SA Post Elections

This time last week, we were all waiting for the outcome of our coalition talks.

Following last Friday’s first national assembly sitting of the seventh democratic administration, political parties reached a Government of National Unity (GNU) deal in which five parties have officially signed the Statement of Intent to participate in the GNU (ANC, DA, IFP, GOOD, and the PA). The FF Plus also joined last night, signing the statement of intent.

In the weeks leading up to the buildup, we shared the 25% probability of a “Grand Coalition” outcome that has materialised. From a financial point of view, markets favour the new status quo.

In reaction, local equity (share) markets rallied to new all-time highs, the bond market made good gains, and our SA currency strengthened.

All positive, our overall mood was further improved with no load-shedding.

After President Cyril Ramaphosa’s inauguration on Wednesday, the next focus will be on the cabinet's announcement, the outlook for reform momentum, and an agreement on policy priorities.

They say, “A week is a long time in politics”. This applies equally to investment markets too, where local markets are looking decidedly more positive over the last week.

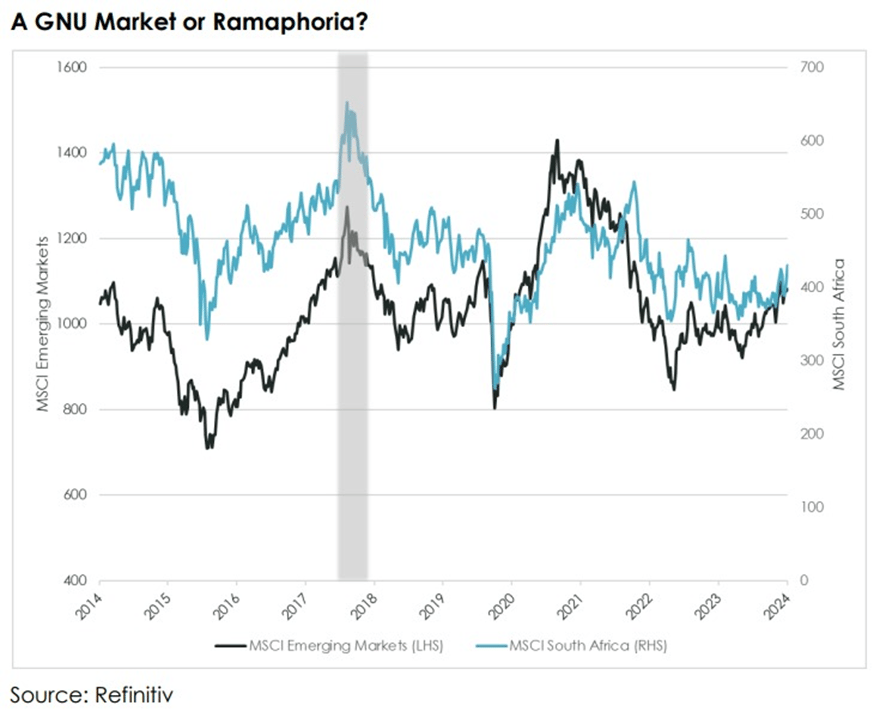

As we enter what is the most market-friendly possible outcome from the elections, we look back at the Ramaphoria rally we saw in 2017-2018 where the MSCI SA gained 24% in USD terms;

Looking back at this rally, a positive outcome could be that SA stocks see the same euphoria this time around. However, what is clear in the graph above is that this short-term optimism didn’t translate into long-term economic growth.

The challenge for the new GNU is to implement policies that will deliver greater GDP growth. The current unknowns are who will be on the cabinet list, and more importantly, will a GNU work in SA?

Keeping a healthy dose of professional scepticism, what I do find encouraging, is the seemingly positive political will to make SA stronger again, (from a financial point of view).

Looking offshore, the latest US Inflation indicators this week saw softer spending by consumers, while the UK saw lower inflation of 2,0% announced, the lowest level since shortly after the onset of COVID-19. Switzerland followed cutting its official interest rates on Wednesday, joining the group of countries who felt it couldn’t wait for the US to lower theirs.

Where offshore inflation and interest rates are lower, as a net importer of goods and services this will be positive for us in SA too, with our lower fuel prices coming through confirming.

And lower inflation and interest rates, provide for a more positive environment for markets.

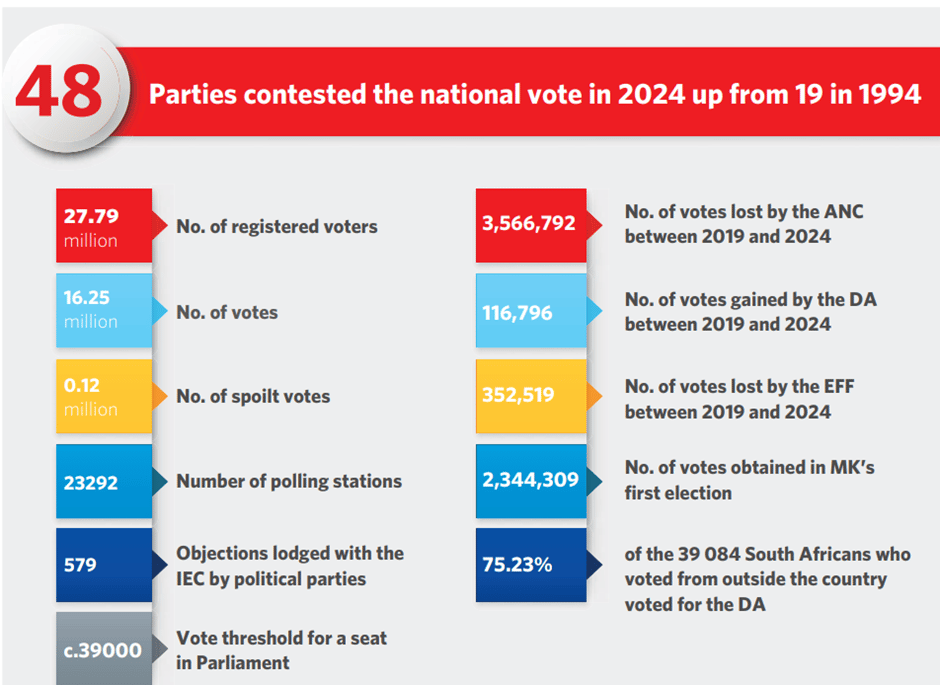

Momentum also sharing some interesting stats on the elections

To view more details, click on the image;

Christo Wiese | How do we make the most of this ‘GNU’ opportunity?

Christo Wiese was quoted via Moneyweb, saying the first step is to do what common sense dictates and ‘fully exploit’ the many opportunities in SA by creating jobs. ‘That should be the light guiding us. All the rest will follow.’

For the full article, you can read or listen to the interview, by clicking on this link;

Piet Viljoen: Re-rating of SA’s stocks, bonds and other assets has only just begun

Veteran money manager Piet Viljoen of Merchant West has been bullish on SA assets for some months, primarily because he believes they had been too heavily discounted by a sceptical global investment community. Despite this relative optimism, he warned ahead of May 29 that was the post-election ANC to partner with the EFF “all bets are off”.

In this discussion with BizNews editor Alec Hogg, the investment guru says despite a strong rally in the past few days, SA assets (the Rand, bonds, stocks) are still far too cheap - offering exceptional value right now, ahead of the coming wave of global interest.

To view the YouTube interview, click on this link;

That Extra Bit – Private Clients by Old Mutual Wealth

Attached please find the latest That Extra Bit, where Private Clients by Old Mutual share a few interesting articles on some of the companies they hold in their portfolios.

In this week’s issue:

Mondi and Traceless partner to develop plant-based coating from agricultural waste

Accenture completes acquisition of German data consulting firm

Nestlé introduces Vital Pursuit for GLP-1 users in the US

Friday Food For Thought