OMIG Chief Economist Views

All excited by the Boks World Cup rugby win and our president calling 15 December as an additional public holiday, this does mean that we are all left with only 3 full working weeks in the calendar year.

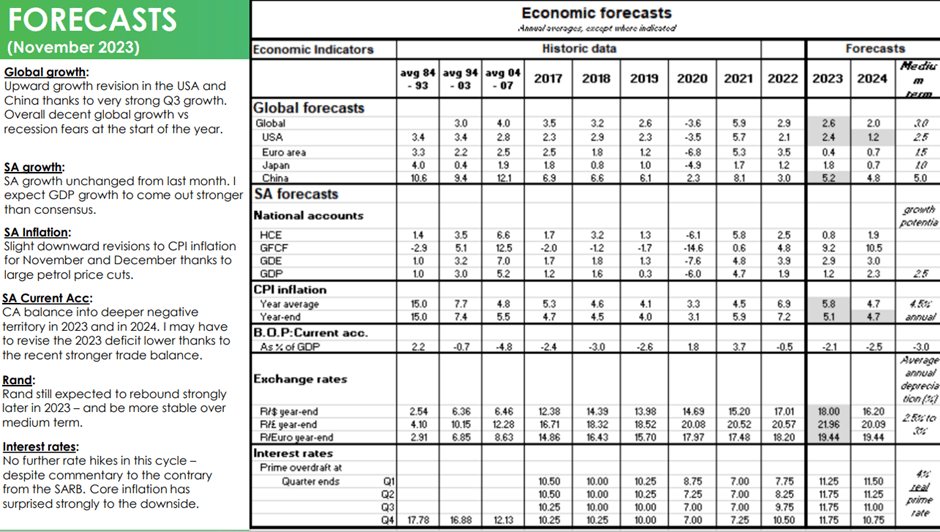

Looking at the remainder of the year and what is potentially in store for the greater economy, on Monday, the Old Mutual Investment Group’s chief economist, Johann Els, shared his latest updated views on the bigger picture economic environment for the remainder of the year, where he summarises his expectations in table format below as;

Many of these aspects are strongly interrelated. Therefore, good recent economic growth coming out of the US and China as the world’s largest economic powers, does bode well for SA too.

Where we are a net importer of goods, lower global inflation will therefore filter into lower inflation in SA, which would be supported by the lower international oil prices we have seen over the last few weeks. And this also presents a more favourable environment for our local currency.

Cheapest retailer for groceries in South Africa right now | via Business Tech

Business Tech released this comparison of a simple basket of groceries between SA’s leading grocery retailers.

The grocery basket comparison now includes:

700g loaf of Albany Superior sliced white bread, or store-brand

2-litre sunflower oil (cheapest option)

2.5kg Iwisa maize meal

2.5kg Selati white sugar

2-litre milk (cheapest option)

2kg Tastic rice

2.5kg Snowflake cake flour

175g bar of Dettol herbal soap

9-pack of two-ply Baby Soft toilet paper (or store brand).

In some cases, store-brand alternatives are used because some stores only keep the store-brand versions of those items. Additionally, the online prices were considered, and therefore, Food Lovers Market was exempt from the article, as they don’t have an online store.

According to their data, the average cost for our basket of nine staple items in July was R415, which is much cheaper than the last recorded month of July (R480).

Makro offered the cheapest basket in November 2023, totalling R369.76. This is R23.65 less than the second cheapest retailer – Shoprite (R393.41). Woolworths had the most expensive basket at R438.91, which is R69.15 more than Makro. It must be noted that Spar is franchised, meaning prices and items can vary from store to store.

The table below gives the breakdown of prices for each item from the eight grocery retailers and who comes out as the cheapest;

For the full article, you can click on the link below;

Could the Tide be Turning? Ninety One Jeremy Gardiner

Ninety One Director of Investments, Jeremy Gardiner, shares his latest views on some optimism returning.

“It has been a tough year across the planet, but particularly for South Africans. However, things feel a little better now, not just because of the rugby.

The economic picture is improving slowly despite sticky inflation globally, sky-high interest rates, a prolonged economic downturn, and two tragic wars. Notwithstanding the mismanagement of most of our state-owned enterprises here at home, it looks like the private sector is coming to our rescue.

Could this be the beginning of our recovery?

Miraculously (or skilfully), the Americans seem to have dodged the recession bullet. With inflation sustainably on the decline and a supportive economy, the runway for the proverbial ‘soft landing’ is now open. It’s quite amazing how the world’s largest economy, finally signalling a peak in interest rates and probably no recession, seems to have improved the mood globally.

Across the pond in both Europe and the UK, the growth picture, however, remains challenging. While rates have probably peaked, inflation remains too high and growth is stuttering, so the ‘hard landing’ possibility remains real.

Geopolitically, the world remains tricky.

Given the lack of media coverage, one could be forgiven for thinking that the Russia-Ukraine war was over, but it is still grinding on. Markets no longer seem interested. Similarly, the devastating conflict in the Middle East appears not to be distressing markets yet; however, if Iran somehow gets involved, it could escalate very quickly.

Oil remains a risk to the global picture. Should the war escalate, pushing oil above $100 per barrel, inflation will rise again, followed by interest rates, and any hopes of recovery will be shelved.

Expect political noise in South Africa to reach a crescendo.

Meanwhile, back home, things feel slightly better. With elections likely in the next 9 months, expect political noise in South Africa to reach a crescendo. Most analysts see the ANC coming in at just under or just over 50%, which could result in the ANC hooking up with one or two of the smaller parties.

Very few see the ANC coming in as low or below 40%, so a tie-up with the DA, which would be positive for the economy and markets, is unlikely.

Even more unlikely, according to analysts, is a potential ANC-EFF tie‑up – fortunately, as the economic carnage a populist government would wreak on SA would be devastating. One need only look at Argentina as a case in point.

In terms of electricity, whilst there could be a few more periods of extreme load-shedding, the first signs of an improved electricity landscape are becoming tangible. There is so much effort, expertise and money being put into fixing this problem that the current improving trend looks set to continue and then accelerate towards the end of next year. By 2025, this should no longer be a problem. Thank heavens for the private sector, without whom things would not be improving. There’s a certain irony in the government claiming credit for the electricity improvements (and the Rugby World Cup victory!).

The mining companies would have exported R150 billion more had our railways and ports been working.

Similarly, and hopefully, the private sector is coming to the rescue of our railways and ports, which also, having been left in state hands, have more or less collapsed. This, together with tough economic times, has seen the government forced to make some hard decisions, in other words, allow business/private sector involvement. Durban has selected a partner to develop and upgrade the container terminal; the others are headed the same way. And not a moment too soon. The mining companies would have exported R150 billion more had our railways and ports been working, and now our fruit exports are declining (and decaying) due to inefficiencies and blockages at Cape Town harbour.

Partial privatisation is not ideal. There will still be difficult and sometimes obstructive government officials involved. For instance, the Durban deal has not been signed off yet, with bureaucratic officials holding the final signature back. But going forward, some level of private involvement should certainly be an improvement. The combination of better functioning electricity, rail and ports is our 3-5 year growth story.

Add to that an improved global picture as global interest rates start declining sometime next year (they’re not going to stay at current multi-year highs forever). This should see the US dollar softening, resulting in ‘happier’ emerging market economies and currencies, which should make us feel quite a bit better.

Just watch out for oil”.

Fuel Prices Due for a Healthy Reduction Next Month

And looking at fuel prices, the Central Energy Fund (CEF) points to another big petrol and diesel price relief month in December 2023.

The CEF’s data points to an estimated drop in petrol prices of around R1,05 per litre, while diesel is lining up for a cut of up to massive R2,14 cents per litre.

If these over-recoveries carry through to the end of the month, motorists and other fuel users will catch a much-needed break ahead of their travels for the festive season.

These are the expected changes:

· Petrol 93: decrease of 105 cents per litre

· Petrol 95: decrease of 107 cents per litre

· Diesel 0.05% (wholesale): decrease of 209 cents per litre

· Diesel 0.005% (wholesale): decrease of 214 cents per litre

· Illuminating paraffin: decrease of 175 cents per litre

A drop in fuel prices presents a general decrease in inflation, where most goods must be transported. And lower inflation is generally very good for investment markets.

For the full article on the lower expected fuel prices, you can click on this link: Here is the expected petrol price for December – BusinessTech

Avoid these common investment mistakes and you’ll be a successful investor

Friday Food for Thought