One of my colleagues at Private Wealth Management, Stanley Tordiffe, recently visited China and wrote the article below which I enjoyed and thought it good to share:

“Returning from China last week, I want to share a few highlights of my trip.

I was also in China this time last year, but seeing three cities (Shanghai, Beijing, and Chengdu) in six days with the Prescient China team was quite the blitz. Only visiting Shanghai this time with Old Mutual International was good for me to revisit.

For many who haven’t visited, Shanghai may evoke images of industrial factories surrounded by smog and pollution, which is not the case today.

Inevitably, my first visit last year was very eye-opening. This time, knowing far more in terms of what to expect and getting over the first year’s initial “wow” factor of an ultra-modern city that very few know much about first-hand, I could look even more closely at a city of 30 million people that is more commonly referred to as the “New York of the East.”

The Chinese Bull outside the Shanghai Stock Exchange is a photo I took regularly showing clear skies from the city centre.

Last year, I also wanted to view the state of the Chinese property market, so I shared my thoughts at the time, which you can view by clicking on this link: 2023 visit making sense of Chinese property.

I now share my thoughts following my recent visit by clicking on this link: Highlights of this year's trip to China.

Prescient China and Foord

I spent some time at the offices of the Prescient China team and with Jing Cong Xue, a portfolio manager with Foord Asset Management based in Singapore.

After looking at their funds in-depth, they also took various site visits, and I will illustrate the overall themes by using only three sets of companies we visited, which offered varying degrees of investment opportunity;

Chinese Electric Vehicles

It’s almost impossible to visit China without seeing its electric vehicles and robotic processes for making them.

IM stands for and is pronounced as “I am” – and is a range of electric vehicles.

While there, we saw that the L6 model had been launched. This electric vehicle has a range of 720 kilometres, and the car battery and the associated parts have a life-long guarantee. In SA, the newer Chinese electric vehicles are coming out here with a battery guaranteed for 1 million kilometres, which I now believe will soon be upgraded to life-long at a far lower cost;

A top speed of over 300 kilometres per hour ensures performance, and this vehicle with higher-end finishes retails to customers for the equivalent of R450 000.

For a short video I took of the new IM L6 model, click here;

This gives some insight into the possible future evolution in this space. The total cost for an electric vehicle is cheaper to manufacture in China than one with a combustion engine, and China produces more than half of global electric vehicles today, with very little exported to the US;

The Zeekr range of vehicles is even more appealing, offering more luxury. Their higher-end models, retailing for around R500 000, offering a back passenger seat experience meets a first-class flight seat. One can’t help wondering why this wasn’t thought of before.

For a short video of the new Zeekr model, click here;

Sense Time – “the bad.”

Revisiting Sense Time, a company specialising in AI technologies within security systems was slightly disappointing for me.

It’s a huge business with offices at least 10 times the size of Mutual Park in Pinelands.

Typical applications they provide are eye-recognition security systems for offices. In these systems, there’s no need for security tags or cards when entering a building where one works, as you simply look at the camera that recognises you and allows you to enter.

The same applies when taking a lift to the upper floors, where there are no buttons to push, but instead, you look into the camera, and the doors open and take you to the upper floors you have access to.

After visiting last year, I was expecting more earnings growth. Last year, they shared that they would turn to first profits after 12 years, which they still haven’t.

At best, their investor relations team went to great lengths to explain how they reduced their net loss by 26% on the previous year.

Yet at the same time, one needs to understand that one of their larger clients is the government in their military applications. Simply stated, the Chinese government isn’t paying their invoices and is only making promises that they will more than make it up to them later in other ways.

Sadly, this reminds me of back home when Eskom, a few years back, wasn’t paying their external electricity suppliers.

While they probably “will still make it up in other ways”, this still leaves me with much professional scepticism and probably explains why, although it may be an exciting, dynamic industry - neither Prescient nor Foord (nor Coronation) have any investment of their funds here.

Yum China

Jing Cong Xue, portfolio manager with Foord Asset Management, took us on a site visit with the investment relations team of Yum (Brands) China, which is listed on the Hong Kong Stock Exchange.

(This is the sister company (but not the same) of Yum Brands listed on the US stock exchange).

With Jing Cong Xue, portfolio manager at Foord Asset Management

Yum China is incidentally also a holding in the Coronation Global Emerging Markets Fund.

Yum China owns KFC and Pizza Hut in China and 4 other leading brands.

Today, they are able to have their capital returned back on a KFC store within 2 years, and between 2-3 years on a Pizza Hut (where pizza is not yet a popular meal in China).

Individual franchise owners battle to do this in SA, yet Yum China can do it on a large scale.

After last month’s general rally for Chinese equities (shares), the share price now trades on a share price/cash flow earnings of 11 times.

In our more regular terminology, the 2025 forward PE ratio of 13,5 times offers good value to the investor, which is amplified when the expected forward earnings growth is 10% per annum in $US currency.

K Bar coffee, a specialist coffee (on tap) that has been placed within the KFC

Where the Chinese appreciate good coffee

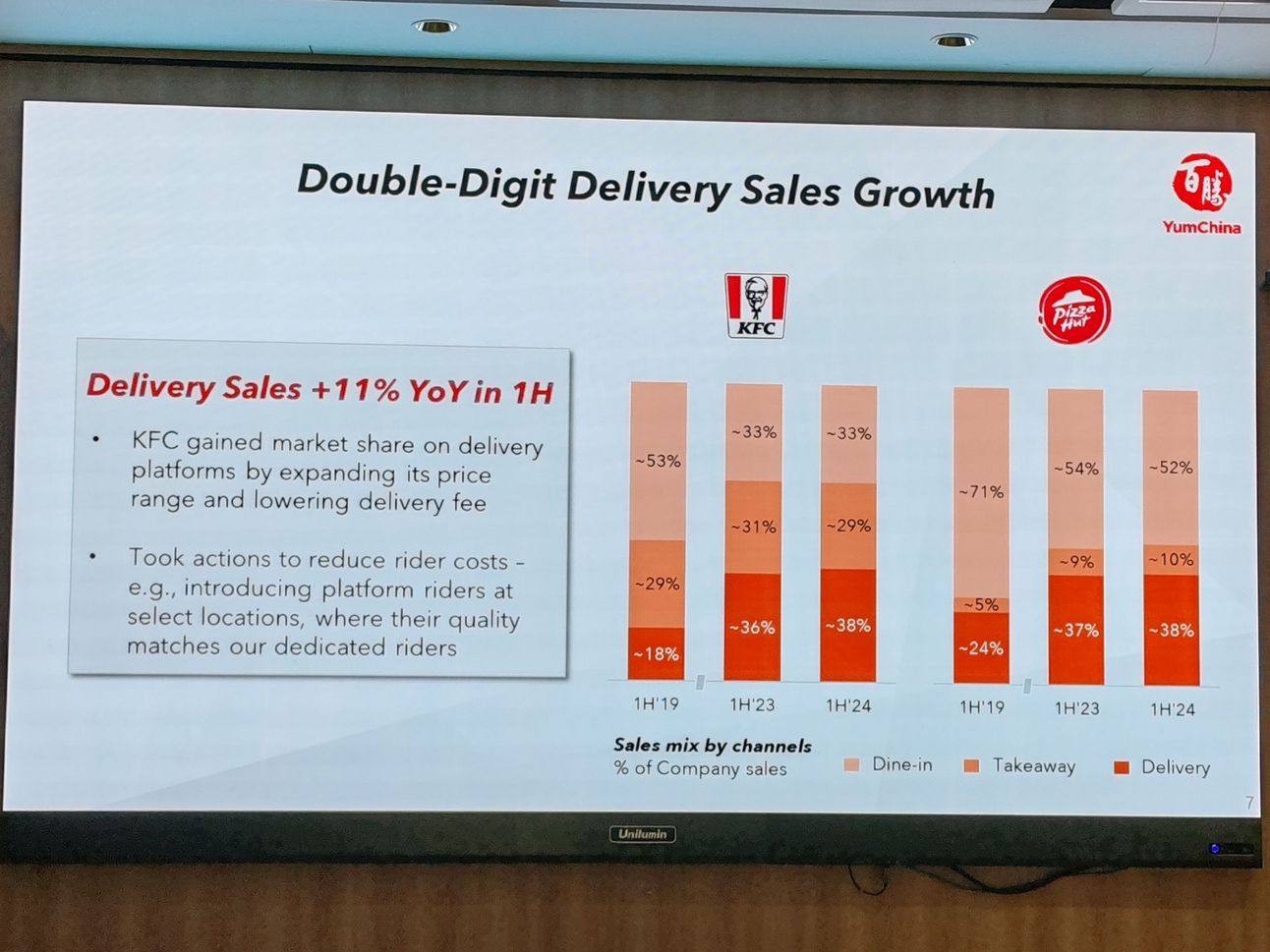

Similar to global trends, delivery sales as a percentage of earnings growing

Lavazza - an upmarket Italian deli also owned by Yum China

The KFC menu in China

New store openings remain having strong targets.

Smart innovations through COVID-19 and beyond

A Visit to Shanghai well-recommended

I know many of our clients are seasoned travellers. If you are ever heading to the East or Australasia, I would recommend a few nights in Shanghai as an additional stopover and worth the visit, where Shanghai is commonly called the “New York of the East”. If you like New York, you’ll enjoy Shanghai.

A trip of 4 or 5 nights with 3-4 full days is ample for the seasoned traveller to see Shanghai. Prices are very similar to slightly cheaper than at home in SA (for example, a good 4-star hotel room would cost around R1 000 per night, a regular meal at a family restaurant would generally be under R100, and a can of coke at a café is around R10).

Concluding Thoughts

China represents the 2nd largest economy in the world, yet it only accounts for 2,5% of the world's overall global stock market index (MSCI World Index).

Our visit coincided with the Chinese markets rallying 23% for the month of September when their government introduced a sizeable monetary stimulus. In addition, their lending rate was cut by 0,5% in an additional surprise special interest rate cut, where no announcement was previously scheduled or due.

The overall global index funds won’t provide the necessary allocation, nor is a Chinese ETF such as the CSI300 suitable, as there are many individual companies I wouldn’t want to see in our client portfolios.

The average Chinese person is becoming wealthier, and with a population of close to 1,4 billion persons (the USA has approximately 340 million people, to give some context), investment in their regular market of goods and services invests into this greater theme.

For investors who want a rounded global portfolio, China remains a compelling proposition to include in a wider portfolio holding.

Friday Food for Thought