I spent some time with one of our asset mangers Peregrine Capital and their thoughts on Eskom and Transnet were quite refreshing. You can click here to gain access to the slide pack of their Insider event I attended recently which also includes more information on their funds.

What also came out very interesting, and links to the previous article I shared where Ninety One talked about, how tax on interest earned on fixed deposits can drastically lower your nett return.

Please refer to the below and attached fund profile of the Pure Hedge Fund. What I would like to emphasize is the tax benefits of the fund, where the growth is 90% capital of nature, which in turn makes it a nice counter to bank fixed deposit investments.

Click here or see below a rudimental table that outlines the difference in net yield that a client will get according to their marginal tax rate. The assumptions made here are that I invested R 5 000 000 in the best-yielding fixed deposit products over 12- and 60 months and I used the 5-year performance of the pure hedge fund.

Let me know if you have any questions.

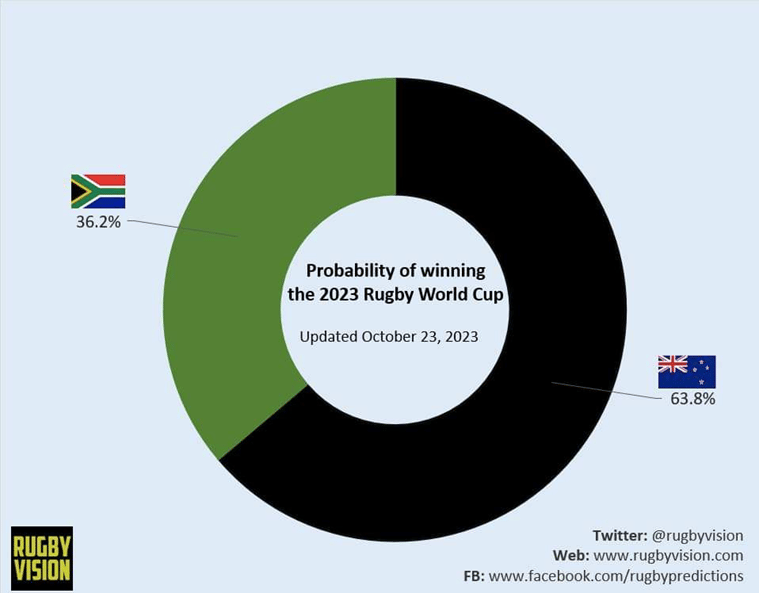

Bok AI Stats for the Final

The Boks winning their quarter and semi-finals against France and England wasn’t the last two weeks awfully tight!

Artificial Intelligence (AI) updates regularly. For the quarterfinals two weekends back, AI proved to be exceptionally accurate. Where some of the results went in favour of teams many didn’t expect (for example when Fiji beat Wales in the quarter-final that AI predicted).

The AI was also 100% correct in the results for the semi-finals.

Showing remarkable accuracy, the last two weekends, the AI says the All Blacks are the favourites for the final.

AI is becoming more prevalent but remember that human interactions are far less predictable. At the same time, my bright statistician colleagues argue that the sample is now too small for accurate conclusions.

Here’s me hoping for the Boks to prove the AI wrong tomorrow!

Friday Food for Thought