OMIG Unveils ‘Coalition Proof’ Stocks

We should all have a better idea of the outcome of our coalition talks by later today, following our national election.

The Old Mutual Investment Group (OMIG), via Citywire, shared their thoughts on the investment case related to the coalition talks.

This is the article;

Old Mutual unveils its Holy Grail for selecting ‘coalition proof’ stocks | Via Citywire

The asset manager believes that clarity about the government of national unity will see it taking stronger positions.

Within each sector, we have focused on companies that can grow their earnings regardless of the political landscape.

That for us is the Holy Grail,’ OMIG portfolio manager Meryl Pick said during a media presentation to discuss the national election results.

“We went into the election without particularly brave positioning. We were exposed to banks and SA Inc. We pivoted toward quality names and winning companies in a sector,’ Citywire A-rated manager Pick added. OMIG avoided taking extreme positions ahead of the elections.

‘We did not position for a particularly weak or strong Rand. We are in global defensives. Pick said that we own British American Tobacco and Anheuser-Busch InBev, our rand hedges.

OMIG positioned its portfolios to hold their own, weather the election period. ‘As we get more certainty on how things will unfold, we can start placing more strongly.

Pick said it is an exciting time for South Africa (SA). ‘It’s the natural evolution of our democracy. Maintaining the status quo may have delivered familiarity but did not deliver growth’.

‘If I zoom in on the SA-facing companies that we own, I think there are those that are more coalition-proof and others where we are probably carrying risk depending on where we go with policy,’ Pick (pictured below) said.

Pick identified six stocks that will weather the risks associated with a government of national unity (GNU). These stocks meet some of the following criteria;

· They are gaining market share.

· They have a strong competitive advantage.

· They are growing or consolidating an industry.

· They meet a staple consumer or business demand.

· They have a strong balance sheet.

· They have a strong management team and board.

· They have several internal problems to fix.

Some Old Mutual-owned companies that fall into the ‘coalition proof’ category include Aspen, Bidvest, Capitec, Sasol, Shoprite, and Spar.

Pick said Aspen is exposed to growing pharmaceutical segments. ‘They own the only vaccine production capacity on the African continent. They have a much cleaner balance sheet than they had a few years ago,’ she added.

Pick said Old Mutual believes that Shoprite has a clear competitive advantage in the retail space. ‘They’ve been on the front foot in terms of taking on the upper end by repositioning the Checkers brand, and they were certainly prescient in the timing of launching Sixty60. Their balance sheet is clean. The management team can focus on growth”.

Many Issues to fix

Pick said Spar is an example of a company trying to turn itself around. ‘They have caused so many issues. Should they fix those, they could unlock value,’ she added.

Pick said Bidvest is an ‘interesting’ share that is exposed to logistics and other businesses like cleaning franchises.

She said Capitec is in the banking sector and had been under pressure but now has a growing market share and a competitive advantage. ‘I’d certainly like exposure to the one [bank] that has demonstrated competitive advantage and can take market share from its incumbents.’

Pick said Sasol has many problems, including operational issues at its coal mines. She said SA Inc. businesses that faced risks due to uncertainty on the composition of the GNU fall into three key categories;

· They do business with the government

· Their products or services are sensitive to consumer and business confidence

· They are sensitive to market movements

Some Old Mutual-owned companies that fall into the coalition risk category include Absa, Exxaro Resources, FirstRand, Nedbank, Old Mutual, Raubex, WBHO, and Standard Bank.

Pick said construction company Raubex, for example, could suffer if the South African National Roads Agency Ltd (Sanral) stops issuing tenders.

Exxaro and Eskom

She said Exxaro Resources provides Eskom with a lot of coal.

If Eskom continued reducing stoppages and consuming more coal, that would be great for Exxaro. If the opposite happens and [Exxaro’s] contracts are interfered with, then there is a risk potential,’ Pick said.

She said insurance houses like Old Mutual, Sanlam and Discovery derived much of their profits from market performance, particularly the SA market.

Pick said the local banks had been topical in the run-up to the elections.

“Anything that negatively impacts consumer or business sentiment will be negative for economically sensitive, cyclical counters. If companies hold back on capital expenditure, it isn’t good for the construction sector. If consumers are afraid, it is bad for discretionary spending.’

‘Any GNU outcome good for confidence can unlock performance,’ Pick said.

The importance of remaining invested

Apple stock was up 9.05% in one week with most of that performance from 11th June to now – after the Apple conference.

That Extra Bit from Private Clients by Old Mutual Wealth

Attached please find the latest That Extra Bit, where we share a few interesting articles on some of the companies we hold in our portfolios.

In this week’s issue:

Standard Bank collaborates with MTN on mobile service plans

Visa and Dash Solutions partner to deliver real-time money movement

Amazon & Vrio to launch satellite internet in South America as a direct competitor to Startlink

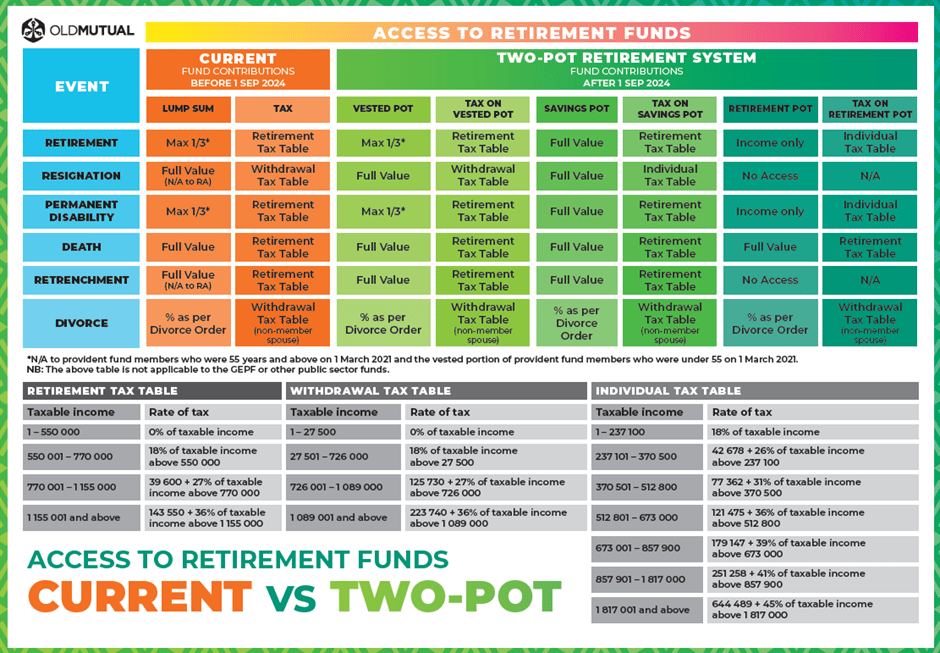

Old Mutual neatly put together in a nice infographic the current vs new retirement system with Two-Pot coming on 1 Sep 2024

Friday Food For Thought

Being a good Father is the most important role I will ever play and if I don’t do this well, no other thing I do matters.

“Michael Josephon”

My son Peter, has the privilege of having 3 fathers and even sometimes getting consufed with his pappa and Oupa. At least Oupa Grootjie has the hair to distinguish him.