Income Funds Revisited

Over the last year, during which I have shared Income Funds as an alternative solution for longer-term cash solutions, past annualised investment returns of over 10% per annum have been very pleasing in the cash and cash equivalents space.

Marriott has a strong track record as a conservative cash manager, consistently delivering superior investment results.

Looking forward, I attended a session last week with the Marriott team looking at their Core Income Fund, where you can view this recording by clicking on this link below;

Marriott Roadshow Sep 2025 - Lourens Coetzee: Marriott Income Fund

From minute 27, there’s a good explanation of how their fund’s volatility/risk metrics differ from many other income funds, confirming that their risk/reward balance is being struck.

In addition to giving feedback on their fund positioning - to do so, this presentation provides further frank insights into their greater overall views of matters that influence bond markets, including those factors affecting local markets, adjusted inflation targeting changes and whether 3% per annum inflation can be achieved, lower interest rate expectations, currency views, as well as economic and political considerations, in how they see events unfolding.

Sasol and South Africa’s Energy Transition | OMIG

The Old Mutual Investment Group (OMIG) view capital as a tool for driving tangible change in the real economy, not as a passive investment. Active engagement, rather than divestment, remains the responsible path forward.

Siya Mbatha, Investment Analyst at OMIG, explains. 23 September 2025 | Read time: 3 MIN

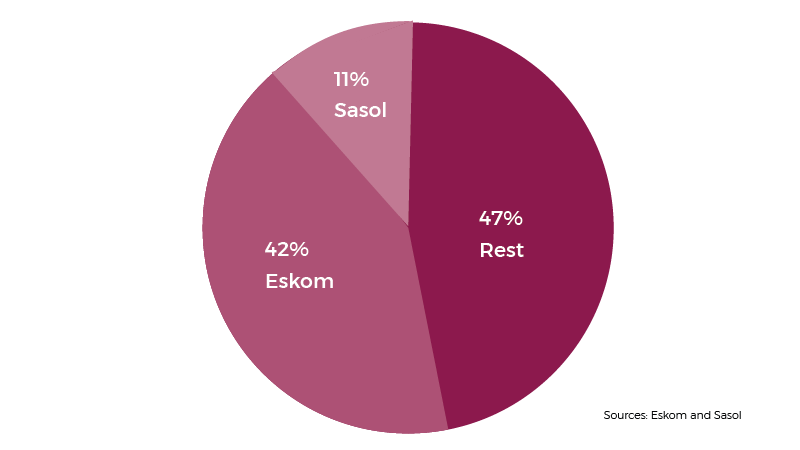

Sasol occupies a pivotal yet precarious position in South Africa’s climate and energy transition. As the country’s second-largest carbon emitter, the company contributes approximately 11% of national emissions, primarily from its Secunda plant

While this is significantly less than Eskom’s 42% contribution, Sasol remains a systemically important employer and will need to play a central role in driving decarbonisation. For long-term investors, this duality presents a complex dilemma, often referred to as the energy trilemma. How do we achieve environmental sustainability without sacrificing energy security and economic stability? Sasol sits at the centre of this debate

Majority Polluters

Eskom and Sasol produce over half the nation’s greenhouse gas emissions.

Global structural pressures to decarbonise are accelerating.

The European Union’s Carbon Border Adjustment Mechanism, set to come into effect in 2026, threatens the trade competitiveness of high-emission producers globally. Domestically, the South African government has committed to reducing national emissions by 15% to 30% by 2030, in line with its Nationally Determined Contribution under the Paris Agreement.

Sasol’s emissions-intensive Fischer-Tropsch process, which relies heavily on coal and gas feedstock, makes decarbonisation a complex and costly task. While Eskom remains the largest lever for national emissions reductions, Sasol faces more direct and unavoidable consequences, particularly from a carbon tax perspective. The decline in carbon allowances post-2026 will intensify this burden, with significant implications for earnings.

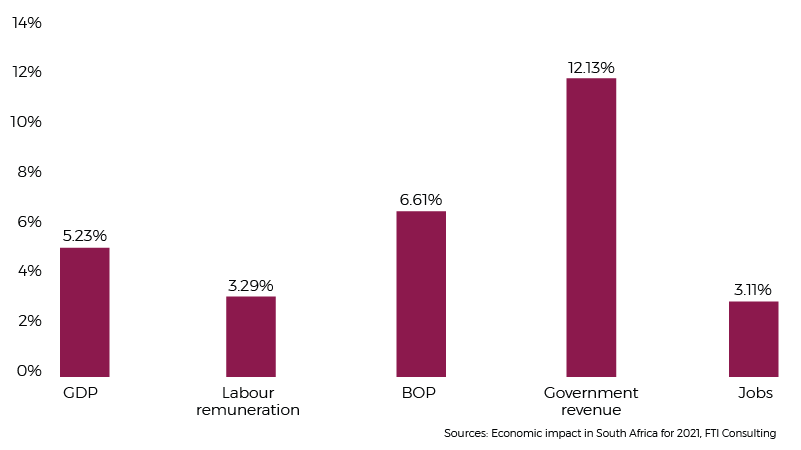

At Old Mutual Investment Group, we believe divestment is not a solution for high-carbon sectors that remain economically critical. Sasol’s contribution to local GDP, employment, and fuel security makes active stewardship the more responsible path. The road to decarbonisation must be pragmatic, with a focus on transition rather than disruption. Climate progress cannot come at the expense of economic stability or social equity.

With this lens, our engagement with Sasol shifts from demanding immediate net-zero outcomes to pushing for credible, staged transition plans with clear interim targets. We focus on how companies balance emissions reductions with economic realities, scrutinising capital allocation, operational changes and social impacts. Engagement becomes solution-oriented and collaborative, emphasising accountability and measurable progress over time.

Our engagement with Sasol focuses on several key areas:

The company’s operational turnaround

Capital allocation and balance sheet management

Progress on the energy transition

Governance and incentives, ensuring management is aligned with shareholder value creation.

At the company’s Capital Markets Day this year, despite changes to the emissions roadmap, Sasol reaffirmed its 30% emissions reduction target by 2030, using a 2017 baseline, and its commitment to net zero by 2050. The company moved away from plans to scale down synfuel volumes post-2030 and is now focused on transitioning alongside its customers. Central to this journey is the use of renewable energy.

Sasol has set a 1.2 Gigawatt renewable energy procurement target by 2030. To date, 550 Megawatts have been contracted, with the remainder in early-stage negotiations. This scale of renewable energy is expected to save the company over R4 billion in electricity costs over five years.

Sasol has also created an integrated power business aimed at meeting its own electricity needs, with the potential to supply surplus power to the South African grid. The company has applied for an independent electricity trading licence, signalling its intention to become a more active participant in the country’s transition.

Renewable energy, coupled with nascent but growing opportunities in sustainable aviation fuel and renewable diesel, adds further pathways for Sasol’s decarbonisation journey. These initiatives support a reduction in overall carbon intensity, while positioning the company for longer-term relevance in a low-carbon economy.

Sasol’s transition is not only about reducing emissions. It is about reshaping the future of South Africa’s industrial economy.

Coronation Thus far Right

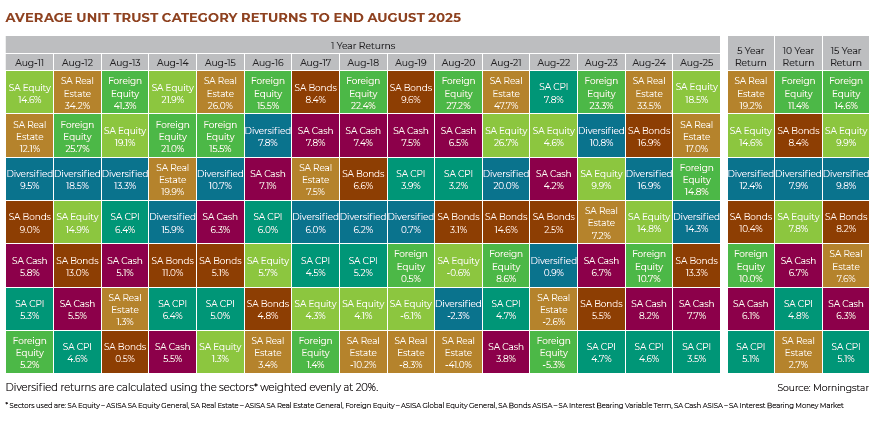

I highlighted the importance of diversification two weeks back, supported by the asset class investment returns to the end of August, as summarised using our “smartie box” slide, which shows the returns of the various asset classes.

I mentioned that I believed very few would have thought, a year ago, when sentiment in SA was extremely pessimistic, that it was even remotely possible for SA Listed Property now to be the top performing asset class over the last 5-year period.

This also shows that over the last 5-year period, the local share market has outperformed offshore markets as a whole.

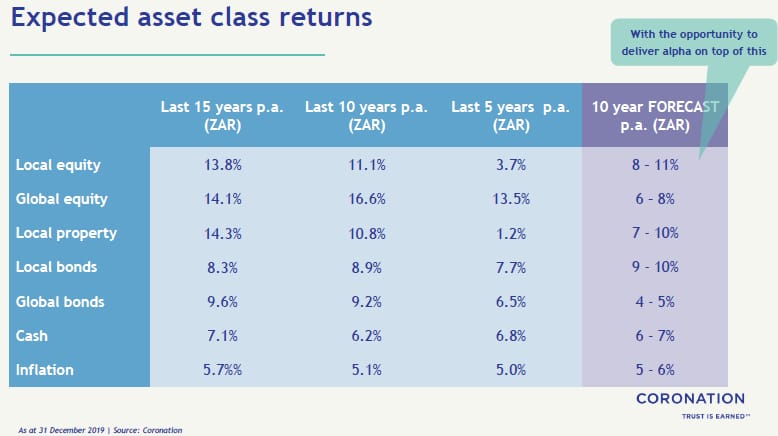

I then looked back at an article I shared in February 2020, from just over 5 years ago,

By that stage, just before the onset of COVID-19, offshore share markets were rallying strongly and had far exceeded the returns from local markets.

Coronation, as a “solid if not fairly conservative asset manager”, as I said at the time, then came out and fairly boldly stated that while offshore markets had outperformed local markets over the previous 10 years, they expected this to reverse, and over the next 10 years, for local share markets to outperform offshore share markets.

Painting the background in the attached email (from February 2020), they then summarised their expectations over the next 10 years (2020 – 2030) as;

Looking at the smartie asset class returns as of the end of August, just after the halfway mark, they have thus far proven to be quite right.

The Great Rebalancing | Ninety One

For more than a decade, US equities and the US dollar have dominated portfolios. But valuation extremes, shifting capital flows, and divergent policy paths suggest that global equity leadership is beginning to broaden.

In the same line of thought, Ninety One’s latest Investment Institute research, The Great Rebalancing, explores why the next cycle may favour international and emerging markets - and what that means for institutional portfolios anchored in the US.

Ninety One believes this shift represents not just risk, but opportunity. It’s a moment to rethink diversification and consider the potential for stronger returns beyond the familiar.

Quick Overview

A quick overview of the key themes in this research, showing how the reinforcing forces that sustain dollar cycles also shape the relative performance of US and non-US equities;

US equities have outperformed both developed and emerging market peers for over a decade, shaping today’s portfolio allocation patterns.

The US dollar has also been exceptionally strong for many years, and there is a remarkable historical overlap between these long dollar cycles and the relative performance of US versus international equities.

Current conditions, valuation extremes, divergent policy trajectories, and recent shifts in capital flows suggest markets may be at a critical inflexion point.

The next cycle could broaden equity market leadership significantly, driven by AI innovation and a weaker dollar, creating opportunities across sectors and regions.

Fundamental indicators suggest a lower allocation to US equities than implied by market-cap benchmarks, with international and emerging markets offering potentially stronger returns.

You can read the full article by clicking on this link;

Their Conclusion

Regional performance cycles have remarkable staying power, but once clear evidence emerges that a cycle is shifting, investors can reposition portfolios for sustained new trends. Today, the convergence of geopolitical realignment, divergent policy paths, shifting capital flows, and coordinated efforts among global policymakers signals the onset of a new multi-year investment cycle.

Market-cap-weighted benchmarks anchor portfolios in the past, reflecting yesterday’s winners rather than tomorrow’s opportunities.

The current dominance of US mega-cap stocks, powered by internet-driven platforms, appears increasingly vulnerable as valuation extremes collide with a weakening dollar and the transformative impact of AI.

Investors should look beyond the familiar to identify new growth engines emerging across regions, sectors, and market segments. Successfully navigating this next cycle will require forward-looking diversification and careful, bottom-up selection to capitalise on a broader global opportunity set shaped by fundamental trends rather than index inertia.

Friday Finish Line