US Election | What Trump’s win means for South Africa

The long-awaited US election resulted in a Trump victory. The race had always been polled as tight leading up to this election, and therefore, the surprise was more in the extent of the overwhelming majority.

The initial market response has been for the dollar to rally and for US bond yields to rise. Unlike in 2016, this outcome did not come as a surprise, and markets were broadly positioned for a Republican win based on Trump’s recent momentum in the opinion polls.

Via Business Tech, our chief investment strategist, Izak Odendaal, shares our rounded views on the expected impacts for South Africa that you can read by clicking on this link;

US Politics and Markets

How will this impact the outlook for US shares? And should investors use this to make big changes to their investments?

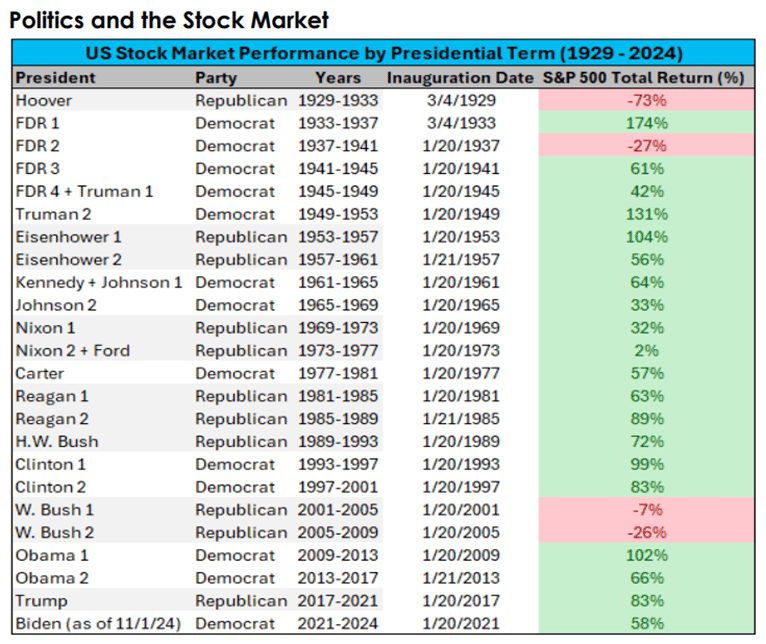

The table below shows how US stock market tends to go up during most presidencies (barring during the Great Depression and the Global Financial Crisis).

Over long periods, a buy-and-hold strategy has trounced the choice of investing in only Republican/Democratic administrations.

US Markets Liked the Quick Result

On Wednesday, when the results came out, the initial US market was very positive.

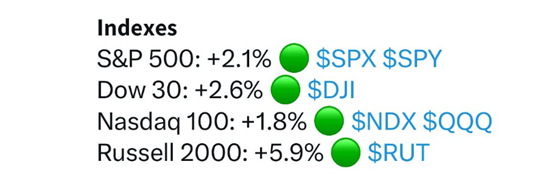

This was supported by Harris’s concession speech accepting the result, and the initial US market reaction for just the day on Wednesday was;

Markets generally don’t like uncertainty, and the quick election result bringing certainty - saw the Russel 2000 Index, being a wider index of the US smaller shares, up 5,9% for the day.

3-year Returns from the Asset Classes for SA Investors

Coming back to us in SA, reviewing the latest asset class returns to the end of October in Rand terms, one-year returns are exceptionally strong.

However, this is partly due to coming off a low base last year and then adding our positive improvements in recent months, including reduced load shedding, corruption, lower inflation and interest rates, and the formation of our GNU.

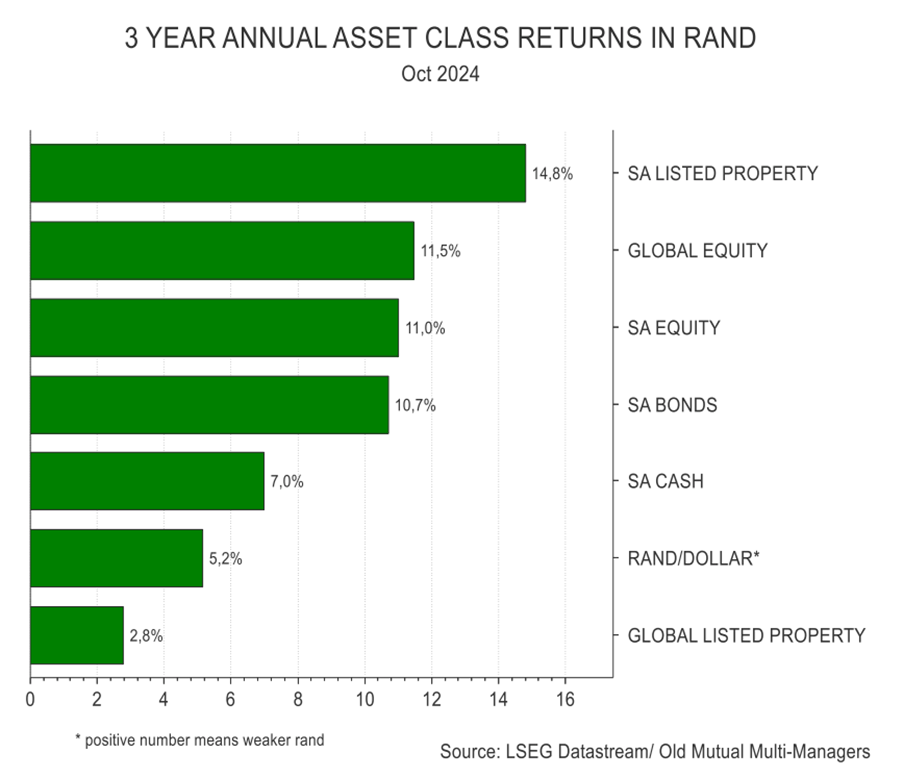

Looking through the short-term positive impacts of the past 3-year results, some interesting returns trends are coming through;

These investment returns are stated in Rands and are the per-annum results over the last three years.

The standout performer is local SA Listed Property, trumping the asset class returns and increasing 14,8% per annum.

Very interesting is that local SA Equity (shares) have returned 11,0% per annum, being rather close to the 11,5% per annum from offshore share markets (Global Equity), even with the Rand depreciating by 5,2% per annum over this period.

And then, on a risk-adjusted basis, SA Bonds returning 10,7% per annum over the three years has been an attractive return relative to both offshore and local and share markets.

The Rand Strength this Year-to-Date

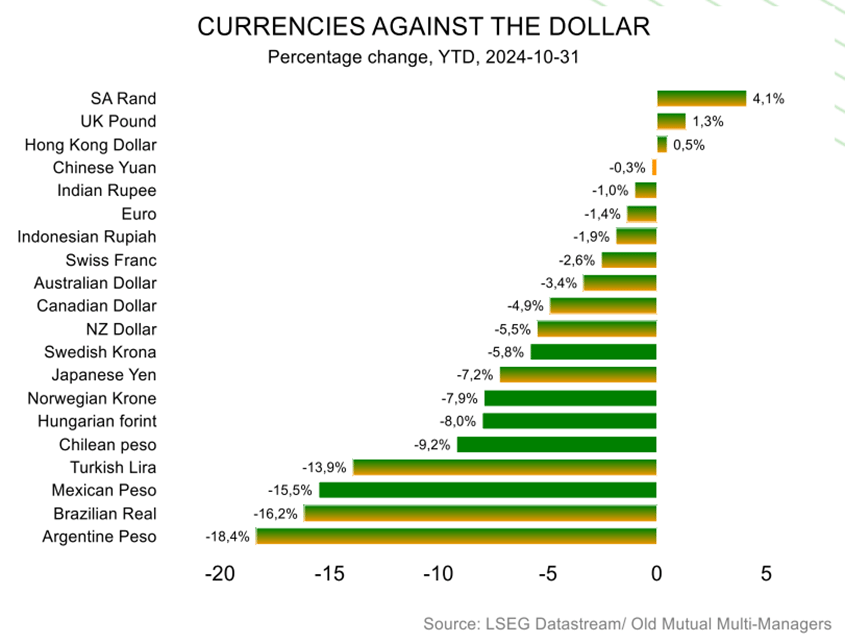

While depreciating 5,2% per annum over the last three years, looking at the Rand over the shorter term of this year-to-date - this includes where to the end of last week, the Rand has been one of the strongest currencies relative to the $US, since the start of this year;

The Prospects for the Rand

In the context of the Rand weakening by 5,2% per annum against the $US over the last three years and then strengthening this year as one of the best global currencies this year-to-date, we expect more strength in the short term.

The extent of how far the Rand can strengthen further in the short-term is largely dependent on continued improvement in domestic fundamentals and a somewhat weaker $US.

Looking longer term, the Rand should softly weaken over time; in the long-term trend, we should see the Rand weakening softly in line with economic theory by the inflation and interest rates differential between ourselves and the first world.

Concluding Thoughts

Over the next fortnight, we anticipate seeing interest rate cuts in both SA and the US. This bodes well for a stronger Rand in the short term.

In terms of geopolitics, we can expect Trump will likely put pressure on Ukraine to start negotiations with Russia, as well as with Israel in its war with Hamas and Hezbollah. He most likely will also take a hard line on Iran. While he is hawkish on China, he is probably less likely to stand up for Taiwan.

Given South Africa’s stance on some of these issues, it becomes a more challenging foreign policy environment and requires greater diplomatic skill on our part. However, Trump is probably not very interested in Africa or South Africa.

This means that South Africa should continue its path of economic reform so that we are more reliant on internal growth drivers, particularly investment, and not on the global environment.

At the same time, we should expect that local markets will always move in line with global trends, as has been the case over the decades. Simultaneously, the local growth outlook has improved considerably.

Friday Food for Thought