2024 sees elections in the US, South Africa, Taiwan, India, Russia and Ukraine. The Old Mutual Investment Group (OMIG) Director of Investments, Hywel George, shares his views on how this will look and what the expected impacts for markets will be.

Before looking into the impact of next year’s elections, he first provides a rounded investment overview of offshore economies and markets and comments on the recent China/US presidential meetings.

You can access his webinar from 9 November via the link below;

(Once you click on this link, then choose the “Join Event” tab. If you have not previously registered for such an event, they will ask you to simply enter your details that is fairly quick and easy).

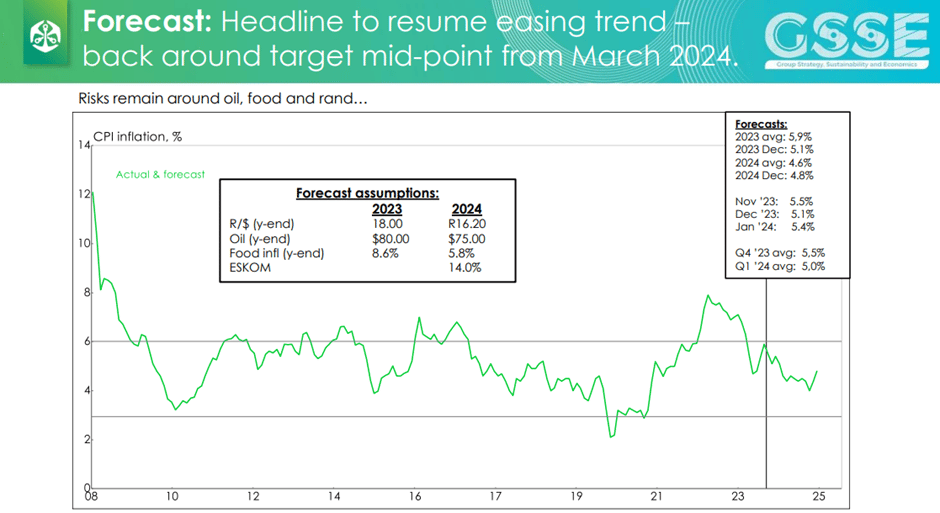

SA Inflation Sticky but Still Heading Downwards

On Tuesday, the latest 5-year SA inflation data was released, - where SA inflation came in below expectations, falling to 5,07%. For the first time since February, this is within the South African Reserve Bank’s target range of 3% to 6%, where it prefers to anchor expectations. And it’s now not too far off the midpoint of 4,5%, which the Minister indicated is their real aim.

Among 22 leading economists in a recent Bloomberg survey, most only anticipate interest rate cuts from the second quarter of next year.

SA 1-year Inflation

Then, on Wednesday last week, our shorter-term inflation data came out with higher-than-expected inflation data, and Old Mutual Chief Economist Johann Els' comments were;

“Headline inflation rose by more than expected – from 5,4% in September to 5,9% in October. A slight increase was expected due to the large petrol price increase at the start of October.

However, egg, fresh chicken and potato price increases were larger than expected, leading to a large monthly increase in overall food prices (+1,7% month--no-month), and causing the year-on-year rate to rise from 8% in September to 8,8% in October. Some of these prices are already easing and should be reflected in headline CPI inflation soon.

Another unexpectedly large increase came in the form of a sharp rise in hotel accommodation costs. The large seasonal price increase in this component was a bit earlier than last year when prices rose in November.

Core inflation – headline excluding food and energy – eased further from 4.5% in Sept (4.8% in Aug and 5.3% in April) to 4.4% in October

Underlying inflation thus continues to ease and is playing out largely as expected – i.e. cost increases are mostly deflationary in nature as it limits price increases elsewhere as consumers are constrained.

This leaves the Old Mutual view for inflation, to continue trending downwards overall over the next 18 months;

In line with this thinking, the SA Reserve Bank highlighting the risks, left interest rates unchanged last week.

OMIG Fundamentals

South Africa’s ongoing infrastructural challenges, such as the energy crisis, the looming water crisis and failing rail system, are all impacting the efficiency of business operations and capacity for local economic growth. As a result, diversification has never been more relevant as local investors find ways to mitigate these risks by looking at alternative markets. Global markets present a hugely diverse selection of different asset classes, currencies and jurisdictions, offering a significantly broader opportunity set for South African investors who are struggling to find value in the local market currently. Our latest issue of Fundamentals explores a range of topics relating to global investing to assess how investors can use global investing as a valuable addition to a well-rounded investment portfolio.

To view the full publication click here.

NAVIGATING THE PEAKS AND PLATEAUS OF THE GLOBAL INTEREST RATE OUTLOOK

JOHN ORFORD, Portfolio Manager

As the debate over inflation and higher-for-longer interest rates across the world continues, what is the current outlook for global and local interest rates going into 2024 and when are we likely to see both local and global economies enter a cycle of rate cutting?

THE POWER OF QUANTITATIVE INVESTING ON A GLOBAL SCALE

MAYURESH KULKARNI, Investment Analyst

With local investors turning their attention to global markets, the sheer scale of the global data they are faced with in these markets can present a challenge. Quantitative investing is increasingly offering a solution to this obstacle for SA asset managers and, as a result, it is currently on the rise when it comes to the processing of global investment data.

THROUGH THE LOOKING GLASS OF HIGHER-FOR-LONGER INTEREST RATES

ZAIN WILSON, Portfolio Manager

Global liquidity tightening continues to be at the forefront of global investor scrutiny; but while the short-run drivers of inflation are easier to define, it is the drivers of longer-term inflation that are more important in the setting of long-term inflation conditions.

IS THE GLOBAL GREEN TRANSITION A NEW DAWN FOR THE PGM SECTOR?

ROBERT LEWENSON, Head of Responsible Investment

The decline of the PGM sector is being largely driven by the growth of the electric vehicles market, which is compromising demand for internal combustion engine vehicles. However, evolving green technologies in the rapid transition to a greener world economy could improve the demand prospects for PGMs.

LOCAL INVESTORS NEED A NEW PLAYBOOK FOR CHINA

SIBONISO NXUMALO, Chief Investment Officer, MERYL PICK, Head of Equity Research

China’s size and its importance to South Africa mean that we need to start paying more attention to its declining economy than we do the economy of the United States, with a fall in commodity demand being bad for South Africa’s economy as a commodity producer.

Charlie Dies at age 99

Charles Thomas Munger (January 1, 1924 – November 28, 2023) was an American businessman, investor, and philanthropist. He was vice chairman of Berkshire Hathway and died peacefully at a hospital near his home in California on Wednesday

The New York Times share this tribute to Charlie that you can read by clicking on the link below;

Friday Food for Thought