The Country is Turning the Corner

Last Friday and the weekend were rather eventful in terms of news flow. First, there was news that the dreaded load-shedding was back, and then we heard that SA was firmly in Donald Trump's sights.

In the following days, Izak Odendaal, actuary and our chief investment strategist shared his insightful views via Moneyweb.

“Things aren’t quite hunky dory, but the cyclical and structural outlook for the South African economy has improved.

By Izak Odendaal 5 Feb 2025 04:05

The author says the GNU is perhaps stronger than it appears from the outside since the parties need each other.

South Africa remains a country blighted by poverty and inequality. Sadly, the economic stagnation of the past decade halted progress in addressing these ills. It left the government with an unsustainable debt burden, while local and global investors became disillusioned by lacklustre returns.

Is 2025 the year when it finally turns a corner? There are good reasons to believe it will be. If things go broadly according to plan, the economy will experience a cyclical and structural growth uplift.

What does this mean? Think of a car. The speed at which it can travel is determined mainly by the size of the engine. The driver’s inputs will matter, but if the driver floors the accelerator too much, it will overheat and seize up. If the driver slams the brakes too hard, the car screeches to a halt. External conditions also matter since foggy or rainy weather will slow things down, as will traffic congestion.

The economy’s structural growth potential can be likened to the size of the engine. The only way to increase the speed sustainably without overheating is to upgrade the engine. The driver inputs are cyclical conditions, including the central bank, which can speed things up or slow them down by changing interest rates.

The external environment – in South Africa’s case, the global financial backdrop – is also critical since we are a commodity exporter and capital importer.

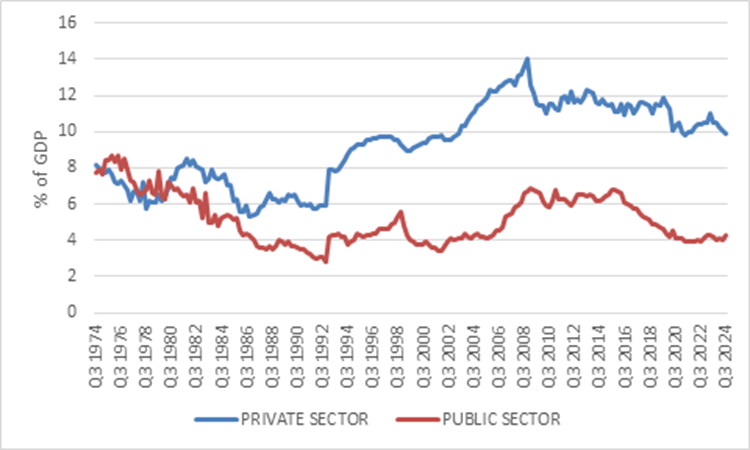

Investment too low

How do you raise an economy’s structural growth potential? More capital investment, faster productivity growth and an expanding labour force.

The latter is not a problem since our workforce is still growing, but the former is. We have more than enough workers, but capital investment is too low.

It is generally believed that countries should invest around 30% of national income (GDP) to sustain rapid economic growth. South Africa barely achieves half that number.

This, among other things, means the country’s infrastructure is inadequate. This, in turn, impedes productivity growth, which is largely the interplay of the various forms of capital—physical capital (such as infrastructure), human capital (skills), and social capital (trust and cooperation).

Human capital formation remains low, though there has been some progress, such as social capital, undermined by crime, corruption, and inequality. For instance, South African businesses have to spend inordinate amounts on security, which could be invested more productively elsewhere. Crime can be deadly for small businesses – literally and figuratively – contributing to South Africa has lower rates of entrepreneurship than our peers.

South Africa fixed investment as a share of GDP

Source: Statistics South Africa

These are not easy issues to fix, but you must start somewhere.

The government must play an important coordinating role. However, the South African government has caused as many problems as it has fixed for a long time.

The formation of the Government of National Unity (GNU) last year raised optimism that things could improve. It hasn’t been smooth sailing, and the past week saw frictions between the largest parties burst out into the open. There are deep disagreements between the coalition partners on a handful of policy areas, particularly National Health Insurance, but broad agreement on the rest.

The coalition is perhaps stronger than it appears from the outside since the parties need each other and find the alternative populist scenarios unappealing, though for differing reasons. However, they must also maintain individual identities and keep their internal audiences onside. Politicians and voters alike must get used to coalition politics.

Glued to the GNU

Nonetheless, the number one question most investors will be asking themselves is whether the GNU can last, at least until next year’s municipal elections and the ANC’s internal elections in 2027. The answer is yes.

If nothing else, South Africa's hosting of the G20 this year means we must avoid global embarrassment over petty political infighting.

However, betting on politics is risky. Anything can happen. Instead, we should focus on the reforms underway that will raise the economy’s long-term growth potential and could survive the GNU if it does collapse. Many pre-date the GNU formation, such as the substantial restructuring of the electricity market.

Though this weekend saw an unwelcome break in the 311-day load-shedding-free streak, such incidents will probably be sporadic.

Returning to the highly disruptive load-shedding intensity of 2022 and 2023 is very unlikely.

The next big challenge is logistics. South Africa isn’t blessed geographically. It is a large country, sparsely populated in many parts, without large navigable rivers. Our largest urban centre is hundreds of kilometres from the nearest port and the biggest export industry (mining).

The country needs world-class rail infrastructure to overcome these setbacks, but it has deteriorated over the past decade. The good news is that change is underway.

Just as Eskom has been unbundled into generation, transmission and distribution businesses, Transnet Rail has been split into a separate infrastructure manager and operator.

It is opening its network to private businesses to run their trains.

Large-scale private investment spending has been unlocked in the energy sector and will continue until the end of the decade. The same is likely to happen in the logistics space and bulk water provision, which can crowd in local and global capital.

Even if the GNU doesn’t survive in its current form, we are unlikely to revert to the world of vertically integrated state-owned monopolies. Those were 20th-century business models that should not have persisted so deeply into the 21st.

There are many other areas that require attention, and this week’s State of the Nation Address [on Thursday] is likely to elaborate on them. This notably includes the second phase of Operation Vulindlela, the joint Presidency-Treasury initiative aimed at removing a defined set of key obstacles to ensure faster economic growth.

Of interest

Apart from the supply-side (infrastructure) challenges, high interest rates have undoubtedly contributed to economic malaise. Interest rates are elevated for both cyclical and structural reasons—in other words, because of the size of the engine and the behaviour of the driver.

The driver—the South African Reserve Bank, headed by Governor Lesetja Kganyago—has eased up on the brakes by cutting the repo rate by a cumulative 75 basis points.

After last week’s rate reduction, homeowners will pay R1 000 a month less on an R2 million bond at the prime rate. This is money that can be spent elsewhere.

The interest rate relief is due to lower inflation and an improved outlook for future inflation. In December, annual headline consumer inflation was only 3%, a bit less than expected. A temporary fall in fuel prices somewhat distorted this. However, even excluding food and fuel, ‘core’ inflation was only 3.6%.

The Reserve Bank expects inflation to average 3.9% this year and 4.6% next year, and even these forecasts might be a touch too high since energy regulator Nersa subsequently announced lower-than-expected electricity tariff increases. In the coming financial year, Eskom will be allowed to raise its tariff by 12.7%. This is almost three times the inflation target, but much less than it asked for and less than generally assumed (the Reserve Bank’s forecast was for 15%).

South African interest rates and inflation, %

Source: LSEG Datastream

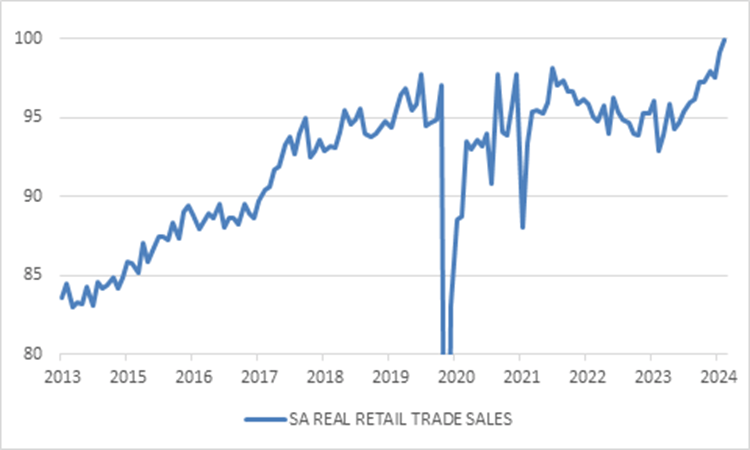

Lower inflation doesn’t just allow for lower interest rates but also increases the real purchasing power of households. Employee income growth generally exceeds the inflation rate, and we can see it in the retail sales numbers.

As inflation rose in 2022 and 2023, households would spend more but get less in return. Now they are getting more again.

This is an important cyclical boost and contributes to a better growth outlook over the medium term. The growth outlook has already improved. The Reserve Bank expects the economy to expand by 1.8% this year and next, rising to 2% by 2027. This is slow compared to many other emerging markets, but it is a meaningful improvement over the 0.5% average growth rate over the past decade.

South Africa’s real retail sales, R100billion

Source: Statistics South Africa

However, interest rates remain structurally elevated, weighing on economic activity and equity valuations.

To lower the long-term trajectory around which rates will fluctuate, a similarly lower inflation trend is required. This is why the Reserve Bank is keen on a lower inflation target—such as the 3% most of our peers aim for—to embed lower inflation expectations. The current goal is the midpoint of 3% to 6%, i.e. 4.5%.

The government's perceived lack of creditworthiness is the other source of structural upward pressure on interest rates.

Its creditors—bond investors—demand a risk premium that ultimately applies to private sector borrowers, directly or indirectly. This risk premium will only decline when economic growth has accelerated meaningfully and structurally and the government’s finances are in better shape. Growth will boost tax revenues, thereby lowering the government’s borrowing requirement, but discipline on the spending side is also necessary.

This is not easy, given the ever-growing spending demands. Still, the Budget Speech later this month will probably show the Treasury sticking to the script of fiscal consolidation, maintaining a rising primary surplus (tax revenues exceeding non-interest spending). Success on this front should see eventual credit rating upgrades and lower borrowing costs.

South Africa’s primary budget balance

Source: National Treasury

The Monetary Policy Committee (MPC) statement noted that a scenario where deeper structural reforms are implemented would allow growth to rise to 3% by 2027 while resulting in lower inflation and interest rates.

Stronger growth usually puts upward pressure on inflation and interest rates as the economy eventually runs too hot. However, in South Africa’s case, the supply-side reforms that boost growth will also lower costs. For instance, improved electricity supply means firms can produce more but also don’t have to pass on the cost of running diesel generators to consumers.

But the global environment – the driving conditions – will always matter. The current global backdrop is particularly uncertain, as witnessed by the rand's volatility since the November Trump election.

The US Federal Reserve has paused its rate-cutting cycle, and the risks of a US-ignited trade war have risen with the imposition of tariffs on Mexico and Canada. This could potentially lead to rand weakness and negative consequences for inflation.

No one knows exactly how things will play out, and the MPC, therefore, described the risks to its inflation outlook as being tilted to the “upside.” Given the uncertain global backdrop, two of the six committee members favoured leaving rates unchanged. This suggests that the bar for future rate cuts has risen, but it is not insurmountable. One or two 25 basis point cuts are likely, but not necessarily at each upcoming meeting.

Drive carefully

In summary, the cyclical and structural outlook for the local economy has improved.

This does not imply that everything is hunky dory or that there won’t be potholes or speedbumps along the way. Many challenges remain, and many South Africans live extremely difficult lives.

From an investment point of view, however, it suggests that we can expect further value to be unlocked from local bonds, equities and real estate, while the rand also has room to appreciate. Patience remains a virtue, whether driving or investing. It might take time before the global investment community recognises the progress.

Izak Odendaal is an investment strategist at Old Mutual Wealth”.

Hywel on Trump

Ten days into the job and around a hundred Executive Orders signed on Day One what are the focus areas for Trump and how will they affect the World?

Hywel George, director of Investments at the Old Mutual Investment Group (OMIG), shared his thoughts last Friday (before our load shedding and Trump's remarks on SA) on the expected impacts of Trump taking over the White House.

To view the recording of the webinar, you can click on the link below;

Retirement Annuity (RA) and Tax-Free Savings Account (TFSA) top-ups are here!

Now is the perfect time to ensure that your contributions to your retirement annuity (RA) fund still meet your retirement goals and to take full advantage of the current tax Year’s deduction regime.

I’ve been writing an article each year for the past 9 years on how beneficial it is to invest in RAs, and all the benefits still exist and is even better than what it used to be. Here is the 9th edition of my article. THE VALUE OF RETIREMENT ANNUITIES 2025

The 2024/2025 year of assessment ends on 28 February 2025. This means you only have until the middle of next month to make additional (tax-deductible) contributions to your RA fund or to make a lump sum (tax-deductible) contribution to a new RA fund if you don’t already have one.

Don’t miss this opportunity to maximise your tax deduction and boost your retirement savings. Also, don’t leave it until Feb 27th to decide to make additional contributions. The product providers have strict cut-off times and if you miss the boat, you miss the tax you could have saved.

If you are not sure what an RA or TFSA is or are still on the fence about making the extra contributions, have a look at this Retirement Annuities And Tax Savings For 2024 - 2025 article we wrote about the benefits of each of them and why everyone is SA that pays tax should at least have a RA.

If you already have enough to retire on yourself, reducing your estate by making TFSA contributions for kids or any other people you care about is a great way to reduce your estate duty. You could create generational wealth with only R36,000 paid into this investment until the lifetime allowance of R500,000 is used up.

FRIDAY FOOD FOR THOUGHT