Looking forward to a Year of Sustained Consolidation after a Great 2025

Global investors have had much to worry about over the last year, given geopolitical risks, sensational mainstream news headlines, declining global growth, a weaker USD, Trump's trade tariffs, and “liberation day” in late March/early April.

Since then, offshore markets have rallied well, and getting back to work after I spent a good festive season in the piety of the Bree Valley mountains, getting ample rest, running and eating well, we are carefully considering offshore valuations on a forward basis, as one ought to after a good investment year.

Making sense of this, declining inflation and interest rates support risk assets, as they have always done, especially where growth rates remain positive, even if somewhat muted; that is our expectation.

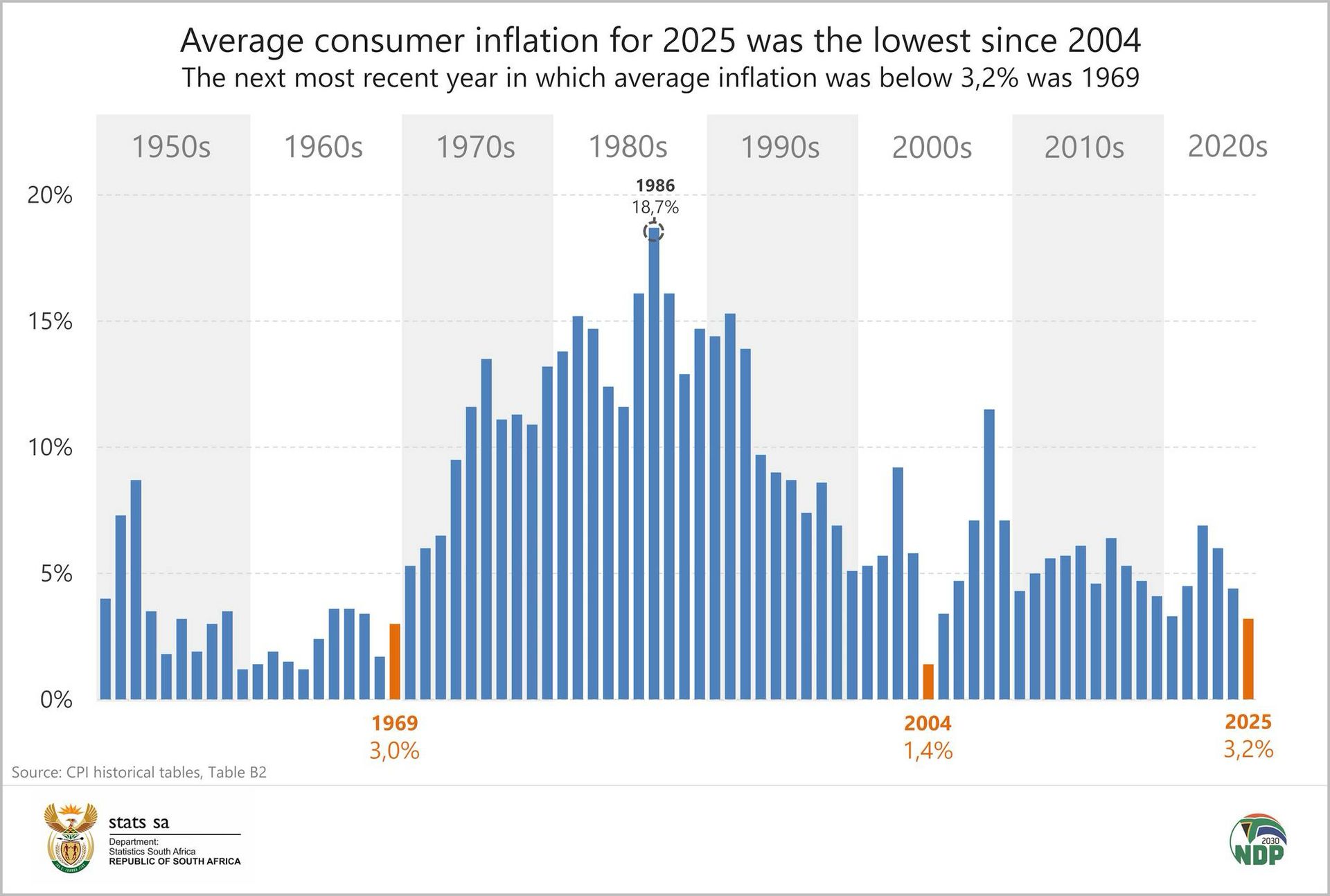

This was further supported by our latest SA inflation data on Wednesday, coming in at 3,6% for December, which is normally a higher month over the festive season.

This, in turn, meant our SA inflation rate averaged 3,2% in 2025, the lowest level for a calendar year in 21 years;

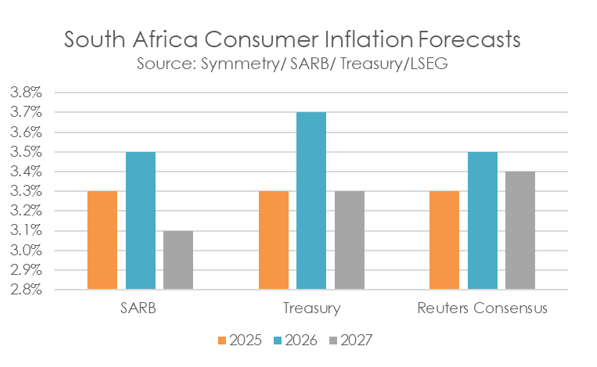

Our interest rate expectations are that we should see two further 0,25% interest rate cuts in SA in the first half of this year. Previously, we thought the first interest rate cut would only be in March. But after this week’s positive inflation confirmation, this first interest rate cut could now be as early as next week when the South African Reserve Bank meets.

Lower inflation has also been supported by lower international oil prices, not only at home but also abroad, and this will give the South African Reserve Bank greater confidence in the lower inflation outlook, together with the stronger Rand.

For the full report from STATS SA, you can visit this link: P0141December2025.pdf

Looking forward, the inflation forecasts of the SA Reserve Bank, Treasury and the market consensus are summarised as;

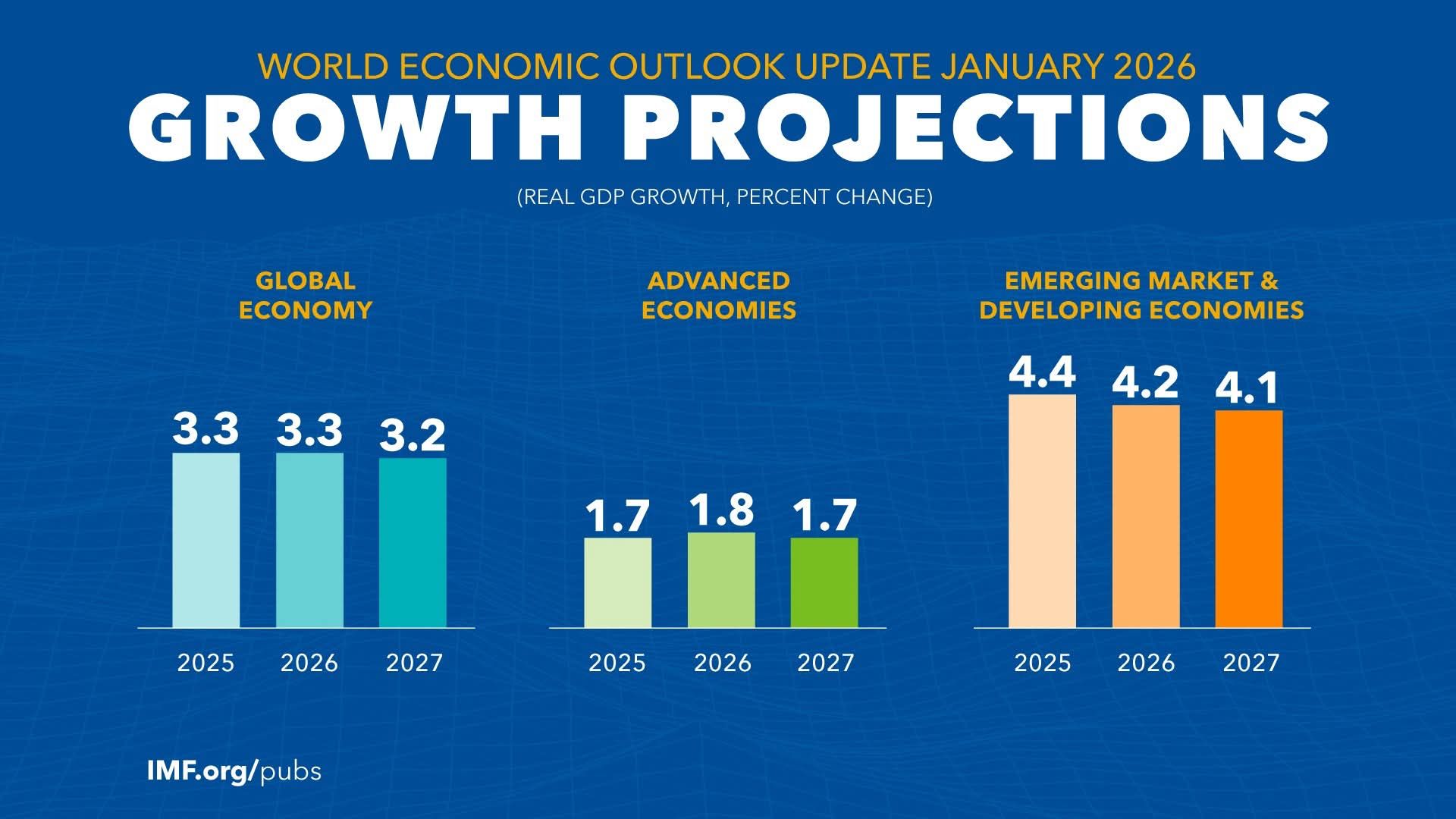

In turn, this is supported by the International Monetary Fund (IMF) latest views and forecasts, updated this week, which now revise their growth projections upwards, with the world economy as a whole expected to grow by 3,3% in 2026 and 3,2% in 2027.

This isn’t high, but it is well up on their previous projections from last year. The importance of these upwardly revised global growth rates is that at these rates, including China, which grew by 5% in 2025, this certainly isn’t a doomsday environment.

Yes, in the short term, we know average market intra-lows of 14% happen each year on the US market. We know to expect normal market patterns.

However, the overall macro bigger picture remains healthy and robust.

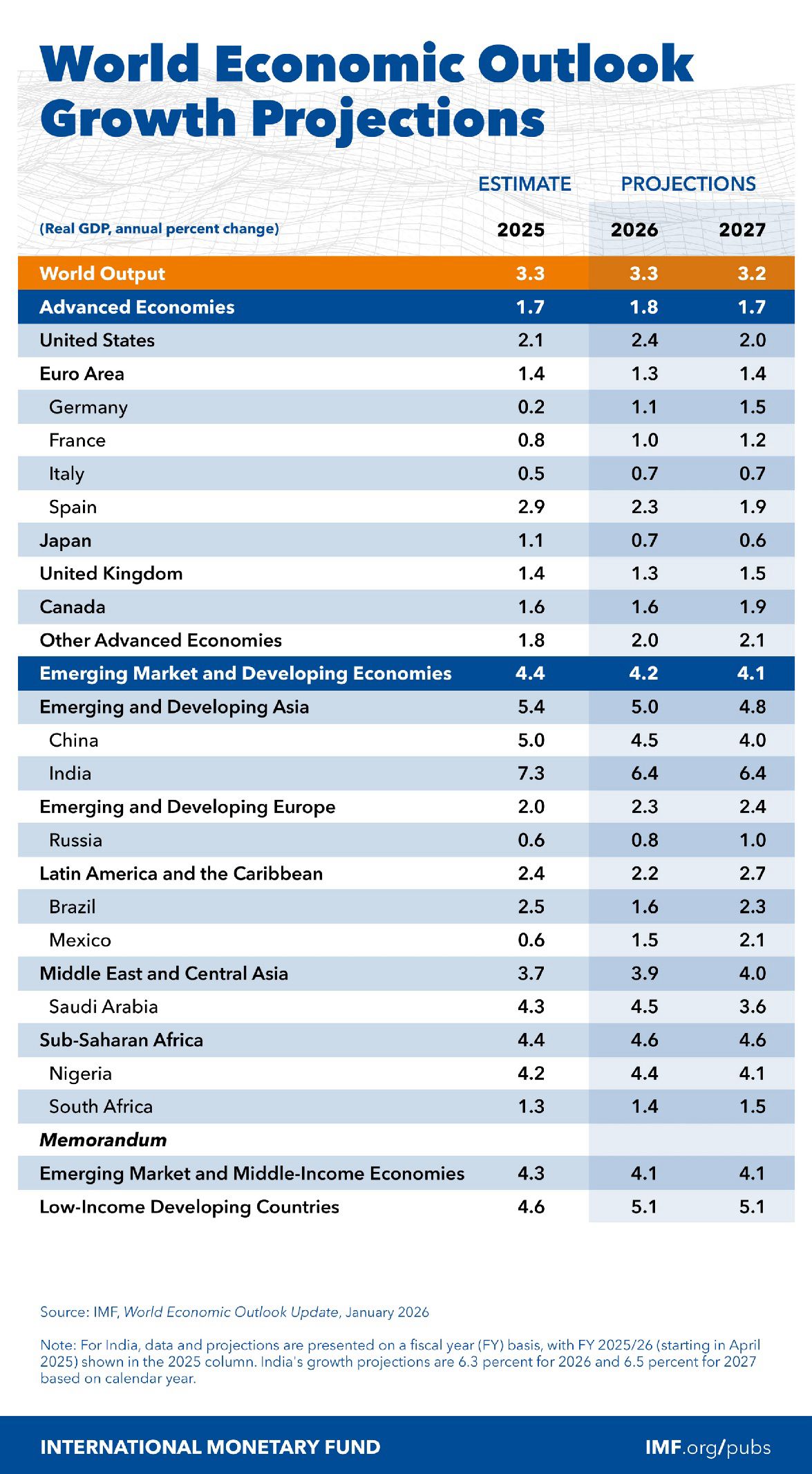

IMF Growth Forecast

Looking at the IMF, who have a good past track record of getting these forecasts right, more often than not, the International Monetary Fund (IMF) has revised their forecasts on global growth this week to what can be expected;

These latest upwardly revised growth projections show that the global economy is in a healthy and robust condition.

The US will lead the Advanced Economies in terms of growth, but what stands out more is the extent to which the Emerging Market countries will exceed them.

At the same time, the IMF has softly increased its growth expectation for SA this year and next.

Prescient China’s Tian C Pan on China

China is having a good year, exceeding expectations. Prescient China’s Tian C Pan was recently interviewed on BDTV, where he also answers many questions on investors' minds, which you can view by clicking on this link: WATCH: China hits 5% growth goal in 2025

China hitting its 5% GDP target for 2025 won't exactly shock the markets. Still, it is a remarkably solid achievement when you consider the year was effectively an uphill sprint against a gale of global tariffs originating from the White House.

On the markets front, Chinese equities proved that they can thrive under pressure. On a total return basis, 2025 saw the CSI300 deliver 26%, and the MSCI China climb 31%, despite significant volatility driven by external shocks. If these emerging geopolitical tailwinds hold steady, 2026 might just offer another solid year with a little less of the turbulence.

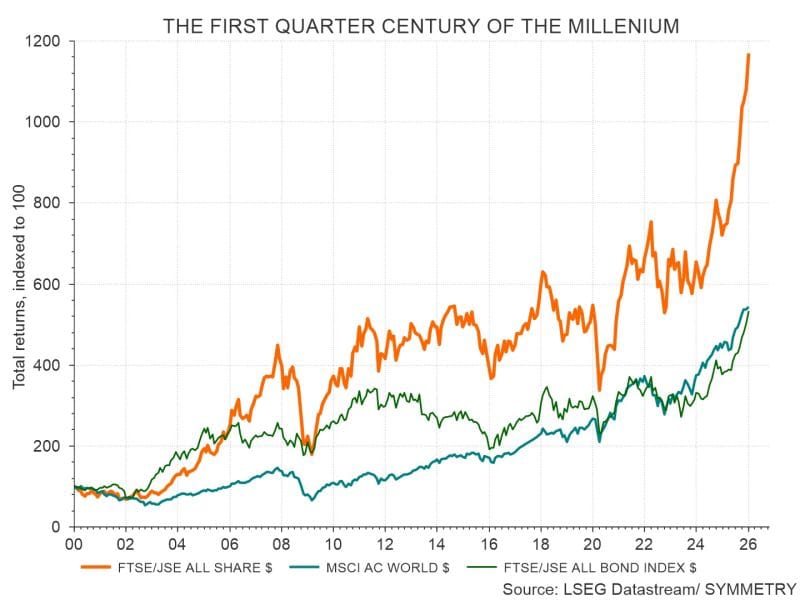

SA Markets outperforming Global Markets over this Millennium

During the course of last year, we saw the back of the stronger Rand, which, over the last 3- and 5-year periods, has outperformed global stock markets as a whole.

Rather interesting looking at the longer term and comparing local and offshore markets since the start of 2000, over the last 25 years, this is now also true.

Of course, all graphs can be influenced greatly by their respective start dates, and this is indeed the case here.

Therefore, we still prefer overweight offshore allocations, while still enjoying allocations to local equity that cannot be ignored.

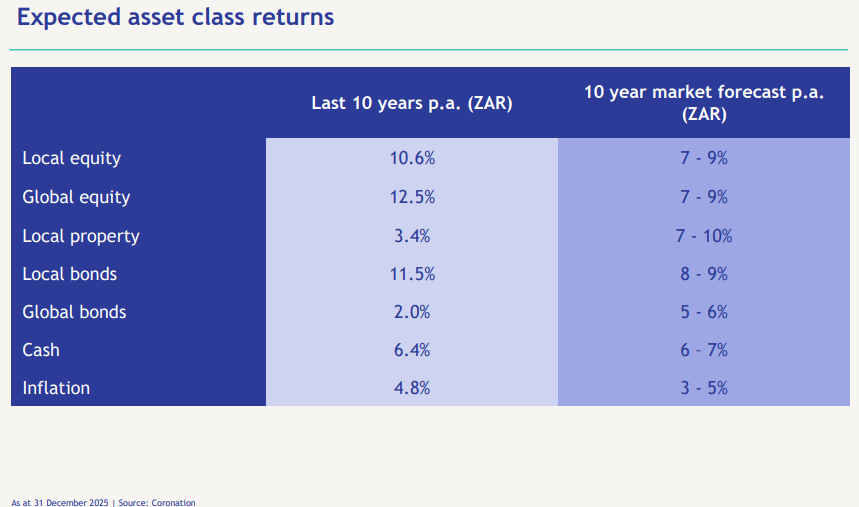

Coronation’s 10-Year Asset Class Return Forecasts

This week, I met up with the Coronation fund management team, going through all their various funds. In this session, they also shared their 10-year forward investment returns expectations for the various asset classes as follows:

From this, we can see that their views imply lower inflation both locally and globally over the next 10 years, as well as a fairly stable Rand currency.

What is also noticeable, and what this means for investors, is that it would be wrong to extrapolate last year’s investment returns going forward as an expectation. Investment markets simply don’t work that way, and expectations should rather be that total returns will be more muted in line with a lower inflation rate environment.

Going forward, the most likely scenario sees consolidation with solid enough returns in the years ahead, compounding on the pleasing gains added last year.

Overall, a Healthy Global Environment

Overall, global economies look healthy and robust despite all the shocks we saw last year. Global growth is widespread, and lower inflation and interest rates support it.

The lower international oil price is also indicative that sentiment for the financial impact of global concerns is rather muted at this stage.

Last year was very good for investment portfolios, and while the patience of South African investors has been severely tested in recent years, it paid off over the past two years.

It is a reminder that long-term returns are always made up of a few really good years, interspersed with bad and boring ones. One has to sit through the latter to benefit from the former.

The good news is that valuations are still reasonable across domestic asset classes, which, together with improvements in economic fundamentals, bode well for future returns.

While SA finds itself in an improving trajectory, of course, there is still much work to be done. Where SA finds itself within the global context and looking at the global economy, the wider macro-economic environment looks fundamentally sound.

FRIDAY FINISH LINE