Look Both Ways Before Crossing

Every six months, the Old Mutual Investment Group (OMIG) shares its updated expected longer-term investment returns for the various asset classes.

This will be done where market circumstances require a revision of these, as in October 2022. We will revisit this every six months when no update is required.

Going back to a leading research paper from 1986, Brinson Hood and Beebower confirmed that asset allocation (being what asset class, or combination of asset classes, you are investing in) is primarily responsible for 94% of investment decisions;

Stock Picking and Market timing are of far less importance, although as professionals, we want to get this right too.

This being the background, Izak Odendaal, as OMMM Investment Strategist, shares his views on local versus offshore here, where included in this segment is the latest revised 5-year expectation on asset class returns;

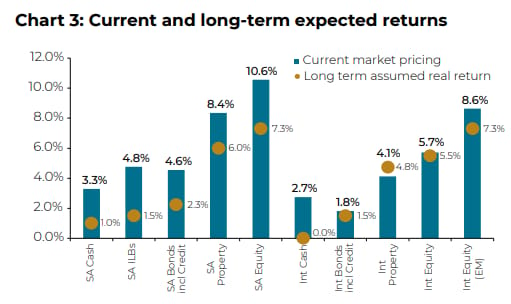

Blue Bars – What the general market believes the various asset class returns will be over the next 5 years.

Yellow Dots – Asset Class returns per annum expected by OMIG over the next 5 years.

*Offshore class returns on the right are stated in $US.

*** All investment returns stated are over and above what inflation will be, i.e. Real Returns.

In other words, reading from the left on the graph, OMIG expects local shares to deliver 7,3% per annum for the next 5 years over and above inflation (while the current market valuation shows 10,6% per annum) and Listed Property 6,0% per annum over the next 5 years (over and above inflation) (while the current market valuation shows 8,4% per annum). Looking at cash and bonds, we see a slight decrease in the inflation and interest rate outlook from before.

Locally, SA investors have been very well-rewarded over the long term (10-15 years). In the last two or three years before the start of COVID-19, local markets were far more flat, and where the valuations and earnings current are that we now see in place point to these investment returns expected for the various asset classes over the next five years.

The above graphic also highlights OMIG views where local markets still give solid investment returns; the feeling is slightly underweighted to consensus market valuations.

Last year’s good bounce back from offshore markets overall, the expectation for returns from offshore assets is also muted generally, compared to the consensus views (to what the rest of the market believes in the valuations).

Within offshore, we believe emerging markets will do slightly better than Developed Markets over the next five years.

Offshore cash for the past two years has been a relatively good place to be, but the future outlook relative to (offshore) inflation is somewhat muted. As offshore interest rates come down, one can only expect that a large number of current investments in offshore cash will be looking for a longer-term home, which will further underpin offshore share markets.

Simplistically, as a financial planner who understands the importance of asset allocation, I am not as interested in the total results being precisely right in five years. I am more interested in the interrelationships between the various asset classes, which present a rounded picture of global and SA markets. When interest rates go lower, for example, this always supports the risk assets of property and shares.

Therefore, by having a rounded picture, we can ensure our client portfolios are correctly tilted where we expect the best returns going forward, with due allowance for their risk considerations, facilitating true bespoke customised solutions.

FRIDAY FOOD FOR THOUGHT