8% next year. This means our GDP growth in SA is expected to be higher than in the USA and Europe next year.

Emerging Markets to grow much faster than Developed Markets This Year and Next

Looking at the expected growth for Emerging Markets, these are expected to grow by 4,0% this year and next, against the Advanced Economies expected 1,5% this year, and 1,4% in 2024. This does support our greater investment view that Emerging Markets are expected to outperform Developed Markets by approximately 2% per annum over the next 5 years.

China Within Emerging Markets

The most significant Emerging Market contributor is China, where they are expected to grow 5,0% for this year. The forecast for 2024 is 4.2%, and while it is well below their historical average, they certainly are back on the upper end and higher than the average of the Emerging Markets.

Over the last few months, the Chinese have softly cut their interest rates where inflation is benign. These were relatively small rate cuts, but at the same time, the rest of the world has been hiking interest rates.

From an investment point of view, the local Chinese Shanghai market presents a market average Price-earnings ratio (PE ratio) of around 11 times in a benign inflation environment, with an economy expected to grow by 5,0% this year and 4,2% next year, which presents a relatively solid investment case.

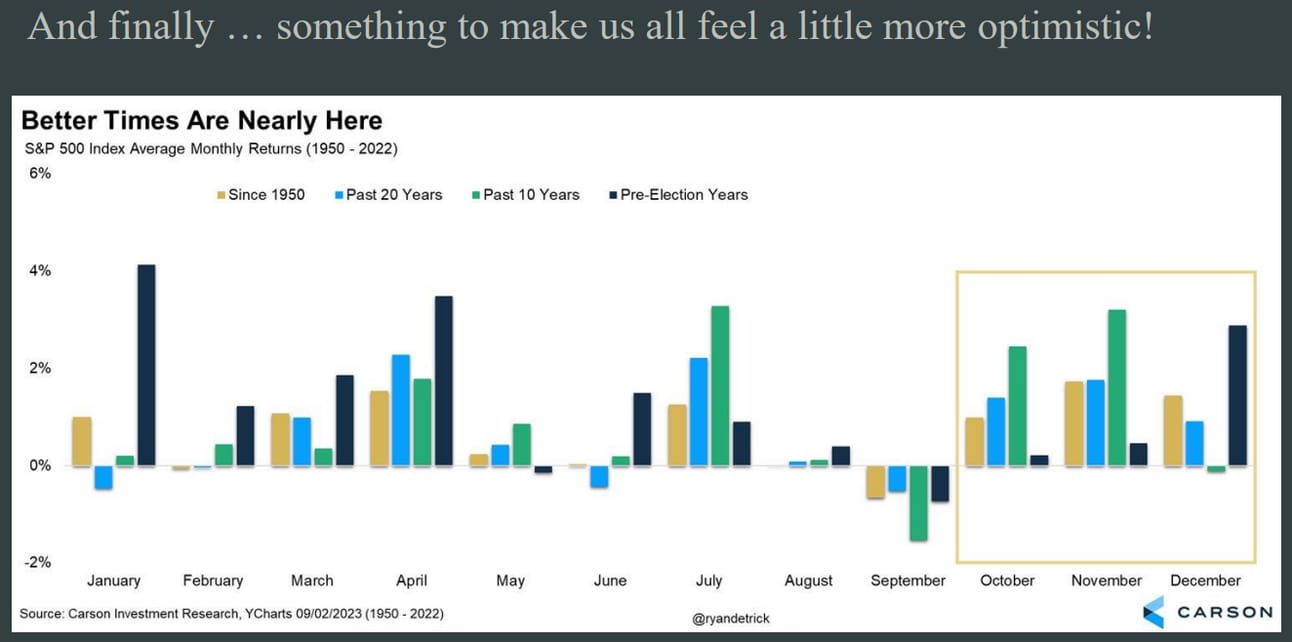

The Last Calendar Each Year is Normally Fairly Strong for Investment Markets

Meeting with our PCS Stockbrokers last week, they shared an interesting historical trend done by Carlson Investment Research. It indicates that, on average, markets tend to bounce back reasonably strongly in the fourth quarter.

The chart below shows the average US S&P 500 share market returns over the past 10, 20 and 77 years since 1950;

The US Market is shown, as this market sees most other world markets following their trend. Also considered is that next year is an election year in the US.

Naturally, this is only a historical view that cannot be guaranteed going forward. It also needs to be mentioned within these periods that there have been some exceptions. At the same time, however, it also played out last year.

That Extra Bit from Private Clients by Old Mutual Wealth

Attached here please find “That Extra Bit” from Private Clients by Old Mutual Wealth. They delve deeper into companies they own in their portfolio.

In this week’s issue:

Mondi’s innovative packaging solution for wind turbine components

Amazon launches first test satellites for Kuiper internet network

Sanlam completes R35bn tie-up with German giant Allianz

AI on the Bok Chances at the Rugby World Cup

Artificial Intelligence (AI) updates regularly. After the completion of the pool stages heading to the quarter-finals this weekend, New Zealand remain the firm favourite, followed by ourselves, and then France and Ireland;

AI is becoming more prevalent, but remember that human interactions are far less predictable. And both the Boks and the All Blacks have rather challenging assignments this weekend.

Friday Food for Thought