Market Performances for Last Year, and Looking Ahead

After a rejuvenating break amidst the serene Witzenberg Mountains in Ceres with my family, a notable aspect of my return to work is the anticipation of reviewing the market performance and assessing the outcomes of our client discretionary portfolios from the past year.

Market Background

Looking at markets, last year was a good year again, following the tough 2022 the year before;

The 2023 Calendar Year

The bar graph above summarises market performances for the past calendar year.

Global Markets as a whole

Earlier last year, I mentioned that for the previous 2022 calendar year, offshore markets were seeing the MSCI Global World Index (global stock markets as a whole) doing -18% and Global Bonds doing -16%, that it was the worst offshore performance ever for a 60% equity (share) / 40% bond portfolio offshore.

From this lower base, offshore markets improved last year, with the MSCI Global World Index up 22,5% in 2023.

While the results from last year were pleasing, what many people may not have considered is that when viewed as annual returns – the figures commonly seen and known – it essentially means that global markets have remained roughly flat since the start of the previous 2022 calendar year. ($100 doing -18% in 2022, and then growing 22,5% for 2023 equals $100 again).

This short explanation, I trust, gives a meaningful short market summary to make sense of overall market conditions offshore. Therefore, while the past one-year was good, offshore markets as a whole still owe investors, all other things being equal.

Within this context, last year Emerging Markets as a whole gained 9,7% in USD terms in 2023 but is still catching up after the -22% result in 2022, while the local market saw the JSE gain 7,9% with the Local Bond Market adding 9,7%.

Rand Currency

Back in August the Rand weakened from R17,78 to the USD, to 18,70. And in September the Rand only weakened a little more by month-end to close on R18,95, and ended October at very similar levels. In early November we saw considerable strength, but by month's end, we were back to around the R18,80 level to the USD at the November month-end. Over the festive season, we did see some rand strength, to end at 18,30 at the end of the reporting period of 31 December.

These movements naturally impact especially on local investment portfolios with offshore funds when they are reported on in Rand value in our client investment portfolios.

Since then, the Rand has weakened again into the new year, broadly speaking back to those of a few months back.

Last 3 Years to End of December 2023

However, examining only the recent year provides a narrow view. Including the previous year in the analysis offers a more holistic understanding of market dynamics.

From the investor’s point of view where one doesn’t invest for only one year and given the large annual fluctuations between individual years - it makes more sense to look at the 3-year results to better understand markets locally and abroad, and what they mean for investment portfolios.

Taking the 3-year result now I also feel is also suitable, as it strips out the rapid COVID-19 fall of the 2nd quarter of 2020, and the subsequent strong rise in the remainder of that year that most of us still can well recall. Therefore, we are so looking at a more overall realistic view in recent times.

Looking at the performances of the various asset classes over the past 3 years;

Over the last 3 years, we get some more meaningful insight into overall returns, where Global Equity markets as a whole gained 13,9% per annum, and Emerging Markets 2,1% (per annum).

Locally, SA Equity delivered 12,7% per annum, with our local SA Bond market adding 7,4% per annum.

Local Cash returned only 5,4% per annum for this period, especially when it’s taxed, highlighting why the asset classes of equity (shares) and bonds are preferred in long-term investment portfolios.

Interest rates are expected to fall this year, and the one-year returns from cash, in the medium term going forward, will most likely be more reflective of the relationship to the 3-year results shown above.

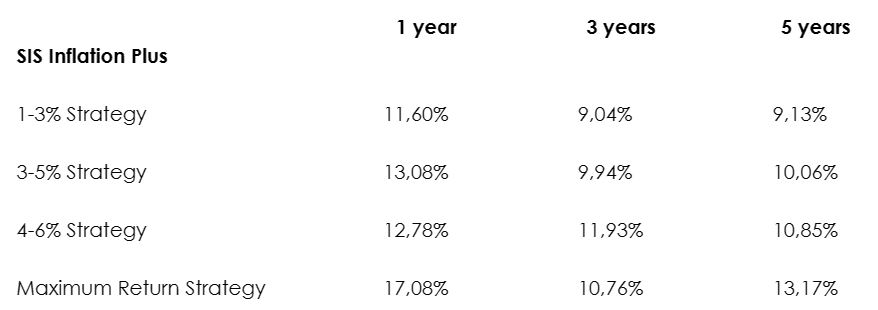

SIS Strategies and PWM Solutions

For clients invested in our discretionary managed SIS Strategies, the regular quarterly reviews were sent out last week.

In the meantime, I can share the latest results to the end of December were pleasing and can be summarised as;

*returns greater than one year are annualised (ie the returns per annum)

These are pleasing performances and are above the general average market returns on a risk-adjusted basis.

For clients invested in our newer discretionary managed PWM Strategies;

The new PWM Extra Income Fund launched late last year as a conservative Income Fund option, sees a current yield of 9,3% pa on the underlying assets.

Old Mutual Chief Economist Views

Looking forward to the rest of the year, attached are the views of Old Mutual’s Chief Economist Johann Els.

From slide 9, his highlights include;

His further views on offshore markets and interest rates, as well as the Rand currency, are included if you click here on the attachment.

Planner Thoughts

Despite the difficult period COVID-19 presented to us all, markets and portfolio investment results are supportive for our clients to achieve their overall strategy to meet their longer-term intended results.

With the market recovery being a factual occurrence since the latter half of 2020, it is gratifying to witness additional investment gains over the subsequent three years. This is particularly noteworthy when examining the results from the last three years, a period intentionally excluding the significant downturn and subsequent rapid recovery during the COVID-19 pandemic in 2020.

Locally, over the last 3 years, SA market-wise saw investment performances that are not far off what Global Equity achieved, and far ahead of the rest of the Emerging Markets mostly found themselves behind the rest of the world in respect of the COVID-19 recovery.

In the negative 2022 market overseas, SA markets fared far better that year posting a marginally positive return. But agreed, there are many SA frustrations at present where we could be doing so much better without all the local headaches/distractions.

Overall, even sorting our problems at home with load-shedding, corruption and so forth - the next element needed and dare I say non-negotiable, will be economic growth.

Looking forward, with China opening up, and US inflation data starting to fall, which last year we communicated as our expectation, it does bode for a more settled market playing field, globally and as this works through SA. Together with lower interest rates that will follow through overseas and in SA, let’s keep in perspective that falling interest rates are overall very good for investment markets.

Last year, we saw good Chinese economic growth to the upside on the back of benign inflation, which is a solid platform to build from. Not only for the investment allocations to China but also where China doing well supports the rest of the world too.

Accordingly, our overall investment view is that we remain of our view in being overweight offshore equities in a negative real yield environment (where offshore inflation is higher than offshore money market rates), favouring value-style equities within Developed Markets, an overweight tilt towards Emerging Markets, good allocation to China, and neutral to negative stance on the USD currency relative to other international currencies.

I look forward to adding tangible value to you over the year ahead.

FRIDAY FOOD FOR THOUGHT