Market Performances for 2024 and Looking Ahead

Enjoying the festive season break with my family in Langebaan en Onrus, I also use this time to recharge, commit to healthy eating habits, and get fit again.

Spending Christmas with my grandfather we were 4 generations of de Kock men together:

Our family also grew with the addition of baby Hannah on January 6th. So I am back at the office with one foot still helping at home.

Market Background

Returning to work, we are always eager to see how markets ended the previous year.

The 2024 Calendar Year

The bar graph above summarises market performances for the past calendar year. The local asset classes on the left are in Rands, and the offshore asset classes towards the right are in USD.

Global Markets as a whole

In the background, going back to the 2022 calendar year, offshore markets then saw the MSCI Global World Index (global stock markets as a whole) doing -18% and Global Bonds doing -16%, that it was the worst offshore performance ever for a 60% equity (share) / 40% bond portfolio offshore. From this lower base, offshore markets improved in 2023, with the MSCI Global World Index up 22,5% in 2023. 2024 saw a continuation of this and gained a further 17,5% in USD terms in 2024.

Local Markets in 2024

Locally, the JSE was solid, returning 13.4% for 2024. The stellar performer was listed property, seeing this sector return just under 30% for the year. In turn, the local Bond market overall returned 17.2%, and when one deducts the 3% currency weakness to the $US, our SA bond market was one of the best bond markets globally.

Therefore, 2024 will be remembered as a good investment year overall, both locally and abroad, that followed the previous strong year.

Last 3 Years to End of December 2024

However, examining only the recent last year provides a narrow view. Including the good previous year (2023) in the analysis and the poor year before that (2022) offers a more holistic understanding of market dynamics by looking at the 3-year results.

From the investor's point of view, since one doesn’t invest for only one-year periods, and given the large annual fluctuations between individual years, it makes more sense to look at the 3-year results to gain a better understanding of markets locally and abroad and what they mean for investment portfolios.

I also feel that taking the 3-year result now is suitable, as it strips out the rapid COVID-19 fall of the 2nd quarter of 2020 and the subsequent strong rise in the remainder of that year, which most of us still can well recall. Therefore, we have been looking at a more holistic view in recent times.

Looking at the performances of the various asset classes over the past 3 years to the end of December;

These returns for both local and asset classes for the 3 years above are now all stated in Rand terms and are the results per annum.

Over the last three years, we have gained more meaningful insight into overall returns, with Global Equity markets gaining 15.5% per annum and Emerging Markets gaining 3.7% per annum.

Locally, SA Equity delivered 8,5% per annum, with our local SA Bond market adding 10,3% per annum.

Local Cash and Money Market returned only 6,9% per annum for this period, especially when it’s taxed. This highlights why the asset classes of equity (shares) and bonds are preferred in our long-term investment portfolios.

Interest rates are expected to fall further this year, although maybe by less than previously thought. In the medium term, looking forward, the three-year returns from cash will most likely be more reflective of the relationship to the three-year results shown above.

Looking forward to lower inflation and interest rates presents a positive framework and environment for investment markets.

International Currencies against the USD in 2024

US Dollar strength dominated across the world towards the end of December. For most of last year, the Rand was stronger against the strong US Dollar, so it ended the year 3% weaker.

Interestingly, while the Rand weakened overall, yet it was one of the stronger currencies internationally last year;

Izak Odendaal, our Investment Strategist, shared his views last week via Business tech you can read the full article by clicking on this link;

SIS Strategies and PWM Solutions

For clients invested in our discretionary managed SIS Strategies, the regular quarterly reviews will be sent out next week.

In the meantime, I can share the latest results to the end of December, which were pleasing and can be summarised as;

1 year | 2 years | 5 years | ||||||

SIS Inflation Plus | ||||||||

1-3% Strategy | 12,49% | 12,04% | 9,41% | |||||

3-5% Strategy | 13,65% | 13,36% | 10,57% | |||||

4-6% Strategy | 13,39% | 13,09% | 11,33% | |||||

Maximum Return Strategy | 12,85% | 14,95% | 12,21% |

*these stated investment returns greater than one year are annualised (i.e. the returns per annum)

These are pleasing performances and are above the general average market returns on a risk-adjusted basis.

For clients invested in our newer discretionary managed PWM Strategies;

1 year |

| 2 years | ||||

PWM Solutions |

|

| ||||

|

| |||||

Stable Fund | 10,65% |

| 11,02% | |||

|

| |||||

PWM Balanced | 12,64% |

| 12,96% | |||

|

| |||||

PWM Dynamic | 12,30% |

| 14,49% | |||

|

| |||||

PWM Worldwide | 14,26% |

| 18,56% | |||

|

| |||||

PWM Extra Interest Fund | 9,73% |

| n/a |

The PWM Extra Income Fund has a current yield of over 9,0% pa on the underlying assets, with especially low risk.

Old Mutual Chief Economist Views

Looking forward, Old Mutual’s Chief Economist, Johann Els, summarises his views as;

Therefore, the bigger picture macroeconomic view is looking fairly positive, where we expect moderate further interest rate cuts abroad and in SA on the back of sustained lower inflation and a stronger Rand.

In turn, SA ratings should gradually improve over the medium term.

Investec Currency View

Separately, Investec Chief Economist, Annabel Bishop, shares their forward views on the ZAR currency.

Therefore, the base case remains for Rand strength this year, with most of it expected in the first half of the year.

For further background and context to these views and the scenarios, you can see the full article by clicking on this link;

This Week’s US Inflation Data

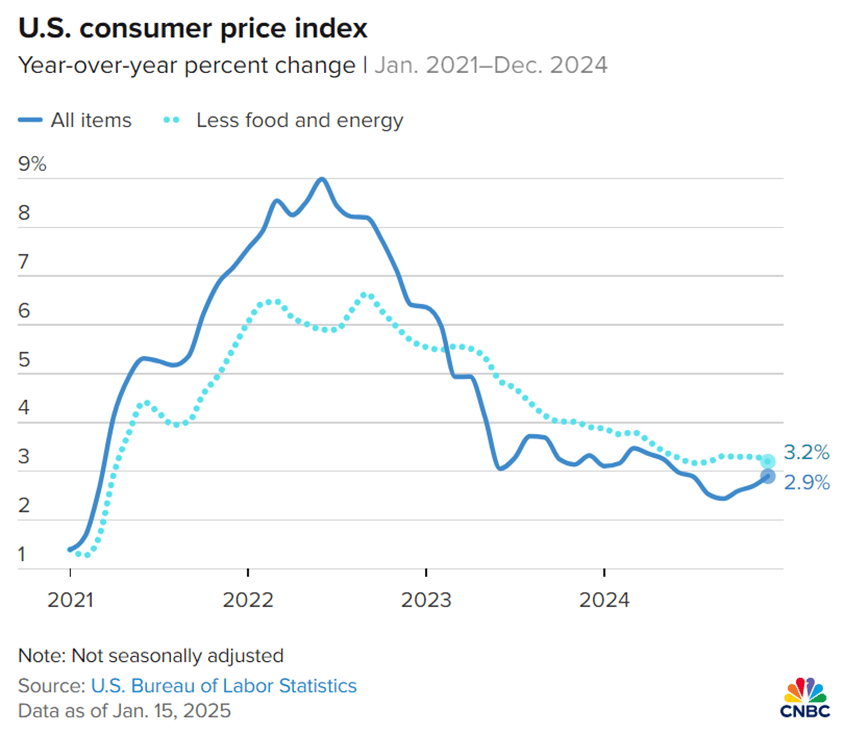

Late December and early January saw markets concerned about US inflation possibly increasing further than previously thought.

After strong jobs data last Friday, this week, December’s US inflation data released showed that inflation is well contained, and this put many market participants more at ease;

Planner Thoughts

South Africans started 2024 with much apprehension. This time last year, apart from basking in the afterglow of winning the 2023 Rugby World Cup, there was little reason to smile as the country was still strained under the impact of electricity disruption while political uncertainty increased ahead of key national elections.

A year later, load shedding seems a thing of the past (unlikely, but it will never be as severe again as in 2022 and 2023), thanks to a massive increase in private production and operational improvements at Eskom. Though the ANC performed much worse than expected in the election, it immediately accepted the results and started coalition talks. A centrist government of national unity (GNU) was formed, and it has prioritised growth-boosting structural economic reforms and ongoing gradual fiscal consolidation.

The patience of South African investors has been severely tested in recent years, but it paid off in the past two years.

It is a reminder that long-term returns are always made up of a few really good years, interspersed with bad and boring ones. One has to sit through the latter to benefit from the former.

The good news is that valuations are still reasonable across domestic asset classes, which, together with improvements in economic fundamentals, bode well for future returns.

The thing about hindsight is that it makes everything seem obvious when, in fact, at the moment, the uncertainty can be enormous. Looking back, history always looks like a linear progression of events, but in fact, it is a giant tree with branches sprouting off in all directions. That we’ve ended up at the end of a particular twig on a particular branch is not inevitable.

FRIDAY FOOD FOR THOUGHT