PWM Investment Solutions

In October 2021, we introduced our PWM range of investment funds for our clients.

Providing this update on these funds is a simplified additional investment option for our clients. The fund names, structure, and different options have all been kept simple to keep this offering simple.

Similarly, as with our SIS discretionary managed strategies, we have registered these funds at the FSB as standalone funds, blending top unit trust and passive fund managers within each fund to meet targeted investment returns.

The background asset allocation and fund research are done jointly between us and the SIS investment team (now called Old Mutual Multi-Managers), using their existing research and investment capabilities.

For the needed product fund structure, Prescient provided us with the best overall solution to hold these funds, for which reason their name is used in the branding.

In the design, we also wanted to provide our clients with a fund solution with external legacy products from years back, where clients might not want to sell out of the existing product if there were valid reasons (CGT as an example). Therefore, these fund solutions are available at various product providers today, including on Ninety One, Sanlam Glacier, Momentum and Allan Gray platforms, in addition to Old Mutual Wealth.

Funds Available

I attach the latest fund fact sheets for each of the four different fund offerings, Stable, Balanced, Dynamic, and Worldwide Funds, to the end of September.

Launching these funds initially took longer than anticipated to get the FSB approval due to COVID-19. October 2021 certainly wasn’t the best timing to do so, being only a few months before the unsavoury Russian invasion of Ukraine in March 2022, with accompanying negative market conditions in 2022.

The recent returns have been pleasing overall, with the last one-year returns seeing a net return of 14,44% for the Stable Fund, 18,25% and 14,03% from the Balanced and Dynamic Funds, respectively, and 12,75% from the Worldwide Fund, where the Rand’s 8% strength against the USD over the last year detracts from the local investor’s point of view.

The investment returns over the last one-year period are certainly pleasing, but it should be noted that this does come off a low base this time last year.

I believe the two-year returns of 12,72% per annum, 16,30% per annum, 14,88% per annum and 16,13% per annum, respectively, is a far better true reflection.

These returns are stated after the fund fees shown on the fund fact sheets. These see a strong reduction in the overall fund fees, negotiated with the various selected fund managers, on the aggregate strength of our client investments.

The difference between the Dynamic and Balanced Funds is that while these two funds will mostly have similar holdings, the Dynamic Fund will see more active tactical decision-making through the market cycle and a greater foreign allocation of around 50% of the fund strategy. Thus far, this is proving popular with clients for voluntary investments.

Looking at worldwide funds, by definition, a worldwide fund differs from a pure offshore fund in that it will have some allocation to SA assets, too. At this stage, we are holding 95% offshore – and while for worldwide funds where investors may reasonably expect this to drift down to up to roughly 30% in local assets, our intention at this stage is to keep to the current 95% offshore allocation,

Our clients have invested just over R6 billion nationally using only these solutions. These funds are available for regular voluntary investments, preservation funds, retirement and living annuities, and are on most leading SA investment platforms.

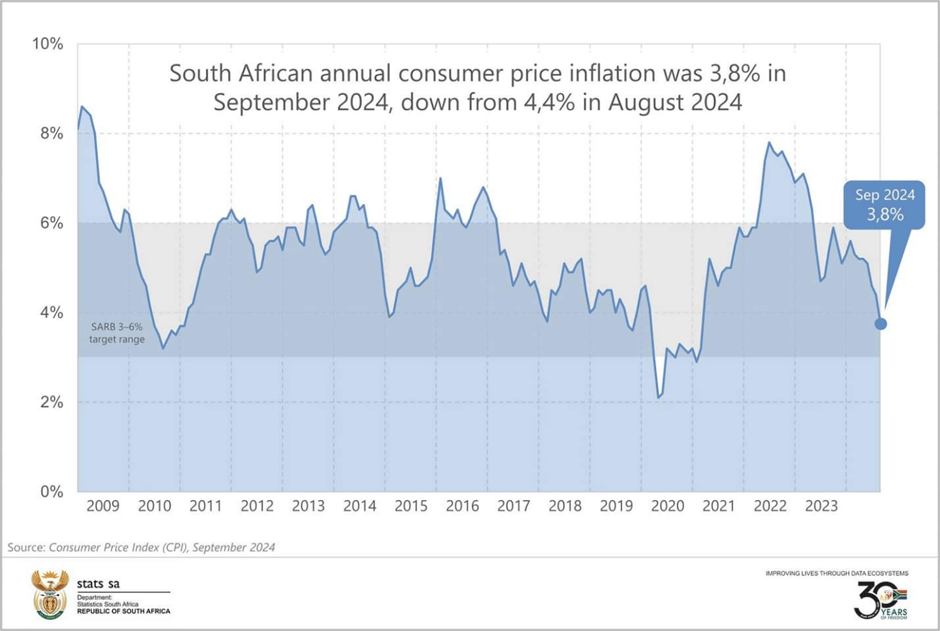

Inflation Heading Lower

In line with our comments from late last year that we expected inflation to fall considerably this year, this was again confirmed this week when our annual consumer inflation cooled for a fourth consecutive month, easing to 3,8% in September from 4,4% in August.

This is the lowest inflation print since March 2021, when the rate was 3,2%. On average, prices increased by 0,1% between August 2024 and September 2024.

Transport inflation continues to ease – specifically on the back of lower fuel prices. Positively contributing are fuel prices that dropped for a fourth successive month and are, on average, 9,0% lower than a year ago. Our petrol price is now almost R5 less per litre than a year ago (R20,26 vs R24,95 in Oct 2023).

Inflation can still drop even further, where some of the present laggards are;

After last month’s interest rate cut, further interest rate cuts are expected next month when the Reserve Bank meets.

What Traditionally Happens to US Markets on Interest Rate Cuts

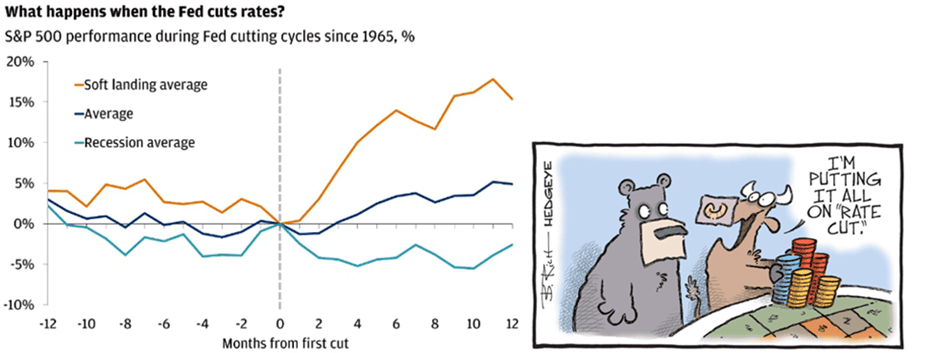

Lower inflation and interest rates historically are good for investment markets.

US inflation has also drifted far lower in the past few months. Bloomberg Finance, in conjunction with the US Federal Reserve - presents this graph showing the US market performances following previous interest rate cuts;

Allan Gray Podcast: A revival for South Africa’s retail giants?

In the latest episode of The Allan Gray Podcast, Siphesihle Zwane and fellow portfolio managers Jithen Pillay and Kamal Govan discuss the thinking behind the retail exposure in the Allan Gray funds.

As sentiment towards the South African economy improves following the formation of the government of national unity, some of the major retailers are seeing improved share performance. Lower oil prices, extended periods of uninterrupted power supply and the recent interest rate cut, which heralds a shift in policy, are notable short-term tailwinds for the sector. However, the longer-term prospects for SA retailers may be different. In this conversation, the portfolio managers delve into the performance drivers for Spar, Shoprite, Pick n Pay and Woolworths and explore key themes influencing the sector.

USD Performance this year

Friday Food for Thought