Why the Very Wealthy Enjoy Living Annuities

I recently had a conversation with a financially strong, long-standing retired client, and I asked how he was generally feeling about his financial planning.

His reply was:

“I’m actually very happy and enjoying my retirement.

Having sufficient funds for my regular living expenses, I have just over R100million invested, where I am paying less than 7% Income Tax each year (for the first two years, it was even far less) - with no Capital Gains taxes, nor any other dividend or secondary taxes.

After that, in my estate planning, my investment when I die doesn’t attract any Estate Duty as it by-passes any estate, and pays directly to my wife (or children, if both spouses unexpectedly die simultaneously), in only a few days upon my death.

In addition, I have no complexities requiring advanced tax structures that is often accompanied by vast professional teams, something that I was used to having throughout my working career.

When retiring, my single biggest fear was actually more around inflation. This is not shown on any investment statements, and this is the silent killer for many in the long term. I personally believe most people just don’t truly appreciate or fully understand this.

My investment in your discretionary managed SIS Strategies returning 13,5% per annum for the last 5 years in admittedly tricky market circumstances, easily covers this. It’s suitably managed, with a robust asset allocation that also has good offshore exposures, and with a 25-year track record, is well-proven over time.

I am drawing a low enough drawdown rate to ensure my capital gets proper real growth above longer-term inflation, while still enjoying my life.

My capital after my monthly withdrawals so easily sees real growth too, having grown by over 10% per year, over and above my withdrawals, over the last 5 years.

This also means that over this period, my after-tax income has also increased by over 10% per annum. And in today’s environment, few people can say the same. Even if they are still working.

The funds growing in real terms will ensure I ultimately leave a wonderful legacy for my children, after my wife and I both die. The longer we live, the greater the benefit will be.

I only hope and trust that my annual discussions with my adult children will ensure that they don’t fall to temptation, drawing down higher withdrawal rates. Between my two children, this really ought to be an adequate base for them to work from. Of course, they are still free to make their own wealth too.

I sleep so well at night that it is important to me, especially at this stage in my life.

In the short term, my full regular income withdrawal I can spend fairly freely, without fear of “spending my children’s inheritance”, as well as knowing my annual increase over time will be far more than inflation.

My own personal goals are in adding significance to others. Especially where I am now getting older, I appreciate that this is more easily done with those closest to me.

My overall financial planning structure is simple, effective, and allows me to live my best personal life to the fullest”.

Much to be Unpacked and Explained

His comments should be explained to give some perspective.

Funds Invested in a Living Annuity

Firstly, the investment of just over R100million is held in a Living Annuity. Admittedly, most of us don’t have such a large retirement fund.

Previously owning a good business, he added substantially to his retirement fund from the profits of his business over a lengthy period.

Before 2016, there was previously no maximum Rand cap on retirement contributions (today the allowance is deductible up to 27,5% of taxable income, but limited to a maximum deduction of R350 000 per annum). At the time, in good business years, he also contributed above the then 17,5% tax deductible limit too (which previously then didn’t have a maximum Rand limit).

This also allowed his initial income, for the amount equivalent to the non-tax deductible contributions, to be not taxable when making his first income withdrawals.

Effects of drawing 2,5% per annum

Today, he is now drawing the minimum of 2,5% per annum from his Living Annuity investment, which is the minimum withdrawal in terms of legislation.

This provides for an income withdrawal of R2.5 million per annum before taxes. The income taxes work out to be R934 604 per annum, leaving the investor with an after-tax monthly income of R130 449 per month.

He previously considered the international commonly referred to “4% rule”, which says that if you draw now more than 4% per annum, both your income and capital should grow by at least inflation over time, in perpetuity. However, this investor specifically wanted more capital growth over time in his instance.

Deferment of tax creates compounding growth thereon

Where the withdrawal rate is fairly low at 2,5% per annum, and the portfolio growth is far higher than this (13,5% per annum), each subsequent year his gross income withdrawal has therefore increased, by the added growth on the portfolio, over and above his regular withdrawal.

Current income withdrawn is growing by over 10% per annum

Over the last 5 years, his annual income has grown by over 10% per annum, after tax.

Quoted tax rate is more his experience than a true calculation

The tax rate of under 7% he used is not strictly speaking correct. This is more of a practical feel, being his experience, based on what tax he is paying now.

At 13,5% growth, on R100 million, this means that the portfolio is growing by R13.5 million (before his income withdrawals) for this year.

He is now saying that R934 604 Income Tax paid, on the R13,5million growth, works out to be 6,9% tax paid.

Of course, the more accurate view would be to say that the R934 604 tax paid as a percentage of R2,5million gross income is 37% tax paid on the income generated and withdrawn.

Yet, this does highlight that the advantage of Living Annuities is that the growth of the portfolio is not taxable and is free from tax, including all taxes (Income Tax, CGT and Dividends taxes).

Only the income withdrawn is taxed, in the same way as employment income is, and is accompanied by an IRP5 each year.

Less than 7% Tax in the first few years

Where the investor had contributions previously disallowed as a tax deduction, the equivalent amount of his first earnings was not taxed as income. Therefore, his tax was Rnil initially (and no tax was payable in the build-up of the portfolio).

It also should be noted, although not the case in this instance, that (any remaining) disallowed contributions at death are included in the deceased estate for estate duty purposes, but only if the beneficiaries opt to take a lump sum that they are entitled to.

This again highlights the importance of the beneficiaries being part of the plan, as well as having these conversations with them during the investor’s lifetime.

Current Capital is growing by over 10% per annum after withdrawals

Where the investor ensures capital growth by having a low withdrawal rate, then this capital growth is accumulating in the portfolio, getting the benefit of no tax being deducted in the buildup of the portfolio, and so enjoys further capital growth thereon.

In other words, since the capital in the build-up of the portfolio is not taxed, the deferment of tax on the benefits is cumulative over time. This means that the compounding effects, which Albert Einstein said was the greatest human invention, are magnified.

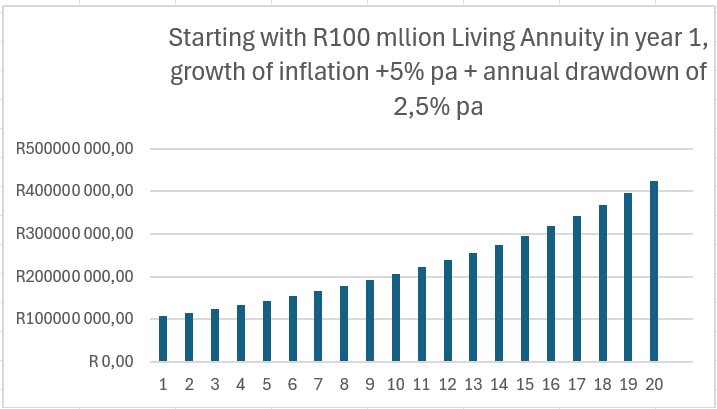

The power of low withdrawal rates over time

This example also shows the power and long-term strength of having a low withdrawal rate.

A living annuity sees the investor having control over their income withdrawal. Getting it as low as 2,5% per annum ensures that the investor, over time, will always enjoy a healthy capital return and resulting income increase of more than inflation.

This growth then compounds over time.

13,5% per annum historic 5-year return, is not quite Inflation plus 4-6% per annum

The funds invested in our discretionary SIS inflation plus 4-6% per annum Strategy, to the end of June, this strategy has returned 13,5% per annum over the last 5 years.

However, this is higher than our mandated and predetermined absolute targeted investment returns for this strategy, of Inflation plus 4-6% per annum. This recorded return over the last 5 years to the end of June is a function of good market conditions (notwithstanding all the doom and articles we all see in the press), and sound investment management on our side.

Our longer-term returns and promise to our clients here is a targeted return of longer-term inflation, which we currently see as 5% per annum (and not the lower quoted one-year returns), plus another 4-6% per annum real return.

This means that the better assumption going forward is that the Strategy will deliver on 5% inflation plus 4-6% per annum over the longer term, which equals 9-11% per annum going forward (assuming long-term inflation remains at 5% per annum).

I so needed to re-affirm this with our client that I did, to reinforce and confirm our long-term commitment here.

Schematic Summary

This leaves his future planning that can be presented schematically as;

On death, no delays, no estate duty, no executor’s fees, and payable to heirs in record time

On death, a living annuity is payable directly to the beneficiary (provided that beneficiary nominations are in place).

Therefore, no estate duty nor executors’ fees are payable.

The portfolio is simply transferred to the stated beneficiaries, which in practice usually takes place within 10-15 working days.

They, in turn, can then alter the portfolio or income withdrawals to suit their personal circumstances.

Liquidity

In this illustration, an investor having R100million in a Living Annuity, one can reasonably assume they have other assets and investments, even if the Living Annuity is their largest asset, if they ever require a capital lump sum for some reason.

The Advantages of Living Annuities

From the interaction shared, this highlights the advantages of Living Annuities, including;

Living Annuities see no taxes payable in the portfolio; only the income withdrawal is taxable as income.

For the wealthy investor where liquidity is not a concern, the tax-free growth in the build-up of the Living Annuity and the deferment of the tax liability to only be taxed on the income withdrawn, may be considered very attractive.

This is especially of even greater advantage if heirs are in a position that they will probably not be in the higher tax rate bands (in their own personal circumstances).

A low withdrawal rate will ensure longevity of the portfolio through generations, for which reason it is called a “living” annuity.

As it can live through generations, the education of the heirs is important this side of the grave, to ensure they understand how to best optimise their inheritance.

On any possible divorce of the subsequent heirs, via your Will, you can ensure that the Living Annuity income stream is not available to any spouses or to ex-spouses (of your children).

For wealthy investors or those using Living Annuities for passing wealth through generations, it’s rather tax efficient, where on death, no estate duty nor executors’ fees are payable, provided beneficiary nominations are in place.

There are also no unnecessary delays waiting for an estate to be wound up.

Previously, I highlighted that Living Annuities are not governed under the Pension Funds Act, but in terms of the Long Term Insurance Act. This means that investors can invest fully in offshore funds if they wish (this for member-owned Living Annuity funds, and not to Fund-owned Living Annuity funds),

and also, that beneficiary nominations must be honoured exactly as per the investor’s instruction, for Living Annuities.

Not many of us have R100 million in a living annuity.

However, the approach of our investor in this instance, and using a larger investment size here as a case study, does highlight the effective and efficient role that Living Annuities can have in your overall portfolio for retirement.

Friday Food For Thought