Soggy Politics, Great Markets

Last month, we reached the halfway mark of the year, and this is always a chance for us to review the market's performance for the first half.

During this time, there was much uncertainty globally, with the Trump tariffs as well as the recent Israeli/Iran/US conflict.

In addition to this international policy turmoil, in SA, we saw two aborted Budgets and local political uncertainty, which presented a decidedly soggy start to the year in SA.

Yet, investment markets forward prices up to a year in advance, and so they appear very different, with a greater focus on the forward view.

South African bonds and equities (shares) have delivered a stellar first half of 2025, despite renewed political uncertainty and substantial cutbacks to the economic growth outlook for the year.

The SA economy only grew by 0,6% quarter-on-quarter in the first quarter, and most forecasters have cut their projections from around 2% growth this year to somewhere between 1% and 1.5%. This is primarily due to global tariff-related headwinds, but notably, local mining and manufacturing activity has not picked up meaningfully despite the end of persistent loadshedding.

On the plus side, consumer spending levels seem to be growing at a decent clip, supported by lower inflation and interest rates, and another round of two-pot withdrawals in the new tax year. With consumer inflation still below 3% in May, and with the oil price spike proving temporary, there is still room for another rate cut when the Monetary Policy Committee meets later this month.

This lifted the second quarter return for local equities (shares) to 9,7%, and the year-to-date return to 16% (not annualised). Over the past 12 months, local equities have returned an impressive 25%, well ahead of inflation and cash.

The second quarter gains were broad-based. Resources returned 9,8%, supported by the higher platinum price, lifting the 12-month return to 30%. Financials returned 8% in the quarter, raising the one-year return 18,5%. Industrials gained 12% in the three months to end June and 29% over one year.

The FTSE/JSE All Property Index also had a strong second quarter, returning 10,8%. This lifted the year-to-date return to 6.1%, while the 12-month return of 26% was slightly ahead of the broader local equity market.

Therefore, these results are very broad-based and not industry or sector-specific.

The ZAR Currency

The rand, in turn, strengthened 1,7% against the dollar in June and 3,4,% in the second quarter to close at R17,70 to the US$. This amounts to a 3% appreciation over one year, which detracts somewhat from global asset class returns from the perspective of South African investors.

Local Bonds

South African bonds returned 2,3% in June and 5,9% in the second quarter, a solid performance despite uncertainty over the Budget and domestic political stability.

This lifted the 2025 return of the JSE All Bond index to 6,6% over the last six months. Over the past year, bonds have also outperformed cash with an 18,4% return.

The SA All-Bond index has delivered a better performance at the halfway mark of the year, only five years out of the past 25. The year-to-date return of 6,6% is almost double the cash return, and well ahead of inflation.

Comparing the first six months’ returns from SA Bonds over the last 50 years, these returns from local bonds have been above the historical average.

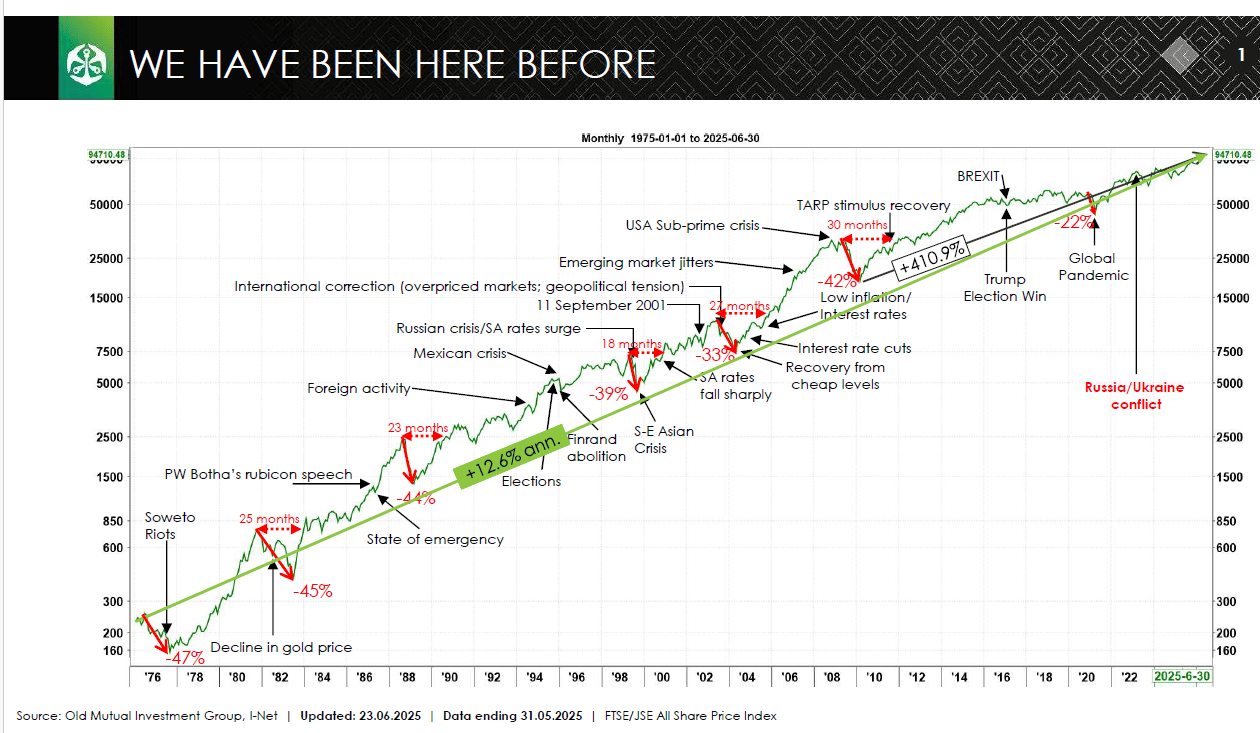

We Have Been Here Before

Graphing key global and SA events to the local JSE share index over the last 50 years, this graphic shows how these events have impacted the local JSE share market, which has returned 12,6% per annum over this period;

Notwithstanding the latest (good) market conditions and (soggy) politics locally and abroad, SA markets are much in line with the long-term (50-year) growth trajectory.

The 38 Letters from J.D. Rockefeller to His Son

Old Mutual Private Clients introduced me to these 38 letters Rockefeller wrote to his son, which I think is a must-read for any parents who have kids and want to leave some sort of Legacy.

With my eldest turning 4 years old on Tuesday, I thought it might be a good time to introduce him to the concept of money. I consulted some friends whose kids are slightly older than mine on when they introduced money and money management to their kids. The overwhelming answer was “when they start asking you to buy things for them”. So I might not quite be there yet, but stocking up the arsenal with these letters is for sure needed.

In the book, he offers guidance on business, wealth, and life. These letters, penned over many years, reveal Rockefeller's perspectives, ideology, and wisdom, emphasising the importance of hard work, diligence, and thoughtful planning. They also highlight the need for strong character, ambition, and a focus on creating one's luck.

Background:

John D. Rockefeller (1839-1937) was an American industrialist and philanthropist, best known as the founder of Standard Oil, which dominated the oil industry in the late 19th and early 20th centuries.

He is regarded as one of the wealthiest Americans of all time and a notable figure in the history of philanthropy.

Rockefeller was born in Richford, New York, and moved to Cleveland, Ohio, with his family. He began his career as an assistant bookkeeper at a commission house and only later entered the oil business in the early 1860s.

In 1870, Rockefeller founded Standard Oil, which rapidly expanded to control a significant share of the oil refining industry in the United States.

Rockefeller became one of the world's richest men through the success of Standard Oil, but his business practices were often controversial, leading to accusations of monopolistic and unethical behaviour.

Despite the criticism, Rockefeller was also a prominent philanthropist, donating millions of dollars to various causes, including the establishment of the University of Chicago, Rockefeller University, and the Rockefeller Foundation.

From a legacy perspective, Rockefeller's legacy is complex, marked by both his immense wealth and business acumen, as well as his philanthropic contributions. He is remembered as a pivotal figure in the development of the modern oil industry and as a pioneer in large-scale philanthropy.

Book Review:

In his book, I particularly enjoyed it when he says;

· “I believe that every right implies a responsibility, opportunity, an obligation; possession and duty,

· We are not owners of wealth, but stewards of it”

Here are a few key themes and insights from the letters.

Action and Choices:

Rockefeller highlights and emphasises that actions and choices are crucial for success, and that one's starting point in life does not determine one's ultimate destination.

Harnessing Knowledge and Making a Significant Difference:

He emphasised the importance of utilising knowledge and skills to make a positive impact on the world, rather than merely relying on privilege or education, in striving to add significance to others.

Creating Your Own Luck:

Similarly to when Gary Player said that “the harder I work, the luckier I get”, Rockefeller, in turn, believed that luck is rather often the result of deliberate effort and planning, encouraging his son to design his own opportunities through strategic thinking and hard work.

Character and Self-Reliance:

He highlighted the significance of character, values, ability, ambition, and a spirit of self-reliance in achieving success and happiness.

Wealth as a Duty:

Rockefeller viewed wealth not just as an entitlement, but rather as a responsibility to be used for the improvement and furtherment of society.

The Importance of Diligence and Hard Work:

He consistently emphasised the value of hard work, honesty, and careful planning in everything one does.

The Dangers of Entitlement:

Rockefeller warned against the corrupting influence of unearned wealth, emphasising the need for a strong work ethic and a focus on giving back to the broader community.

Beyond Money:

In achieving his wealth, he still believed that true happiness comes from enjoying one's creations and contributing to the world, rather than solely possessing material possessions.

This book is available online via leading bookstores. For our longstanding clients, I am pleased to offer you an electronic copy of the book upon request.

Friday Food For Thought