Interest Rate Cuts | To Act and Take Advantage

Yesterday, our South African Reserve Bank Governor, Lesetja Kganyago, cut our interest rates by 0,25% annually.

For the full presentation video, you can watch by clicking on this link:

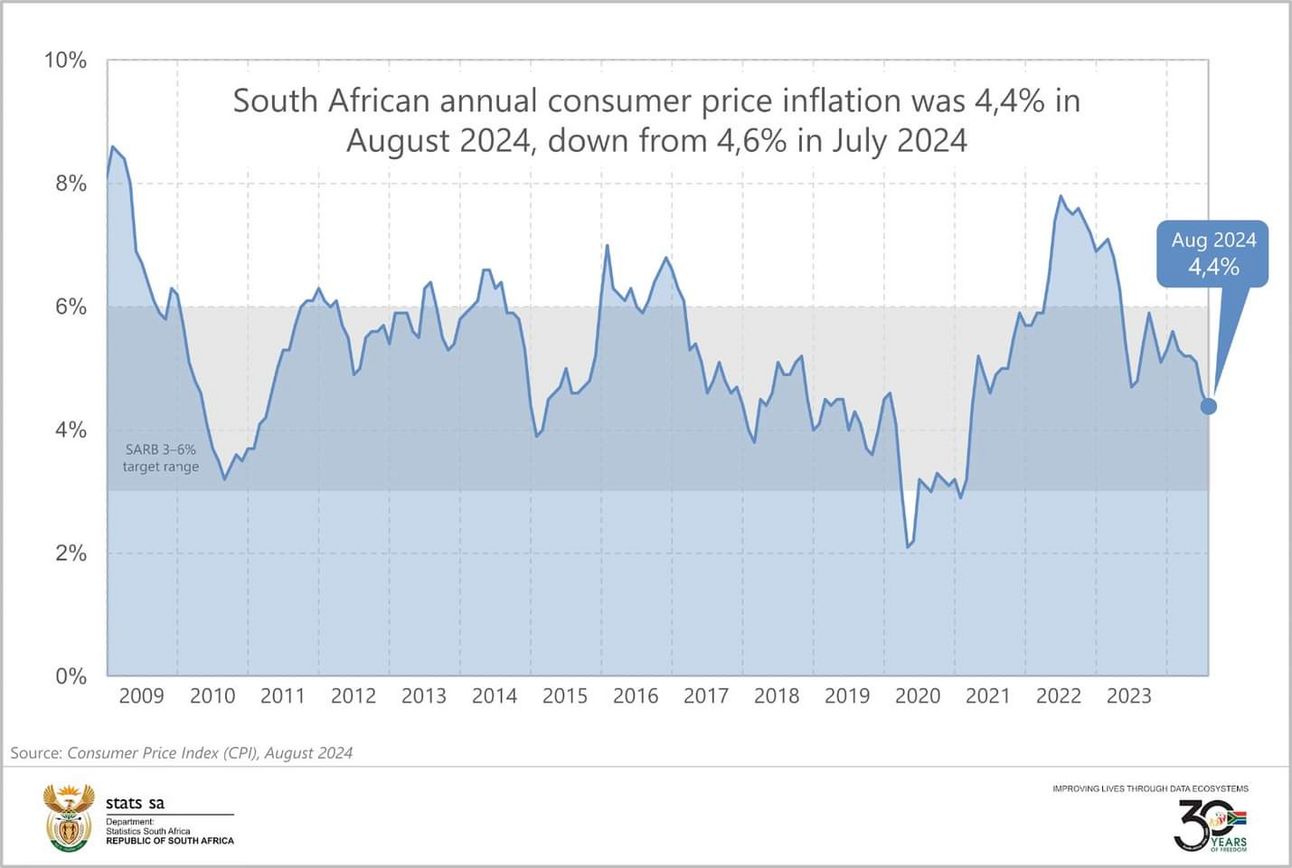

This followed when SA consumer inflation slowed for a third consecutive month, cooling to 4,4% in August from 4,6% in July.

This is the lowest inflation print since April 2021 when the rate was also 4,4%;

US Interest Rates Cut By 0,5%

This follows Wednesday’s US Fed decision to cut US Interest rates by 0,5% on the back of lower inflation in the US;

This, in turn, saw the Rand currency strengthen down to R17,39 to the $US by yesterday morning.

At this stage, our smaller interest rate cut will be positive for the Rand currency. The interest rate differential between us and the US is now 0.25% greater than a few days ago. This makes foreign investment into our local Bond Market even more attractive.

Kevin Lings as Chief Economist at Stanlib, explains this relationship between our currency, and then why US rate cuts is good news for SA stocks, and economic growth – Kevin Lings, you can view by clicking on this link below;

This is also largely in line with our expectations, which we shared over the first half of this year, and which are now all coming to fruition.

Personal Inflation Versus Impact on Investment Markets

Two weeks ago, in this distribution (6 September), I mentioned that “with personal inflation and interest rates falling, one must keep in mind interest rate cuts take several months to work their way through to the man-in-the-street.

And even a 0,25% rate cut, both offshore and in SA, actually does very little in the very short term. But 1,25% to 1,5% over 6 months, given a little time to work through, then does make a significant difference.

(Investment markets on the other hand, and specifically the risk assets of share, bond and listed property markets, however, forward price themselves up to a year in advance, on the information available today. These markets benefit from lower inflation and interest rates, and therefore, they are far quicker to react to changes in inflation. Our interest on this side is in keeping a close watchful eye here).

Incremental Interest Rate Cuts

Therefore, further interest rate cuts are expected to follow in the coming months.

Each interest rate cut will be fairly small, but collectively, they could mean a significant difference in a year.

To Act and Take Advantage - For Those Carrying Debt

Where our clients use debt, such as a home and vehicle loans, an interest rate cut of 0,25% won’t make that much of a dent over the next month or two.

A meaningful difference will only be felt later, once the next few interest rate cuts come through.

In addition, our lower inflation will reduce the rate of increases, which is positive for everyone.

In the meantime, what happens to this saving in your monthly budget?

Given the small size of the savings at each potential interest rate cut, it’s very easy to not budget for this and let it slip through into “lifestyle creep,” where one can simply spend the funds.

To budget for these savings, here are a few ideas which one can easily allocate these funds;

Inform your bank to change your current home loan repayment, to a fixed amount payment, equivalent to the present amount that went off last month.

This will ensure more capital is paid, and you benefit from yesterday’s interest rate cut, by paying less interest.

Tip: First, check with your bank to ensure that you can access these funds in the future if necessary.

Do the same with the vehicle loans.

If you are not utilising your full RA contributions for tax purposes, increase these by the amount you are saving on your debt repayments to enjoy the use of the interest savings and the further tax deduction.

Tip: then decide how you will allocate the resulting tax savings.

Add the savings to any of your personal financial planning goals - such as your children’s education provision, holiday fund or similar.

These lower interest rates could well be in place for several years – and applying additional savings to any of these goals can make a meaningful difference over the medium term.

To Act and Take Advantage - For Those Not Carrying Debt

Where our clients don’t use any debt, lower overall inflation included seeing our fuel prices, for example, drop considerably over the past few months, with further lower prices expected.

In the same way, where is this savings to be allocated?

On the capital markets, lower interest rates are positive for share and property markets, and so these allocations in our client investment portfolios will safeguard against lower interest rates.

On one’s emergency reserve of 3-6 months, where too many savings funds accumulate in money market – at a minimum, Income Funds should be considered, which will give respite to the lower interest rates on money market and cash funds.

(See my email dated 16 August entitled: the Alternatives in the Space of Cash and Cash Equivalents” – for a detailed description of these).

Overall message

Whether you are using debt or not, the overall message is to take advantage of the lower inflation rate and reduced interest rate cuts.

Firstly, you can identify what saving is and then apply it to your personal goals that are most important to you.

Personal News from Jurie

I wanted to remind you that I am on soft leave until Friday, 27th September. During this time, I’m spending quality time with my family at our family farm in the Eastern Cape. As the area has limited signal and Wi-Fi, I won’t be able to conduct meetings, and my response time to emails will be slower than usual.

While I will still be checking emails occasionally, please note that my availability will be limited. For any urgent matters, feel free to send me a WhatsApp message or call me directly. If you’re unable to reach me, you can contact our office at 021 555 9300.

For administrative queries, please reach out to:

Charlene Kemper at [email protected] or

Angela Paterson at [email protected] or

Natasha Jonker at [email protected]

For advice-related queries, you can contact:

Heinz Nel at [email protected]

Thank you for your understanding and for respecting this time I’m spending with my family. I appreciate your patience and look forward to connecting with you upon my return. Here is some photos of our trip so far.

Friday Food for Thought